Technology is again the “new new thing” sector (credit to Michael Lewis), and capital is freely flowing to technology stocks and venture capital. There appears to be an insatiable demand for investing in “unicorns”, “disruptors”, or artificial intelligence, and every investor believes they’ve found the one manager who has unique investment insight. There should be no doubt that AI and the like will dramatically change the economy over the next decade, but investors should care only about expected returns, which tend to fall as allocated capital increases.

The lunacy of some investment ideas seems obvious if one ignores the hype. In 1999, it seemed blatantly obvious that investment priorities were misguided, and we pointed out that investors thought “buying a green pepper on the internet is technology, but building a fighter plane isn’t”. Consider for a second that today there are several companies competing to fly to Mars each funded by speculative capital flows. Yet, here on boring Earth, one can’t get to Penn Station on time during the morning commute.

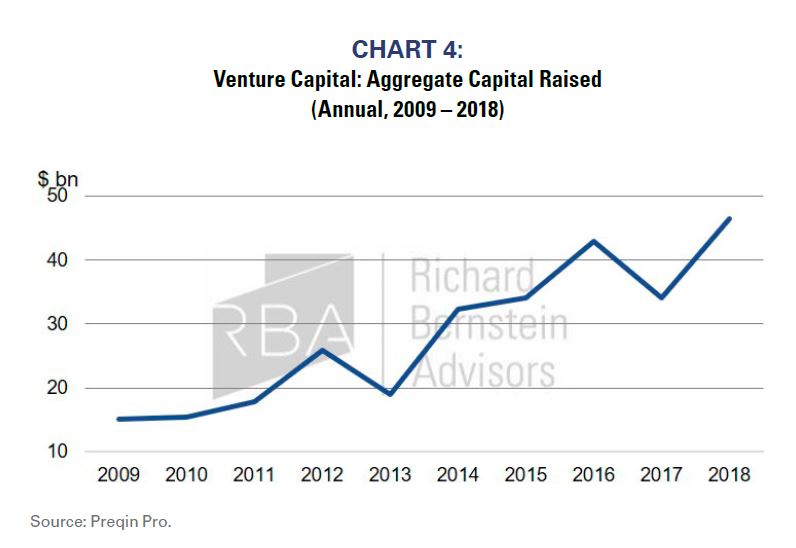

Chart 4 shows the annual flows to venture capital funds. Capital allocated to venture funds has basically tripled since the beginning of the bull market. Simple supply and demand of capital suggests expected returns and allocations to the asset class should be going down, not up.

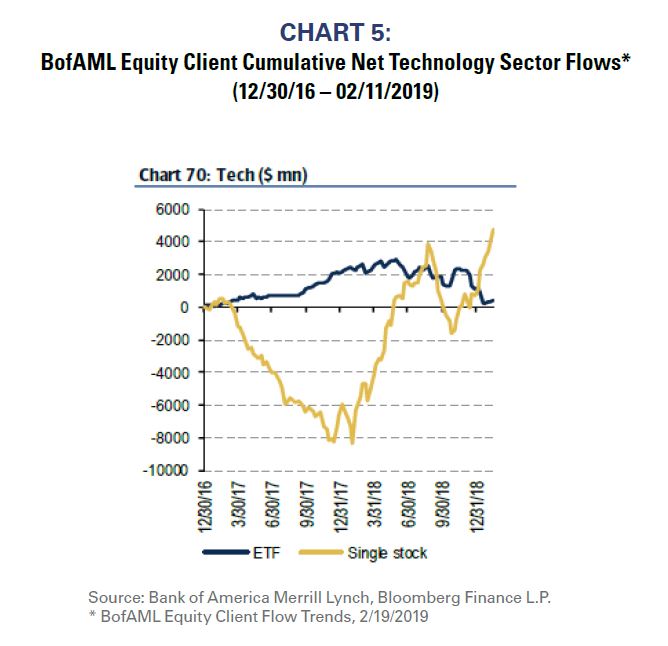

Chart 5 shows that individual investors are investing in individual technology stocks rather than in ETFs. Investor confidence is so strong that individuals apparently believe their stock-picking skills are superior and that diversification is unnecessary. It’s ironic that active management is under pressure yet individuals have increasing confidence in their own abilities to pick technology stocks.

No bubble-like returns, but getting close Charts 6-8 show the distribution of 10-year returns since 1975* for Hardware, Software, and Chips. We added significantly to our Technology holdings in the first quarter of 2016 because we forecasted overall corporate profits would significantly accelerate and, as noted earlier, Technology is a highly cyclical sector. 10-year historical returns at that time for the sector were below median. Today, 10-year returns for Technology are starting to seem extreme.

Returns are not as extreme as were those at the end of the Tech Bubble, but both Hardware’s and Chips’ 10-year returns are now in the highest quintile of historical returns and Software’s is in the second highest. It’s apparent that investors initiating technology investments today are doing so more toward the end of a normal return cycle than toward the beginning.

Doomed to repeat the past? We significantly lightened our Technology exposure early in 2019 because Technology has historically been a cyclical sector and profits look poised to decelerate. In addition, strong late-cycle capital flows to Technology and venture capital may be suggesting that investors’ expected returns are too high for the sector.

The Tech Bubble deflated 19 years ago this month, but it increasingly appears that investors did not learn from that episode. We feel our reduced positions in Technology are very appropriate. To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative. For more information, visit www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf.