Favorable Scenario: 2007-08, Bear Stearns to Lehman Brothers.

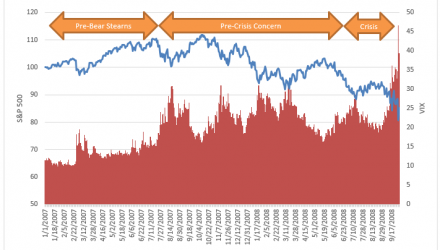

During the first half of 2007, markets were up a healthy amount. By mid-July the S&P 500 was up over 10% and the VIX spent most of the year in the 12–14 range. However, on July 16, 2007, Bear Stearns disclosed that two of their hedge funds that focused on subprime mortgages were all but wiped out.

In the year following Bear Stearns’ revelation, the S&P 500 trended nervously downwards, losing almost 18% of its value. More important to the DRS was the fact that the VIX entered a new trading regime, spending most of its time in the high teens or 20s. As stated previously, this is the “sweet spot” for the DRS, where option premium is both rich and sustained. The DRS did quite well with its harvesting of option premium during this period, the lead-up to the Global Financial Crisis[1].

Source: Morningstar Direct, Bloomberg

Conclusion

In a related note, the start of 2018 bears a striking resemblance to the start of 2007. VIX was at similarly low levels to start the year. However, 2018 has seen numerous concerns rattle the markets—the end of the easy money period, rising inflation, a potential trade war, etc. Will we see the markets shift from a low volatility regime to a mid-volatility regime, which the DRS prefers? Time will tell.

This recent series of blog posts provided an executive summary version of the three primary drivers of DRS performance during downturns. For a more in-depth exploration, please refer to the white paper “Managing Expectations: Drawdown Scenarios and Swan DRS Performance Analysis.” In addition to these three primary factors, the paper discusses various special situations like V-shaped recoveries, extended declines from heightened volatility, whipsaws, and the differences in volatility regimes.

Marc Odo is the Director of Investment Solutions at Swan Global Investments, a participant in the ETF Strategist Channel.