The game hasn’t changed, but better tools may yield better outcomes

By Hafeez Esmail, Main Management

Among asset management teams there is a common belief that it’s better to own the worst stock in the best performing sector than the best stock in the worst performing sector. This scenario plays out in almost all cases and underscores the fact that identifying the correct market segment at the right point in the investment cycle is the key driver of investment returns.

Prior to the advent and proliferation of ETFs, Sector Rotation strategies were populated using single stocks. Executing the strategy with individual positions was challenging as you have to get two decisions right –

- Correctly identify the right sector, and

- Select the right handful of stocks that best replicate the capital weighted performance of that particular GIC sector.

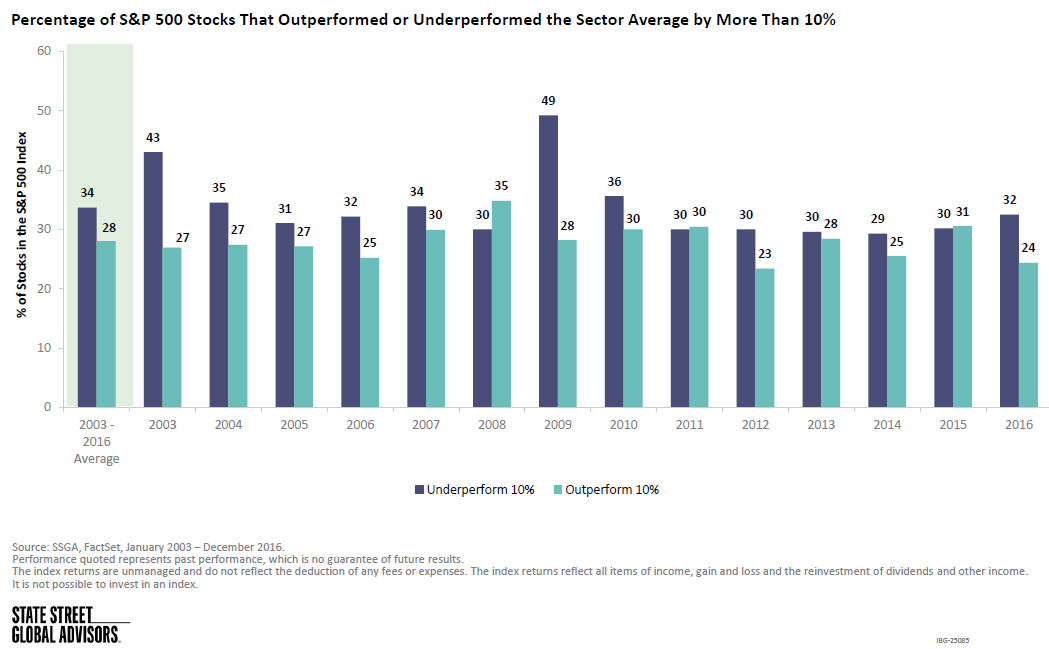

The chart below highlights that even if the correct sector is identified, there is a fairly consistent larger percentage of single stocks that underperform the overall sector by 10% than single stocks that outperform the sector category by 10%. This appears to underscore the fact that the odds are not in the stock picker’s favor.

![]()

Given that the challenge involved mastering multiple disciplines, there were few managers that could consistently execute on both fronts, year after year. The onset of ETFs did simplify the process in that pinpointing the right sector was the key exercise. State Street was first to market with the S&P GICS Sectors, all of which currently have sizable trading volumes. iShares has also been instrumental in building out the sector suite, expanding the toolkit beyond US markets.

For those that underestimate the variations in outcomes for each sector, the following chart highlights the array of correlations among sectors. It provides a useful illustration as to how certain sector overweights offer diverse equity exposures and also create opportunities for outperformance due to a wider dispersion of returns.

Managers may seek to overweight particular segments of a given sector that to seek out greater price appreciation than the overall sector. Such industry exposure can potentially amplify a thematic sector exposure with agility and precision. ETFs exist for technology sub-sectors such as software or semiconductors as well as for health care sub-sectors such as biotechnology, a number of which have significant liquidity and offer efficient trading.

ETF Asset Managers are essentially Active Managers of Passive Indexes/ETFs. The goal of each is to generate outperformance over a given benchmark. For Sector Rotation strategies predominantly focused on US Large Cap stocks, the benchmark that most managers aim to outperform is the S&P 500.