This year has had no shortage of twists and turns and the third quarter of 2020 has been no different. The end of Q3 provides an opportunity to look back at the path of the Astor Economic Index® (“AEI”) and our flagship Dynamic Allocation (“ADA”) strategy over the course of the past three months in lieu of our standard monthly economic review.

A Year Like No Other

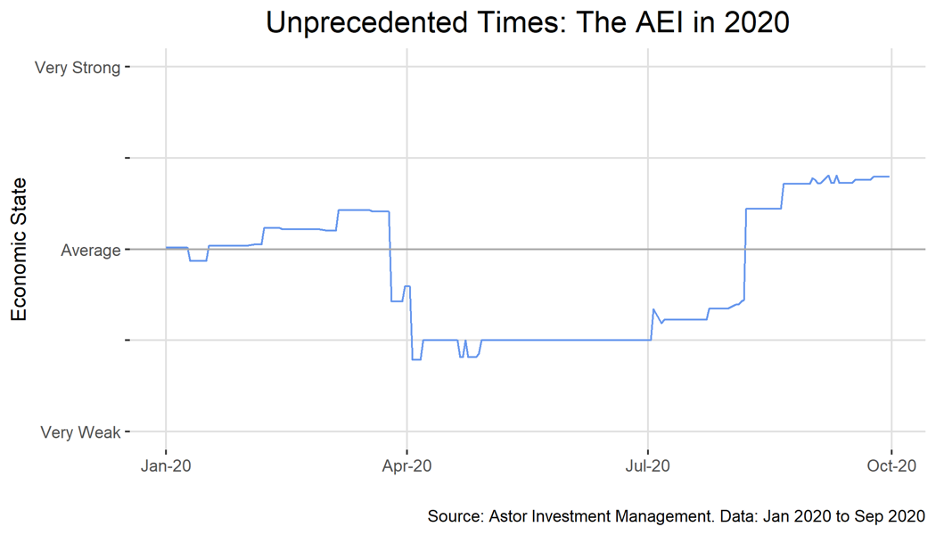

It will likely come as no surprise that in 2020 the AEI, our proprietary nowcast of the U.S. economy, experienced its greatest volatility since the Global Financial Crisis (“GFC”) in 2008. The AEI entered January at a level consistent with average economic growth. ADA was positioned accordingly in neither a defensive crouch nor an offensive position with a moderate beta (equity exposure) target. Following the onset of the COVID-19 pandemic and a broad economic shutdown, the AEI plummeted to its lowest level since the GFC, and the Investment Committee was quick to react, cutting substantial amounts of equity holdings in Q2. The AEI’s reading at that time of a weak and deteriorating economy has since been confirmed by backwards looking data, with Q2 GDP printing at -31.4% SAAR.

Q3 Developments

The third quarter has brought upward developments in the Astor Economic Index and Astor’s portfolio positioning. Government restrictions put in place during the depths of the pandemic have reversed in part or in full throughout the country. Economic activity has accordingly recovered, although we have some distance to travel before the depths of the recession have been retraced.

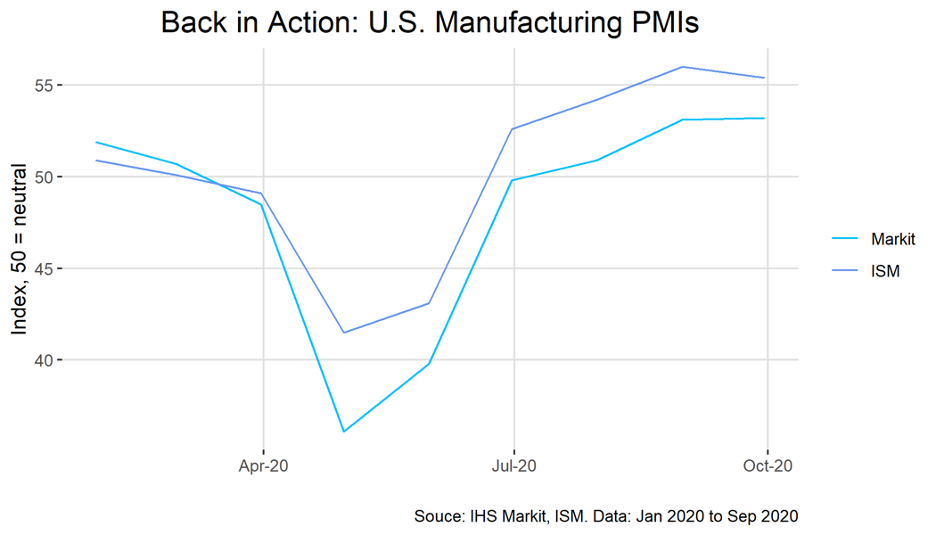

Purchasing manager’s indexes, which measure the level of activity in manufacturing and non-manufacturing sectors, began Q3 back in expansion territory (above 50) and strengthened throughout the quarter. In aggregate, manufacturing and service sector PMIs suggest a broad return to growth, with much of the gains coming from retail and hospitality in the latter sector. Of course, expansions in dining and hotels are fragile and depend on the virus remaining relatively contained.

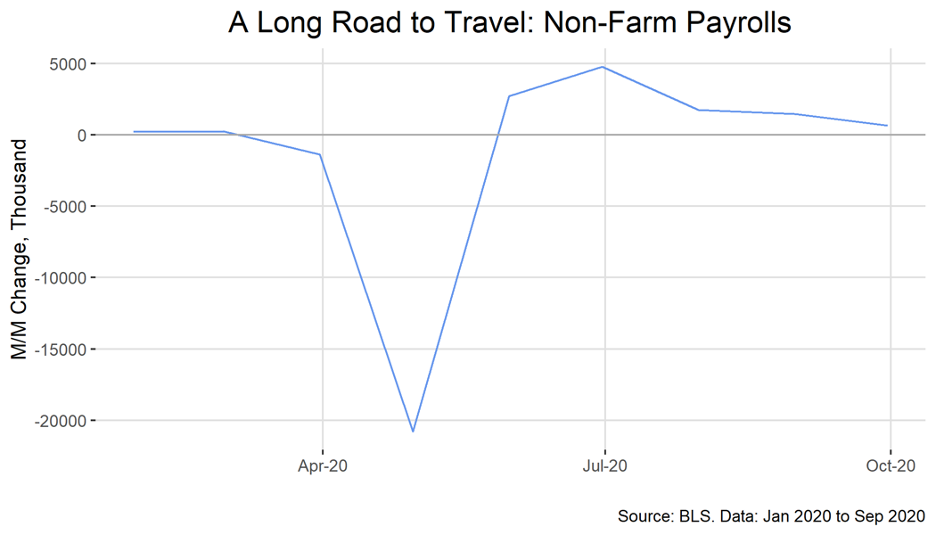

Employment trends have also been encouraging, although unemployment remains elevated. Non-farm payrolls have recovered about 11.5m of the 22m jobs lost since the pandemic began. The pace of gains has slowed substantially in Q3, suggesting that the path to full employment will be long and winding.

Portfolio Adjustments