The ETF Think Tank was created to provide technology and advice to advisors using ETFs to manage client assets. To that end, we are constantly updating our technology per the feedback of our members and sponsors. Today, we revisit the concept of “Smart Cost,” which we last wrote about in July of 2018. We will also look at the enhancements to our “ETF Portfolio Builder,” that now allows advisors to see the unique position within an ETFs active share. And finally, we will introduce a new application, sponsored by EMQQ, that helps investors evaluate ETFs focused on the Emerging Markets.

Smart Cost

Although within the ETF Think Tank, we are not fans of the term “Smart Beta,” we do acknowledge the simplicity and intentions of the word “smart.” That is why we created the “Smart Cost Calculator” – to identify the cost of the unique parts of an ETF relative to a benchmark. The origins of this concept stem from a piece we contributed to ETF.com in 2015.

How can investors analyze the “real” cost of smart beta?

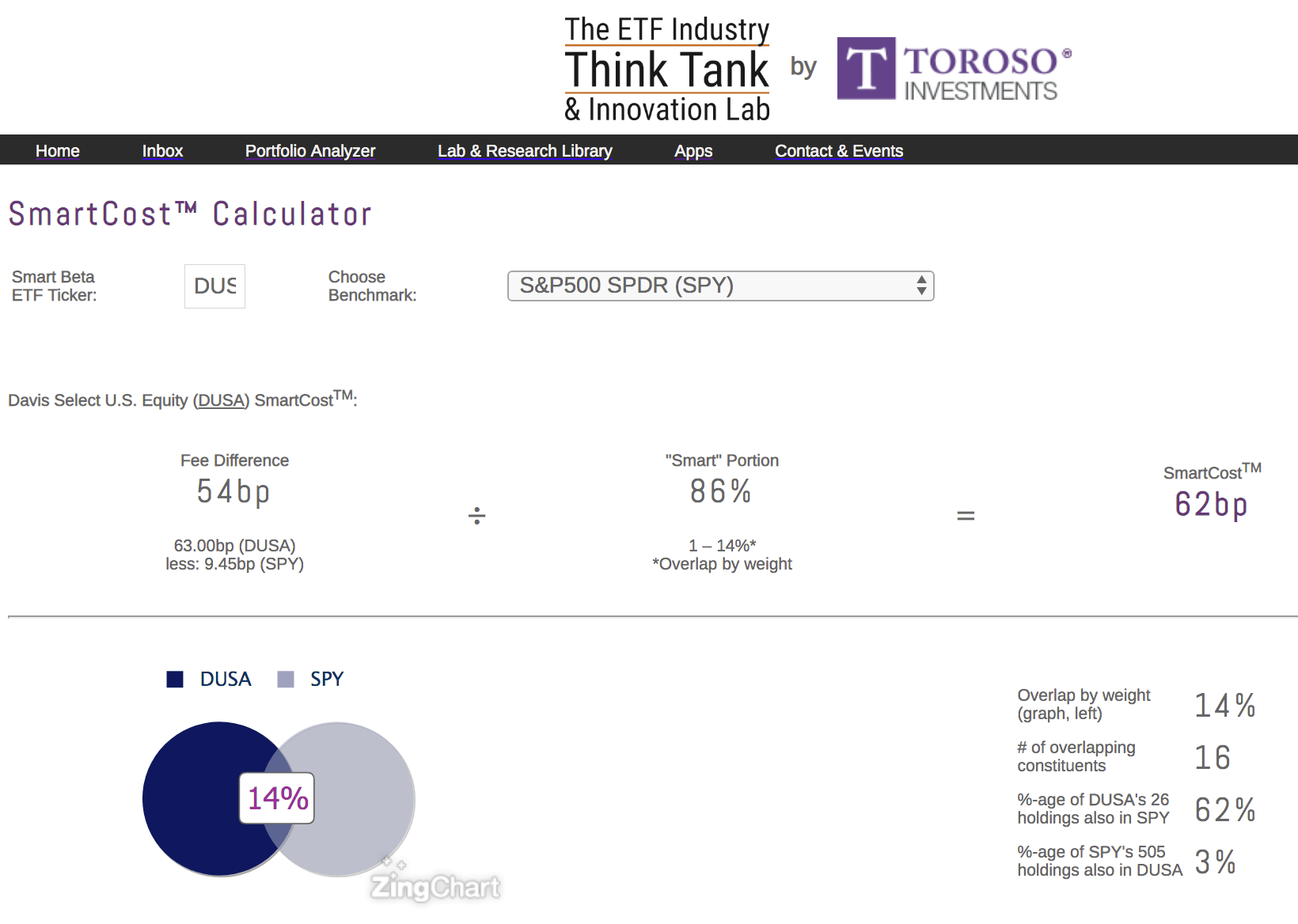

We look to identify a static metric, which can be used to evaluate the merits of the alternative index weightings. We accomplish this by identifying the overlap of the smart-beta ETF to the traditional market-cap-weighted index as a benchmark. Then we apply the difference in expense ratio to the unique portion known as the active share or “smart component” in the world of passive indexing.

ETF Think Tank members with access to our application, have the ability to calculate smart cost in a few clicks. For more information or to schedule a demo, please contact: Dan Weiskopf or Kedar Wilson. If you’re attending Schwab Impact, look for Dan Weiskopf. He will happily walk through a practical application of how Portfolio Managers build portfolios using this tool.

As you can see in the chart below, we compared DUSA Davis Select US Equity to SPY S&P 500 ETF and found 86% active share. When the difference in fee is applied to the active difference, we calculate a smart cost of 62 bps. This tells us the cost of the intellectual property the manager has contributed to the ETF and as general rule we believe the smart cost should be equal to or less than the stated expense ratio.

Smart Delta

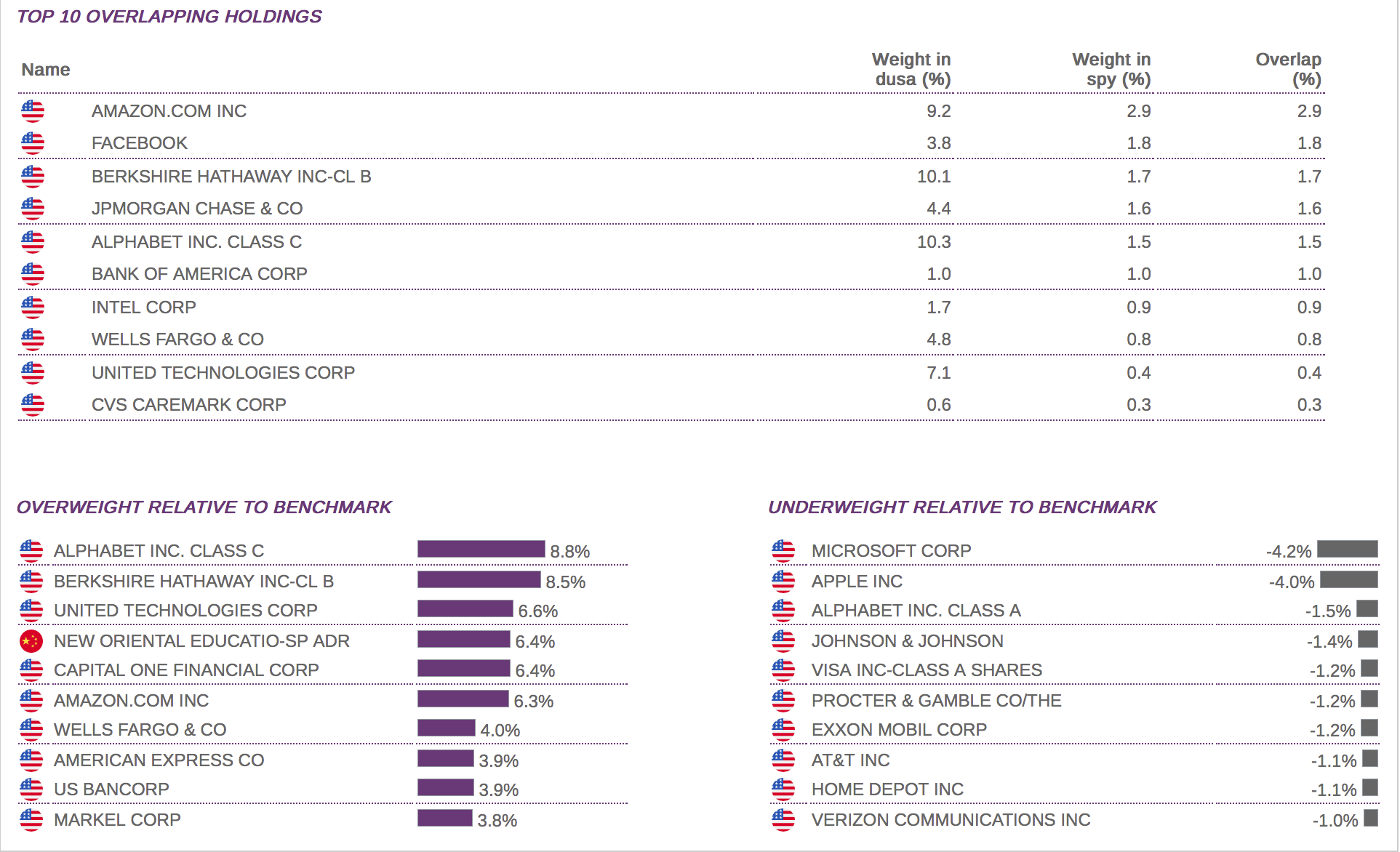

We constantly strive to improve the technology offered within the ETF Think Tank based on member and sponsor input. With that in mind, we recently updated our portfolio builder to include the delta of position changes between two ETFs or models. The chart below uses the same two ETFs: DUSA and SPY. From this chart we can see at a granular scale the overlaps and the positions within the active share that can generate differentiated performance from the benchmark.

Emerging Market Active Share

Now that we’ve reviewed the basics – tools that allow advisors to evaluate equity ETFs for general active share, we are excited to introduce an enhancement to the ETF Think Tank; an application we developed for one of our emerging market ETF sponsors. In collaboration with the management team at EMQQ, we offer a tool that highlights the active social and growth metrics that are important for emerging market investing. For more information on this application, please contact Kyle Parker at [email protected].

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.