Chart 3 compares the returns of stocks, commodities, and various popular fixed-income benchmarks since July 2016. The ongoing popularity of income-oriented investments shows investors have yet to understand the implications of higher potential inflation.

Household and corporate balance sheets constructed with general combinations of fixed asset values and floating liabilities tend to outperform during periods of disinflation/deflation. However, a combination of floating assets and fixed liabilities has proven more beneficial during periods of inflation. FIXED-income is unlikely to be a successful core holding if we are correct and inflation continues to be higher than investors expect. Inflation is the kryptonite of income.

CHART 3

Stocks, Commodities and Fixed Income

(Total Returns Jul. 2016 – Jul. 2018)

![]()

Secular inflation?

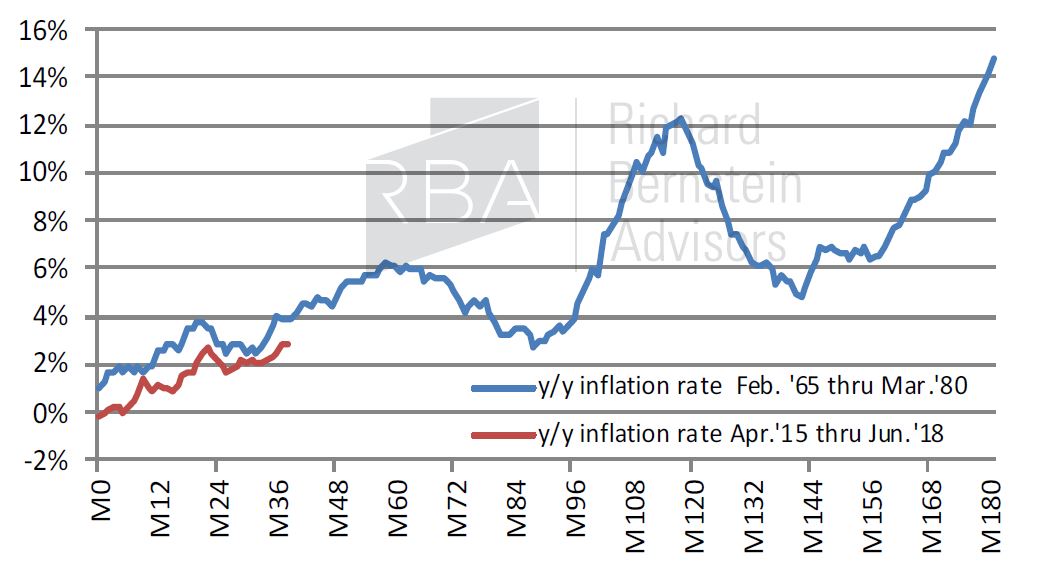

We’re not wild about these types of charts, but Chart 4 compares the current cycle’s inflation with the secular period of inflation from the 60s and 70s. We are not showing this chart to suggest that inflation will follow a definitive pattern. Rather, we show it to demonstrate how benignly one of the worst inflationary periods in US history started. That might be worth considering simply because investors remain quite sanguine about inflation given the economic and policy backdrop. (http://www.rbadvisors.com/images/pdfs/

Overheating_Ahead.pdf).

CHART 4

Secular Inflation:

Feb. 1965 thru Mar. 1980 vs. Current

Quick history lesson

RBA believes that there could be considerably more inflation than investors currently expect, but we do not believe there will be secular stagflation. Nonetheless, it is a good history lesson to review what asset classes and sectors outperformed during the stagflation of the late-1970s (see Table 1 below).

To learn more about RBA’s disciplined approach to macro investing, please contact your local RBA representative.

www.rbadvisors.com/images/pdfs/Portfolio_Specialist_Map.pdf.

This article was written by Richard Bernstein, Chief Executive and Chief Investment Officer of Richard Bernstein Advisors, a participant in the ETF Strategist Channel.