- Going into the election, we have trimmed some risk.

- We are maintaining our preference for US growth stocks.

- With so many uncertainties, we recognize the importance of staying flexible.

Our Portfolio Positioning Going into the Election

Often, when we think about the word outcome, it can evoke a sense of an end or finale of sorts. While Election Day 2020 has finally arrived, we believe the tale of the markets is ongoing. As we turn the calendar from November 3rd to November 4th, we mark the end of a chapter in an even longer story, but it is not the end of the story. Regardless of the voting results on Election Day 2020, we are seeing fundamental economic drivers unfolding that could be positive for equity markets ahead. Citizens and businesses are starting to understand how to ‘live with’ COVID-19 and economic activity is slowly returning to normal.

- We believe there is an economic recovery underway as indices tracking activity in both manufacturing and services are trending higher.

- Consumer activity is rebounding as evidenced in confidence data, consumer net worth, and retail sales.

- Housing trends are back to pre-pandemic levels and builder sentiment is at an all-time high.

- Corporate earnings are rebounding faster than expected and forward guidance is becoming more encouraging than discouraging.

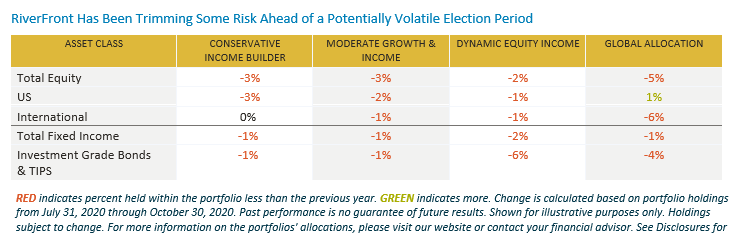

Rather than waiting to see who will reside at 1600 Pennsylvania Avenue on Inauguration Day, we have continued to rely on our process to determine portfolio positioning throughout 2020. In our opinion, equities remain the most attractive asset class for growth over the long term and our portfolios are positioned accordingly. However, over the past three months Riverfront has been trimming some equity risk in the face of new all-time highs in the US market, and what we perceive to be a volatile post-election period. The chart below summarizes the changes we have made at the asset class levels over the past three months in our balanced strategies. These actions have been a combination of risk management decisions as well as fine tuning selection with the addition of more individual equities.

We favor equities over fixed income: We acknowledge that US equity valuations are elevated, but we believe these valuations can stay elevated given the lack of alternatives. Given the starting point for yields and spreads, we believe equities offer the best prospects for growth over the long term.

We prefer US over international: International equities – both developed and emerging – offer relatively more attractive valuations when compared to US equities, in our view. However, we recognize that the US economy was the strongest in the world ahead of the pandemic, and current economic data trends suggest it is also the strongest developed region as we emerge from the downturn.

We have a higher degree of confidence in quality and growth over cyclicality and value: Throughout 2020, there have been brief periods of rotation away from growth and towards value. Generally, these periods were brought on by hopes of a vaccine or therapeutic for COVID-19 and the prospect for additional government stimulus. As COVID-19 cases have begun to increase and stimulus talks appear indefinitely stalled, a lasting rotation has failed to materialize. While we have slightly increased our exposures to value and cyclicality in the longer horizon strategies over the past few months, we are unlikely to materially increase these allocations until we get a better sense the economic recovery is on solid footing.

US sector preferences:

- We remain overweight technology with an emphasis on software and services owing to our belief that the growth cycle for these companies has accelerated as society gravitates to greater use of technology to facilitate working from home.

- We also favor areas within consumer discretionary that are COVID-19 recovery plays and beneficiaries of stimulus, such as home improvement and multi-channel (physical and virtual) retail.

- Within industrials, we have bumped up exposure to sub-industries that play into infrastructure spending as either a Democratic or Republican Administration will likely embark on high levels of infrastructure spending in order to support our economy.

- Within health care, we favor medical devices over large cap pharmaceuticals due to potential drug-price legislation.

We have a barbell approach to fixed income positioning: Our primary exposures within fixed income at this juncture include shorter-to-intermediate investment grade corporate bonds. Additionally, we hold longer-term US Treasuries to act as a buffer against equity volatility. In our longer horizon strategies, we have added exposure to ‘fallen angels’ (bonds that have recently been downgraded below investment grade) as we believe the combination of monetary and fiscal support could be viewed as backstops for companies that fall under this category.

Tactical Risk Management: Even though the S&P 500 is roughly 8% below its September 2nd record high the primary trend as defined by the 200-day moving average is still rising. In our opinion, the pullback over the past three weeks has taken the S&P down to what we would consider a minimum retracement of its rally from March’s bear market low. So far, we believe this is a relatively mild pullback in the context of a bull market. As can be seen in the chart (below), S&P 500 levels (blue line) we are watching include support around 3240 (September’s low) and then 3050. We would wait for a decisive break of these levels before becoming more cautious.

![]()

Perhaps the starkest lesson learned in 2020 is more a reminder – always be ready for the unexpected and adjust portfolio positioning when our process suggests it is necessary. We believe the risk management component of our investment process enables us to navigate through uncertain periods seeking to reduce and remove the weight of emotions. From a technical perspective our team has identified price levels that would trigger risk management. Additionally, there are a host of fundamental factors such as, prolonged election uncertainty, an unexpected downturn in corporate earnings, or weakening in economic data; that could also lead to a course correction.

Bottom Line: With so many uncertainties, we recognize the importance of staying flexible over the next few months.

Originally published by RiverFront Investment Group

Important Disclosure Information

Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

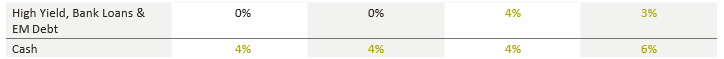

ASSET CLASS WEIGHTINGS AS OF 10/30/20

| ASSET CLASS | CONSERVATIVE INCOME BUILDER | MODERATE GROWTH & INCOME | DYNAMIC EQUITY INCOME | GLOBAL ALLOCATION | |

| Total Equity | 30.17 | 49.88 | 70.04 | 78.36 | |

| US | 30.17 | 42.05 | 45.64 | 52.26 | |

| International | 7.83 | 24.4 | 26.1 | ||

| Total Fixed Income | 63.25 | 43.11 | 21.8 | 12.48 | |

| Investment Grade Bonds & TIPS | 63.25 | 43.11 | 17.06 | 9.39 | |

| High Yield, Bank Loans & EM Debt | 0.00 | 0.00 | 3.83 | 3.07 | |

| Cash | 6.58 | 7.01 | 8.16 | 9.18 |

Strategies seeking higher returns and thereby greater allocations to equities will also carry higher risks and be subject to a greater degree of market volatility. Allocations subject to change. Source: RiverFront. Cash is included in the weighting for fixed income. The portfolio weights and statistics shown above are based on RiverFront’s Advantage separately managed accounts (SMA) only. They do not reflect other RiverFront portfolios or UMA/MDP models. While our SMAs and models for UMAs and MDPs will have similar investment weightings, there may be differences between the models; as such, there will be differences in the current portfolio weights/statistics in actual client accounts.

In a rising interest rate environment, the value of fixed-income securities generally declines.

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Index Definition:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1393372