Rotations, rotations, rotations. Following the scare in the financials and banking sectors, market strength continues to rotate. While the rise in volatility impacted most of the market, its effect was largely ignored by technology-related stocks. Technology stocks, which had some of the worst performance in 2022, are now leading the markets on a relative, risk-adjusted basis.

The table below shows the S&P 500’s 11 sectors, ranked according to Canterbury’s Volatility-Weighted-Relative-Strength. The ranking is a risk-adjusted rank that accounts for both a sector’s performance as well as its level of volatility (risk). Currently, Information Technology is the number 1 rated US sector on a risk-adjusted basis. Another tech-related sector, Communications, is ranked 3rd.

|

Risk Adjusted Ranking |

Sector |

| 1 | Information Technology |

| 2 | Industrials |

| 3 | Communications |

| 4 | Consumer Staples |

| 5 | S&P 500 |

| 6 | Basic Materials |

| 7 | Energy |

| 8 | Health Care |

| 9 | Consumer Discretionary |

| 10 | Utilities |

| 11 | Real Estate |

| 12 | Financials |

Source: Canterbury Investment Management Volatility-Weighted-Relative-Strength

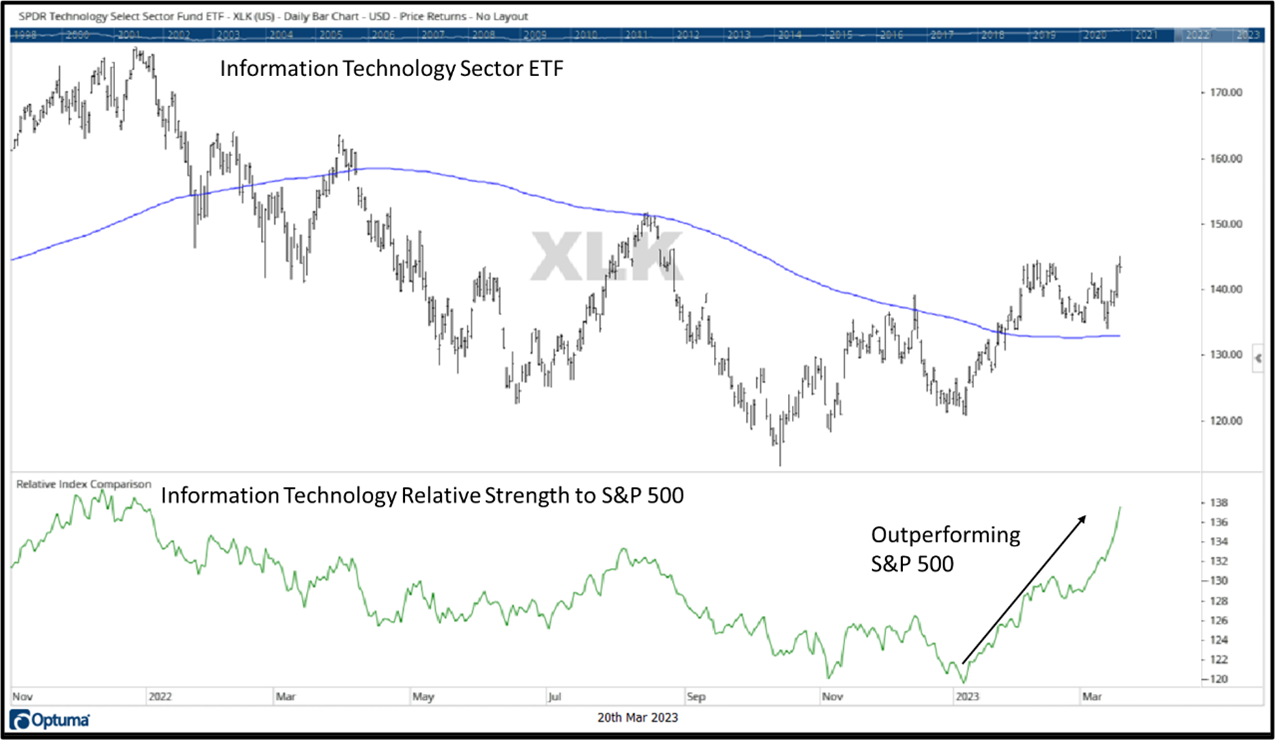

The chart below shows XLK, which is the Information Technology Sector ETF. Information Technology’s two largest stocks are Apple and Microsoft. The lower third of the chart shows XLK’s relative strength (green line) to the S&P 500. When the line has a positive slope, Information Technology is outperforming. When slope is negative, the Information Technology sector is lagging. As you can see, for most all of 2023, and particularly in the last few weeks, Information Technology has been leading the broad market.

Source: Canterbury Investment Management. Chart created using Optuma Technical Analysis Software.

Market Comment

Since the market’s relative peak in early February, it has been choppy and has declined to its 200-day moving average. Off of the market’s highs, it is normal to experience a “pullback,” especially following a significant rally. In a previous update, on February 13th, we wrote:

“As for the short-term, the market had been overbought and coming off of a rally… In other words, a pullback, like the one being experienced, is normal after a sharp rally. The ideal scenario would be for the market to establish another higher low, and then put in a new higher high… It would be normal for the market to test its moving averages for support as it attempts to establish a new, upward trend.”

The S&P 500 is currently hovering right around its 200-day moving average. It broke below the moving average two weeks ago in the wake of the surprising banking news, before rallying back to the 200-day moving average last week. All-in-all, volatility only rose a few points, while volatility of the technology sector, which is the index’s largest component, has been stagnant.

If we look at the other US market sector components, only four of the eleven US sectors are in one of the 5 Canterbury “Bullish” Market State. A “Bullish” Market State means that a security is exhibiting positive trend characteristics and low or declining volatility (risk). Those four sectors are Information Technology, Industrials, Communications, and Consumer Staples (which were the top 4 ranked sectors shown at the beginning of this update).

Bottom Line

Markets can be unpredictable. Just when you think you have the key, the market changes the lock. The financials sector had actually been highly ranked prior to the banking news. Now, the sector is experiencing a wave of volatility that has bled over into other market segments. This has caused market conditions to shift slightly, and allow for other sectors to rotate into leadership positions.

That being said, the Canterbury Portfolio Thermostat has a process for adapting its holdings to deal with everchanging market environments. It can and has rotated into those tech-related sectors mentioned above and has taken a defensive, inverse position, in a weaker market segment to lower its volatility. As the market finds its footing and figures out where it wants to go, the Portfolio Thermostat will continue to make adjustments to navigate whichever environment comes next- bull or bear.

For more news, information, and analysis, visit the ETF Strategist Channel.