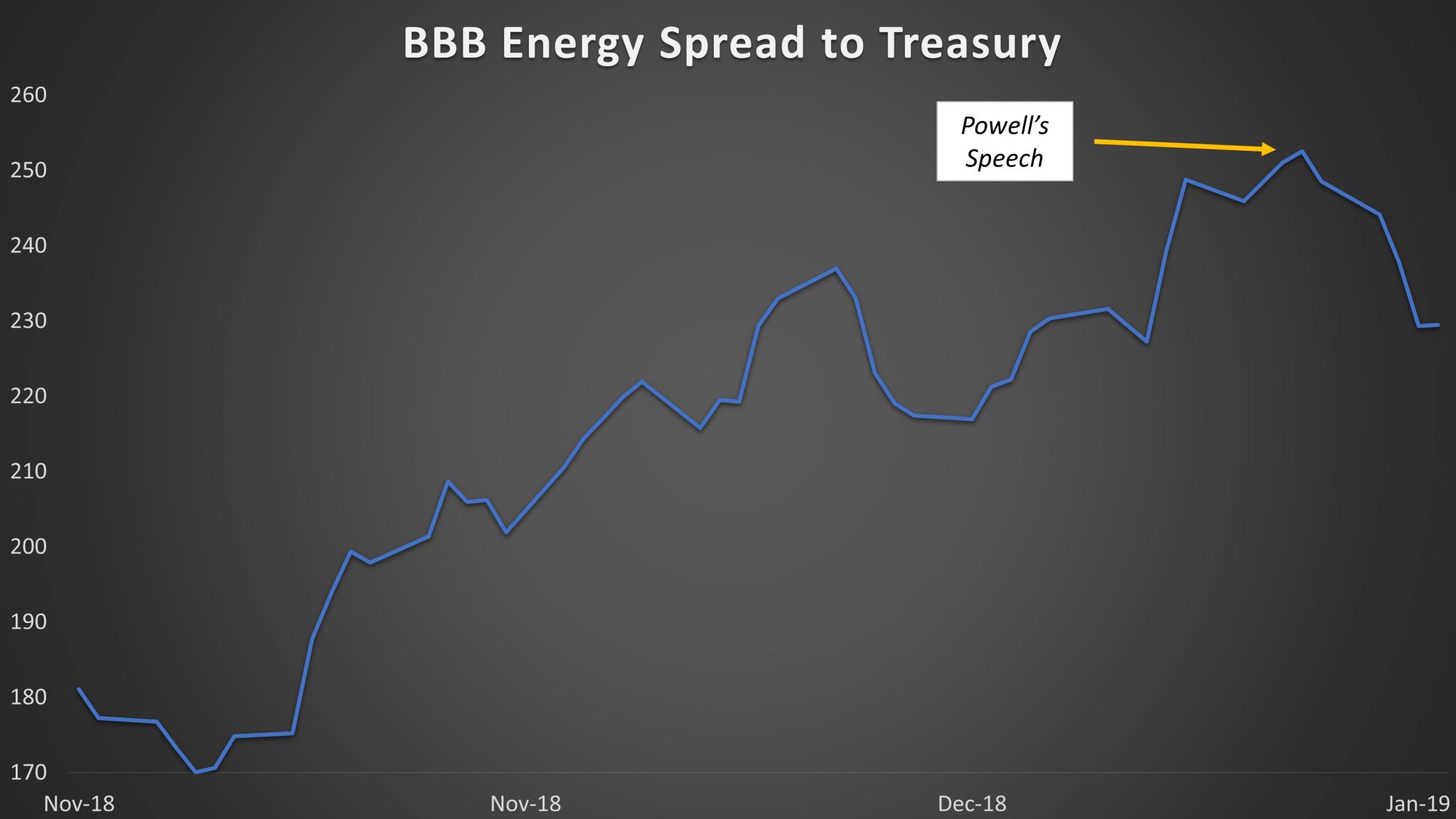

Energy sector BBB spreads compressed nearly 20 basis points following Powell’s comments, but perhaps the most notable development was the reopening of the high-yield new issue market by natural gas pipeline operator Targa Resources (NYSE: TRGP). Targa priced the first high-yield bond issuance this year, the first since December 11, 2018. Prior to this deal, the high-yield new issue market had been effectively closed for a month due to extremely poor sentiment surrounding risk assets.

It’s significant that the volatile Energy sector was the home of the first company to break the drought. So strong was the demand for this speculative new issue that Targa was able to garner $1.5 billion in bond proceeds, twice the planned initial amount. The new bonds have performed well thus far, trading 2 points higher and nearly 40 basis points tighter in spread since issuance.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.

Disclosures:

This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.