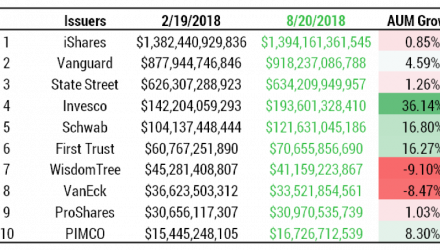

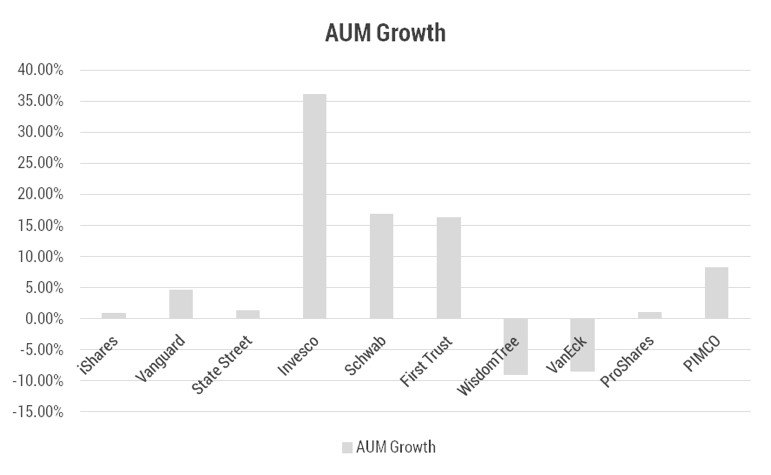

The first standout is Invesco’s increase, which is chiefly due to their acquisition of previous #8 on this list, Guggenheim, a few months ago. Ironically, the stock Invesco (IVZ) has suffered through the acquisition but it appears that Invesco may have acquired a unique intangible asset in that Guggenhiem had leveraged and inverse exemptive relief. Secondly, WisdomTree, our ETF March Madness Bracket winner, has lagged in the past 6 months compared to their top 10 peers, but they have increased their international assets by over $20 billion through multiple acquisitions. Lastly, Schwab and First Trust have had strong performances in the past 6 months. The largest flows are still focused on “client alignment growth factors” like low cost beta. Companies like Blackrock, Charles Schwab, and State Street continue to acquire low fee assets while maintaining margins and revenue growth.

The first standout is Invesco’s increase, which is chiefly due to their acquisition of previous #8 on this list, Guggenheim, a few months ago. Ironically, the stock Invesco (IVZ) has suffered through the acquisition but it appears that Invesco may have acquired a unique intangible asset in that Guggenhiem had leveraged and inverse exemptive relief. Secondly, WisdomTree, our ETF March Madness Bracket winner, has lagged in the past 6 months compared to their top 10 peers, but they have increased their international assets by over $20 billion through multiple acquisitions. Lastly, Schwab and First Trust have had strong performances in the past 6 months. The largest flows are still focused on “client alignment growth factors” like low cost beta. Companies like Blackrock, Charles Schwab, and State Street continue to acquire low fee assets while maintaining margins and revenue growth.

Since February 19th, the top 7 issuers have stayed in the same order, but you can see the slight shifting around they have done, whether good or bad in relation to the 3.05% AUM growth the ETF industry has had since then. To track this growth, as always, we suggest using the TETF.index, which aims to track the asset growth of the publicly trade ETF ecosystem.

This article was written by the team at Toroso Asset Management, a participant in the ETF Strategist Channel.

Click here to see disclosures.