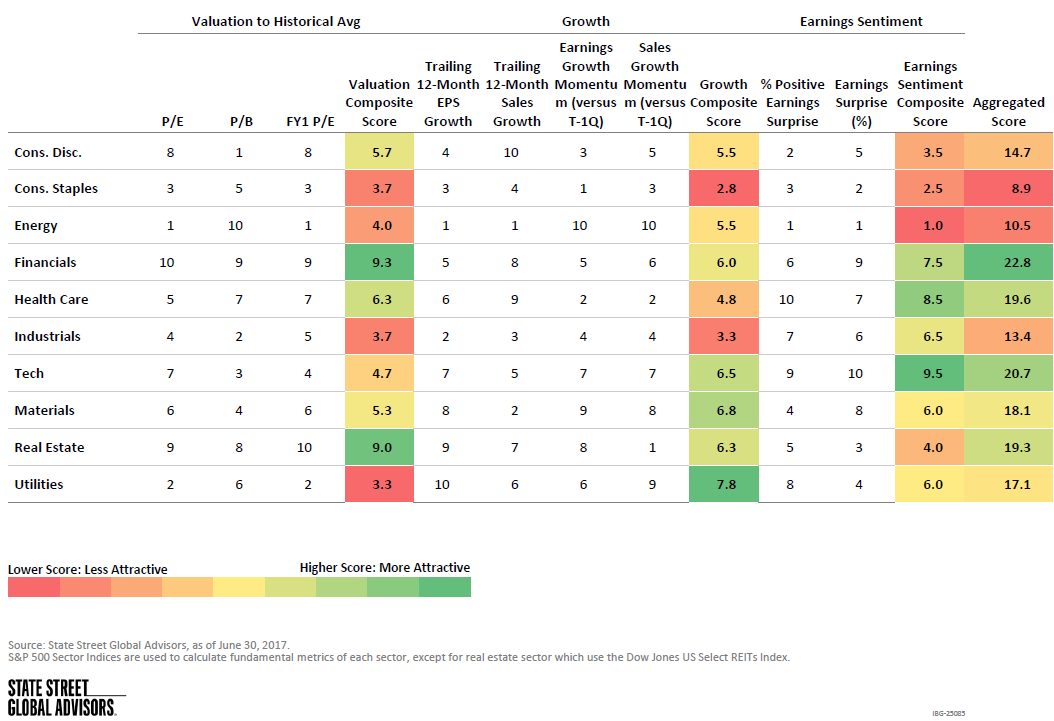

There are different approaches to try to outperform the benchmark. Firms using fundamental analysis, such as Main Management, seek to pinpoint undervalued sectors/sub sectors and seek out a catalyst that should propel that sector to revert to its mean. This process involves ranking sectors by valuations relative to their historical average, growth and/or earnings sentiment metrics. Accordingly, sectors with cheaper valuation, higher growth and stronger earnings sentiment are given higher scores. An example of metrics that may be used are illustrated below –

One can express these findings by overweighting favored sector ETFs based on their relative scores and similarly choose not to sectors with less favorable risk/reward metrics. Doing so potentially captures shifts in business cycles as sectors are closely aligned to specific economic variables.

The other well-known approach to sector rotation is tactical management. These are firms that use either technical or proprietary signals to rapidly move in and out of sectors, and potentially move out of the market altogether. Some of these approaches have been highly successful during certain periods (including the 2008-09 recession) but a number have had less favorable outcomes where there have been more consistently positive market returns.

While tactical approaches may have their merits, being tax aware is typically not one of them. While a fundamental manager generally has more judicious turnover, this may generate appealing outcomes on an after fee, after tax basis. The rapid signal changes of tactical models tend to generate a higher proportion of short term gains/losses.

The economy moves in cycles where specific sectors may outperform or underperform during different phases. We believe that ETFs offer a more efficient and one may argue, more effective, means of increasing allocations to sectors expected to outperform and decrease allocations to those that are expected to lag.

Hafeez Esmail is Chief Compliance Officer at Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. For more information, visit http://www.mainmgt.com.