By Astor Investment Management

The January 2019 Federal Open Market Committee (FOMC) meeting gave market participants a welcome respite from what many viewed as a decoupling of rate expectations between the Federal Reserve and the market. As a result, we expect the Fed’s balance sheet normalization to end sooner than previously expected and at a level greater than previously indicated.

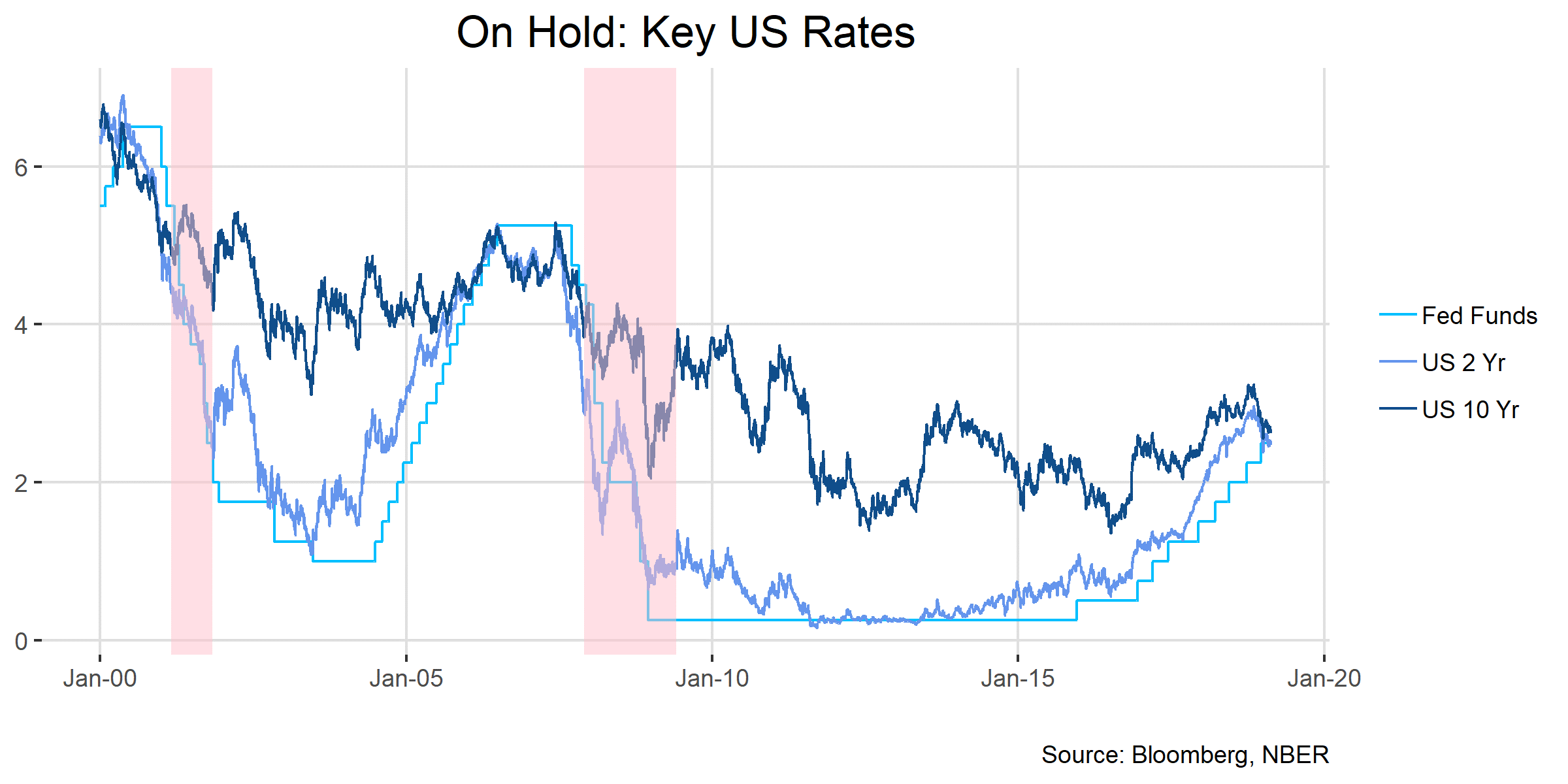

Financial markets have been concerned about the perceived lack of forward guidance regarding the Fed’s plans for balance sheet normalization in 2019, and rising rates and a declining global macroeconomic backdrop led to tumultuous equity markets in Q4 2018. In recognition of persistently low inflation expectations, a downturn in global growth, and financial market volatility, the FOMC removed any reference to gradual rate rises in the January statement.

Market participants also welcomed guidance on the FOMC’s plans for future balance sheet normalization. Recall that as part of the Fed’s crisis-fighting toolkit, the Fed undertook a massive expansion of its balance sheet (dubbed Quantitative Easing) in the post-crisis years. The Fed has since begun to reduce its holdings of Treasuries and Mortgage Backed Securities at a gradual pace, as seen in the chart below.

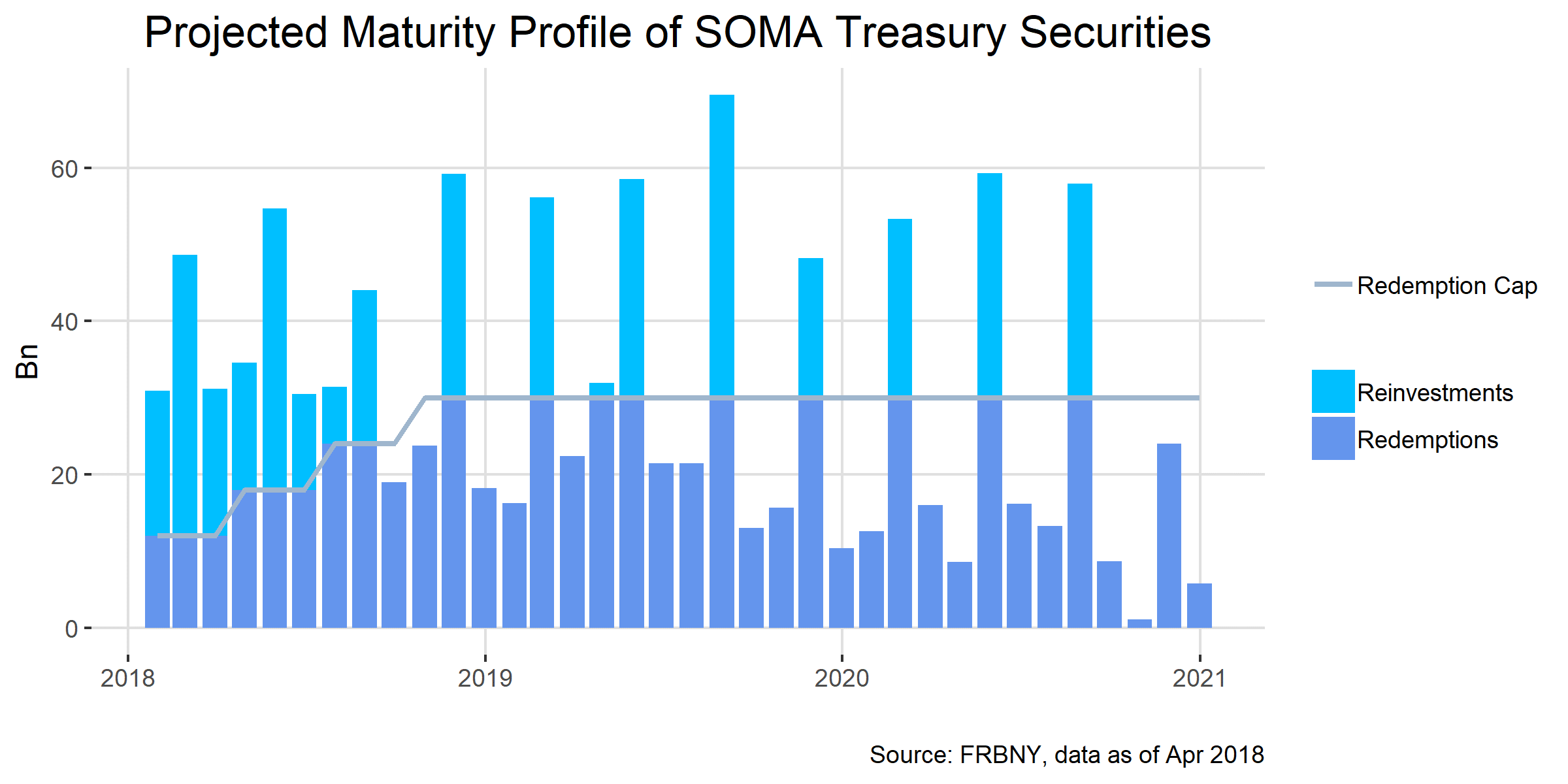

With the Fed judging economic and financial conditions as appropriate for rate normalization, maturing securities under a cap have been allowed to roll off the balance sheet since October 2017. The following chart shows the ratio of projected security reinvestments to redemptions if balance sheet reduction plans continue unaltered.

Redemptions below the cap (below the grey line) are rolled off and therefore shrink the size of the balance sheet. Maturing securities above the cap are reinvested.

Despite the inherently transparent nature of the balance sheet reduction, the Fed’s plans for the terminal level of the balance sheet has been no small source of consternation for market participants. In the past, the Fed has indicated that excess reserves in a post-crisis environment will be significantly higher than prior to the Global Financial Crisis, but the ultimate level of reserves is anyone’s guess. The chart below shows the expected size of Fed holdings, based on survey responses of primary dealers and market participants. Regardless of the path, holdings are expected to be larger than in the pre-crisis world.

Market participants have looked for commentary from the FOMC about the balance sheet in previous meetings to no avail. The January meeting addressed these concerns in a rare supplementary statement, saying:

“The Committee is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. Moreover, the Committee would be prepared to use its full range of tools, including altering the size and composition of its balance sheet, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate.”

The January FOMC minutes provided additional clarity on the FOMC’s plans for balance sheet reduction, noting:

“Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve’s asset holdings later this year…… Participants commented that, in light of the Committee’s longstanding plan to hold primarily Treasury securities in the long run, it would be appropriate once asset redemptions end to reinvest most, if not all, principal payments received from agency MBS in Treasury securities.”

In aggregate, this is a mea culpa (or perhaps a love letter) of sorts from the FOMC to financial markets. It seems likely that the Fed will slow or halt balance sheet reductions within the next year should economic conditions remain at or below trend.

This article was contributed by Astor Investment Management, a participant in the ETF Strategist Channel.

All information contained herein is for informational purposes only. This is not a solicitation to offer investment advice or services in any state where to do so would be unlawful. Analysis and research are provided for informational purposes only, not for trading or investing purposes. All opinions expressed are as of the date of publication and subject to change. Astor and its affiliates are not liable for the accuracy, usefulness or availability of any such information or liable for any trading or investing based on such information.

2019-73