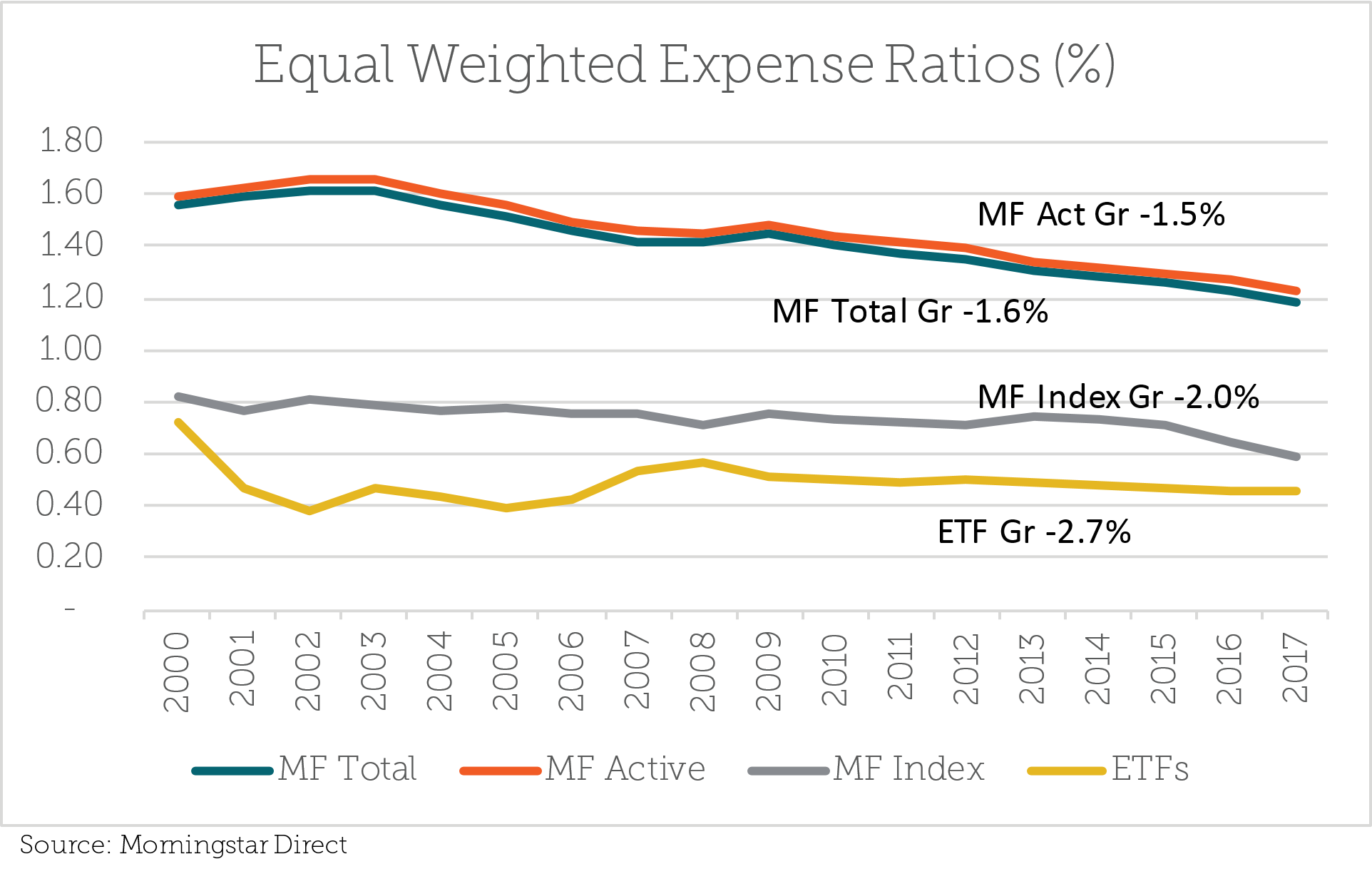

Second, index MF growth shows a huge drop relative to active and actually ends up being lower than ETF growth — evidence that investors put a major focus on cost for index MFs. Lastly, and most interestingly, ETF asset-weighted expenses have actually increased. The reason is the rise in availability of smart beta and actively managed ETFs for which, similarly to active MFs, investors are willing to pay a little extra for alpha generation.

![]()

In summary, I present a snapshot of the actual numbers for categories we have covered comparing where we were in 2000 to where we are today. Certainly, the rise of ETFs has had a meaningful impact on the MF world, but it is interesting that MFs are also rubbing off on ETFs as investors show they don’t mind paying a little extra for non-market-cap index exposure.

This article was written by Kostya Etus, CFA, a Portfolio Manager with CLS Investments, a participant in the ETF Strategist Channel.