By Chris Konstantinos, Doug Sandler and Rod Smyth, RiverFront Investment Management

This week we focus on a critical driver of the global economy; the future growth trajectory of China’s economy. We believe the evidence clearly suggests that China’s economic growth has bottomed and is turning up. This was an important pillar of our 2019 Outlook. This improvement in growth is likely due to the lagged effect of monetary and fiscal stimulus and should be helped going forward by easing trade tensions.

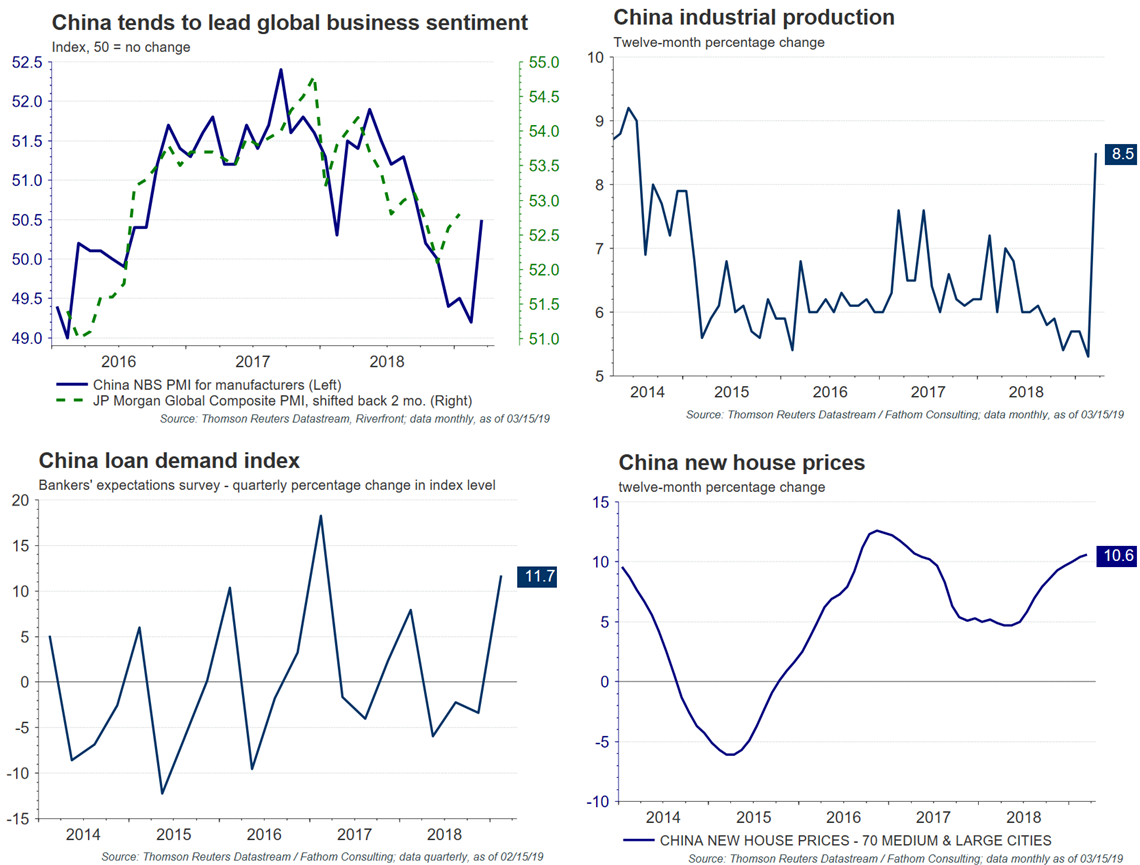

Our view is corroborated by recent positive surprises in Chinese economic data such as quarterly GDP, Purchasing Manager Index (PMI) surveys, industrial production, property prices and investment, and retail sales (see charts on next page). Given China’s importance to the global cycle, this view impacts Riverfront’s portfolio positioning in the following ways:

- From an asset allocation perspective, we remain constructive on stocks versus bonds.

- In our more risk-tolerant, longer-horizon portfolios, we remain overweight emerging market and Asian stocks.

Today we discuss why we believe understanding China is so important for investors, and how we attempt to get our analytical arms around China, an admittedly opaque area.

CHINA ACCOUNTS FOR ONE-THIRD OF GLOBAL GROWTH

To say that China plays a crucial role in the global economic cycle is an understatement. A Bloomberg study citing IMF projections from last October suggests that China is currently accounting for close to a third of the world’s economic growth (see chart). The US, the largest economy by size, is only the 3rd largest contributor to global growth behind India.

China is the fuel that powers the developing world’s economic engine. For example, nations like Korea, Taiwan, Vietnam and Malaysia depend upon supplying and/or competing with China in the Asian supply chain. Other major developing countries and regions like Russia, Africa, and Latin America, rely on China, the world’s largest consumer of commodities; to purchase their oil, minerals and agricultural products. China is also an important economic catalyst for large export-oriented economies in the developed world, such as Germany, Japan, and Australia.

This global reliance on China helps explain why global economies have struggled since President Trump’s imposition of trade tariffs and trade restrictions early last year. However, as we’ve written before, we believe this relationship is starting to thaw. For example, a China Commerce Ministry spokesman was quoted last Thursday saying there had been new progress towards an official trade deal. It appears from news reports that negotiators are aiming for an official signing of a deal as early as late May.

We believe that the global economy is now likely to receive a boost from China in the second half of this year; in fact, we believe we are already starting to see the signs. There is some evidence to suggest that China’s manufacturing PMI survey leads the global PMI survey by a couple months, with a high correlation recently (see upper left-hand chart, below). If this relationship holds, then we expect to continue to see a rebound in global business sentiment heading into the summer.

A MOSAIC APPROACH TO UNDERSTANDING CHINA’S ECONOMY

China has a well-deserved reputation for opacity. As a centrally-planned Communist country wary of Western hegemony in the East, China has little incentive with sharing too much information with the rest of the world. This extends to their selective and ‘engineered’ release of economic data.

Relying on a single data point like GDP to tell the story on China is a little like trying to observe a painting by staring closely at a couple of brush-strokes… only when you take a step back can you comprehend the larger picture. We employ this ‘mosaic’ approach in tracking a myriad of indicators both hard and soft that we consider having relevant and impactful information, in order to try and see the forest through the trees, so to speak. Over the past couple of months, we have been observing meaningful positive inflection in PMIs, industrial production, loan demand, and house prices (see charts right).

This mosaic can be enriched by viewing data through the lens of the commentary Chinese policymakers choose to share with the world, and what game theory suggests it says about their ultimate aims. A telling moment happened a month ago, in our opinion, when China’s Vice-Premier Li stated: “We must take strong measures to cope with the current downward pressure.” Such admissions of economic weakness are surprising for China, especially during a protracted trade spat with its largest rival.

In this case we think the meta-message is clear: China is sending a strong signal that it is willing to throw the ‘proverbial kitchen sink’ at its economic issues anytime growth drops below their target. This includes monetary stimulus such as reserve requirement loosening for banks, as well as fiscal stimulus equaling roughly three percentage points of annual GDP, including meaningful tax cuts for businesses and consumers. According to weekend press reports China now appears ready to address some of its deeper structural issues, which suggests to us that the economic turnaround is well underway. We are encouraged by any signs that China is serious about considering the reforms that the rest of the world is asking for.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared with the portfolios’ composite benchmarks. For information on our portfolio’s current holdings and benchmark definitions, please visit our website: www.riverfrontig.com

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing. It is not possible to invest directly in an index.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 826418