In last week’s ETF Think Tank research note, we structured our information as ETF Nerd Trivia, which included 5 questions designed to challenge your intellect, pique your curiosity, and illustrate the value of ETFs beyond their purpose as investment vehicles.

This week, we dig deeper into the trivia question that stirred some controversy and expand on it by investigating the most widely held equities of a well-known robo-advisor. And here again, we find ourselves talking about transparency.

You May Adjust Your Score

Here’s the question from last week’s ETF Nerd Trivia that sparked some interesting conversations:

Question 5: What equity is held by the greatest number of ETFs?

a. AAPL

b. SPG

c. VZ

d. PG

The answer (as of March 31, 2019) is PG, because it is held in low vol, value, and dividend focused ETFs. All the buzz over this question motivated us to update the data to June 16, 2019. We discovered that, according to the more recent data, VZ is the most widely held equity by ETFs, but for similar reasons to PG. So, for all the over-achiever ETF Nerds that selected answer “C” last week (VZ), you may adjust your score😊.

Being over-achievers ourselves, we decided to take it even further and compare the equities widely held in ETFs, Mutual Funds, and “do-it-yourself” investor portfolios.

A Little Bird Told Me

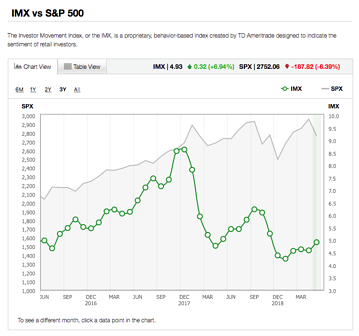

Since we already have the data that categorizes the equities by ETFs and Mutual Funds, we went ahead and added the equities with greatest number of holders at Robinhood, the online broker and robo-advisor. Most ETFs are fully transparent and offer daily holdings – even mutual funds give delayed transparency; but the holdings of individual investors are difficult to ascertain in a publicly available format. TD Ameritrade aggregates custodial client data into an interesting investor sentiment index, but the details of their purchases are selectively shared in narrative form.

Ironically, and perhaps unintentionally, there is a web application called www.Robintrack.net that allows users to see the number of holders for every equity and ETF on Robinhood’s brokerage platform.

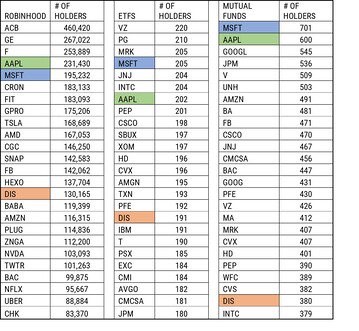

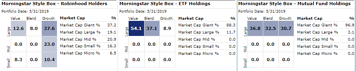

This site allows the tracking of individual investor behavior with a tilt toward millennials. In the table below, we combined the list of the top 25 equities held in the greatest amount of Robinhood accounts with the same information from ETFs and Mutual Funds.

What is Common?

Although the 3 lists have obvious differences, there are some commonalities.

• Apple, Microsoft and Disney are in each top 25 list.

• Many of the companies are large-cap, well-known brands.

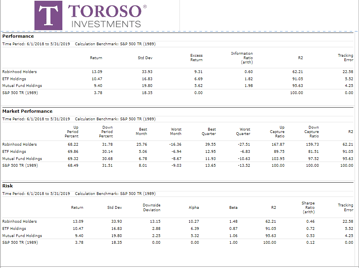

• An equal-weight portfolio of each list outperforms the S&P 500 over the last year.

What is Unique?What is Unique?These are very different portfolios in terms of a traditional measure of size and style factor.

• The top mutual fund holdings are almost exclusively large-cap core.

• ETFs have a strong bias toward value.

• The Robinhood investors favor all-cap growth.

The holdings were also very different on income generation. The average yield for the ETFs holdings was the highest at 3.25%, followed by mutual funds at 2.1%, and Robinhood stocks at 0.71%.

There were some unique attributes to the Robinhood list that were different from ETFs and mutual funds. First, a focus on stocks with low share prices like GE and F. Second, 4 out of the top 25 were focused on the cannabis industry.

What can we Learn?

Transparency is one of the key client alignment growth factors in the ETF industry. Anytime transparency can be embraced to provide advisors an edge into investor behavior, true value can be fostered.

In our experience, advisors are focused on growth; growth of their practice, growth for their clients. The ETF Think Tank was created because we believe ETFs are the investment vehicle of the future and that advisors who embrace ETFs are clearly aligned with what is in their clients’ interests. Learn more about the key attributes of the ETF structure and how they foster client alignment here.

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.