By Kevin Nicholson, Chris Konstantinos, Doug Sandler, Rebecca Felton, Rob Glownia and Rod Smyth, RiverFront Investment Management

A Rotation to More Cyclical/Value Stocks Now More Likely, in Our View

The 2020 election results are not yet finalized, but we believe a number of conclusions can be drawn.

- Joe Biden and Kamala Harris are likely to be our next president and vice president.

- Republicans are likely to retain their Senate majority. (There are two runoff elections in Georgia, but we believe Republicans are still likely to retain majority.)

- Democrats will retain their House of Representatives majority albeit by a narrower margin than the previous congressional term.

No ‘Blue Wave’

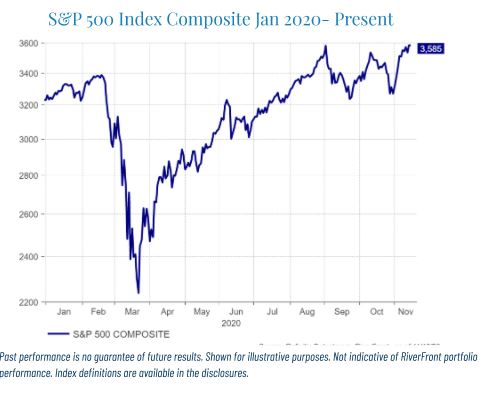

A government with no party holding both Congress and the presidency (aka a divided government) can result in one of two outcomes: gridlock or compromise. As we have noted in our Weekly View: 2020 Election FAQ on 10/19/20, stocks tend to do well even in gridlock, and we think will do better with some compromise since reasonable checks and balances will be in place. Indeed, based on recent performance, we believe investors seem to have voted in favor of the divided government: The S&P 500 is now back to all-time highs following the recent post-election rally (see chart below).

Summary

- With the election results almost tallied, the stock market seems to have voted in favor of balance (a divided government).

- Between a likely stimulus package in Q1 and a viable vaccine in the first half of the year, we expect the global economy to reaccelerate in 2021.

- Our balanced portfolios are now overweight stocks.

While it remains to be seen whether gridlock or compromise will become the model for governance over the next two years, we are hopeful for the latter. The United States faces a number of challenges entering 2021 with the most important being the global battle against COVID-19 and the re-opening of the global economy. Compromise, not gridlock, represents the best outcome, in our view, and we think bipartisan cooperation is possible on some issues. President-elect Joe Biden and Senate Majority Leader Mitch McConnell have a history of working together and putting their differences aside. The extension of the Bush-era tax cuts in 2010, the raising of the debt ceiling in 2011, and the avoidance of the ‘fiscal cliff’ in 2013; are three examples of the two finding a path on important legislation when others could not.

Whether a new spirit of bipartisanship can blossom or not, we do believe that a divided government takes some of the most controversial legislative proposals ‘off the table’ while encouraging lawmakers to embrace more moderate reform. A few of the ‘likely’ and ‘unlikely’ agenda items we see from the incoming administration include:

‘Likely’ |

‘Unlikely’ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Implications and how we are playing ‘the hand we are dealt’

Stocks should beat bonds:

A divided government means better checks and balances on government spending. In our view, this should please inflation ‘hawks’, keeping interest rates low for the foreseeable future. Low interest rates create a low hurdle for stocks, making them one of the few assets that offer investors the opportunity for inflation-adjusted growth. We also see stocks benefitting from the dissipation of uncertainty regarding the election and worries regarding significantly higher corporate tax rates.

- What we are doing: RiverFront continues to favor stocks over bonds in its balanced portfolios and has increased its equity allocation since the election.

Growth stocks should still win over the long run, but Value stocks will rebound as economic uncertainty eases:

Stimulus raises our national debt, essentially borrowing from the future and tends to result in slower economic growth. As a result, companies that can deliver growth in a low growth environment will likely remain in short supply, and thus be afforded ever increasing valuations. However, we would expect a bounce in more cyclical Value-oriented stocks at some point over the next year if an effective vaccine is widely distributed.

- What we are doing: RiverFront portfolios have been and remain biased to growth companies, but we have recently been adding exposure to Value stocks.

A vaccine may deliver what a gridlocked government can’t:

A COVID-19 vaccine should deliver the sustainable economic growth that stimulus packages cannot do on their own, in our opinion. An effective vaccine would enable a faster re-opening of the global economy and lead to the pent-up spending that many expect. On November 9th, Pfizer and its partner BioNTech released the preliminary analysis of their Stage-3 trials noting that the vaccine was showing greater than 90% effectiveness with little to no side-effects, and this Monday Stage-3 results from Moderna’s vaccine candidate showed similar efficacy. Pfizer and Moderna are just two of more than a dozen companies/research cooperatives working on COVID-19 vaccines and many experts expect additional positive news on potential vaccines in the coming weeks and months.

- What we are doing: RiverFront recently increased our weighting to stocks in our balanced portfolios.

International: Better foreign relations and less use of economic tariffs is positive for international stocks:

Foreign companies and countries have faced a stiff headwind over the past four years as the Trump administration toughened US trade-policy including tariffs, withdrew from several international alliances and created uncertainty regarding future foreign relations. President-elect Biden has stated that ‘improving foreign relations’ is high on his administrative agenda in his initial days in the White House. Friendlier and more predictable foreign policy should be a positive for the valuation of international stocks, in our view.

- What we are doing: We recently increased our holdings of non-US markets but retain a long-term preference for the US.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1414621