*Last profits cycle trough

Source: Richard Bernstein Advisors LLC, Standard and Poor’s, Bloomberg Finance L.P.

Still little incentive to take duration risk

RBA avoided duration risk during 2018, and that proved to be prudent. Chart 7 shows the 2018 total return of various fixed-income indices, and shorter-duration bonds uniformly outperformed longer-duration ones.

For example, the Bloomberg Barclays 1-3 Year Treasury Index was up roughly 2% for the year, whereas 20+ year Treasuries returned-2% with substantially more volatility.

We continue to see little incentive to take duration risk within our portfolios. Chart 8 shows the term premium through time for the 10-year T-note. The term premium simply suggests whether it is better to buy one 10-year note or better to roll over 10 one-year notes. The recent term premium has been historically negative. A negative term premium suggests that investors are underpricing duration risk and that shorter- term notes will probably outperform longer-dated ones.

A negative term premium is a relatively rare occurrence (limited primarily to the current period and the early-1960s), but shorter-term notes have outperformed longer-term ones during most 12-month periods in which the term premium was negative. More importantly, RBA’s research shows that there is a strong correlation between the term premium and the probability and magnitude of longer-term notes out/ underperforming over subsequent 12-month periods.

CHART 7:

Fixed Income Indices 2018 Total Returns

Source: Bloomberg Finance L.P.

CHART 8:

10-Year Treasury Term Premium (Jun. 16, 1961 – Jan. 14, 2019)

Source: Bloomberg Finance L.P.

2019’s potential risk

Investors and companies are typically the most bullish at a market’s peak. Instead of reducing risk as market peak nears, investors and companies add cyclicality and ignore the business cycle because they believe “this time is different”. The resulting buildup of operating and financial leverage exacerbates cyclicality, and the businesses and the stock market become most sensitive to the economy right at the peak of a cycle.

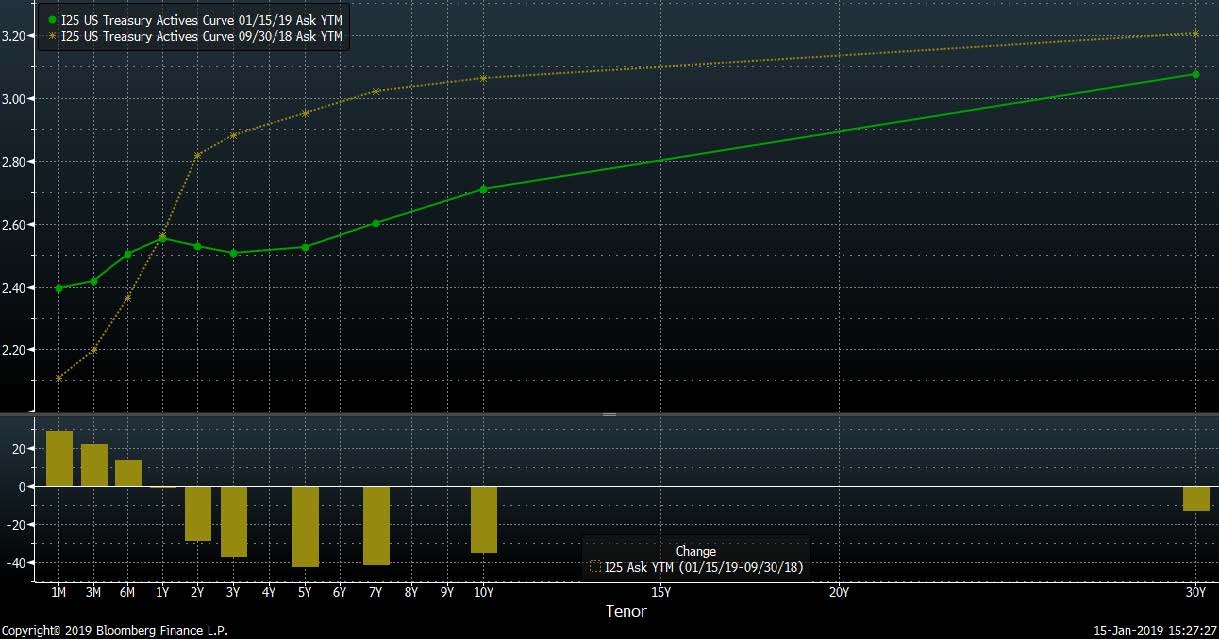

The fourth quarter’s emotional “run” on the market might be setting up such late-stage over-optimism. Although there is limited evidence that the corporate sector is accentuating cyclicality, some stock market investors are claiming that a new market cycle has begun despite that the yield curve has continued to flatten since market volatility rose (see Chart 9) and slowing earnings growth rate forecasts. Investors should be wary of a strong market rally during 2019 if that rally is coupled with waning profitability and an inverted yield curve. Increasing investor optimism amid deteriorating profits and liquidity has rarely, if ever, ended well.

CHART 9:

Slope of the US Treasuries Yield Curve: Sep. 30, 2018 vs. Jan. 15, 2019

Source: Bloomberg Finance L.P.

Initial 2019 positioning

Although RBA’s various portfolios differ by risk characteristics and asset categories, the following general themes are embedded in our portfolios as we begin 2019:

We remain overweight equities, but not by nearly as much as we had been for the past several years. This reflects our view that profits growth will slow, but no profits recession is yet on the horizon.

We prefer to accentuate stable growth rather than either traditional growth or value. The growth and value universes are both presently dominated by cyclical industries that tend to underperform when profits decelerate.

Chinese stocks might present opportunities in 2019. Although our profit indicators have yet to turn (which would remove our uncertainty), China is the only major economy actively stimulating via monetary and fiscal policy. In addition, China is one of only two major economies in which leading indicators are accelerating. Profits remain a sizeable question mark.

The term premium is historically negative, and our fixed-income holdings are primarily short-maturity Treasuries. A negative term premium suggests that investors are underpricing the risks of longer-duration bonds. A decelerating profits cycle suggests quality over credit.

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative. www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf