A few weeks ago, we discussed the Starbucks/Howard Schultz factor on ETFs. In this week’s TETF.index update, we again embrace the transparency growth factor of ETFs and dive into to Facebook’s (FB) impact on the ETF industry.

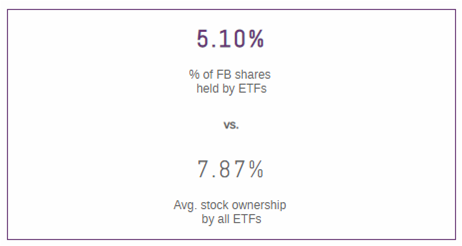

According to our ETF Think Tank software, 5.1% of all FB shares are held by ETFs and 1.14% of all US equity ETF assets are invested in FB. Considering the recent controversy surrounding the company, FB’s effect on ETFs can be significant.

Stock Picking an ETF

“Embracing transparency” sounds great, but how can investors locate an ETF with substantial ownership in a specific stock? We would like to share two complimentary solutions.

ETF.com Stock Finder

This is new tool offered by ETF.com that helps investors identify ETFs with exposure to a specific equity. The tool is concise and quite focused on finding the most concentrated exposure. It does appear to include leveraged or derivative exposure, which can be confusing.

ETFRC.com Stock Locator

![]()

This is the original stock locator and ETFRC has been offering this service for over 7 years. The tool links nicely to other ETF research applications within the site.

Both sources note that the new Communication Services Select Sector SPDR (XLC) has the most FB exposure at over 18%.

Exposure or Influence

These locator tools are both extremely effective for finding exposure of an equity, but as alluded to in the introduction, within our ETF Think Tank we also look at how ETFs influence the price of FB.

On average, ETFs own 7.87% of the market cap of every US equity, but only 5.1% of FB. So in theory, the ETF influence on FB is below average. That said, the changing of the sectors may have a greater influence.