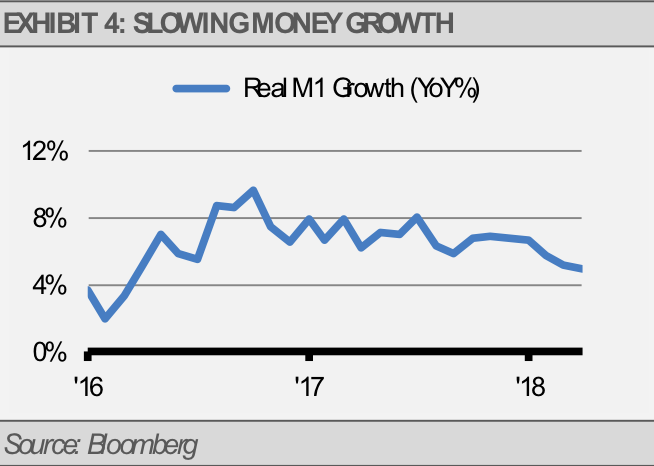

Other factors come into play as well that relate to money supply. For example, small business lending has accelerated and we also have the potential for tax relief from the tax cuts that went into effect at the beginning of this year. While those are positive for the money supply, a rising U.S. dollar and more hurdles for consumer credit can detract. Therefore, it is important to consider the growth of the money supply as an indicator the Fed may overshoot with rate hikes. For example, we are watching inflation-adjusted M1 growth closely. A negative growth rate of inflation-adjusted M1 could be a sign of a Fed overshoot and an economic downturn.

![]()

Finally, geopolitical risks continue to surface that are potentially a threat to the economy and create volatility. While these issues are typically not foreseeable, we think the Fed should allow some room for these risks in their trajectory.

HOW TO POSITION YOUR PORTFOLIO

Currently, we have reason to believe the Fed will stay on course despite these other factors and are invested accordingly. We expect the broad equity markets to continue advancing at relatively muted rates compared to recent years due to several factors, such as the ones discussed above. In this environment, investors may want to tilt their exposure to more defensive sectors, such as healthcare, REITS, and minimum volatility equities. Alternative strategies can also be beneficial in this environment, especially those that offer downside protection compared to a traditional equity holding. As for fixed income, we expect to see the yield curve flatten with the longer end showing more resistance to higher interest rates. We are finding value in the intermediate duration and some longer duration sectors, as well as alternative positions in variable rate products that benefit from rising short term rates.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.