We Have Cash to Deploy When Visibility Improves

By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

Ireland is a tiny nation but it sits at the crossroads of a lot of what is happening in both Europe and the world. As such, studying Ireland can help investors both understand the complicated cross-currents of Brexit, and perhaps also show the way towards a more productive future Eurozone. After two weeks there, I formed the following opinions.

- Ireland has a very open economy: Since before the industrial revolution in the 1800’s, Ireland has always had an open border for people and goods with the United Kingdom which persisted after 26 of the 32 counties became an independent nation (‘EIRE’) in 1922. Ireland was closely tied to the UK even after independence, and some would argue that its greatest export for the last 200 years has been people. Ireland values its open border for goods and people with the UK and with the EU. The post famine (of 1845-51) population has remained fairly stable at around 4-5 million (2 million died and 1 million emigrated). The Irish have become integrated into all the English speaking countries, most notably the U.S., but also significantly the UK, and have risen to prominent positions of power in politics, business and the Church. Twenty of the forty-five U.S. Presidents claim Irish descent, according to historian Gary Roberts.

- Ireland has a pro-business mindset: In 1999, EIRE pushed for, and received permission from the European Economic Community (EEC) to reduce the Corporate tax rate for foreign multinationals from 32% to 12.5% (and most pay as little as 4%). Furthermore they negotiated 72 additional bilateral tax treaties. The result was a massive shift of profits by foreign companies to Irish subsidiaries and a meaningful investment in Ireland. Today foreign multinationals employ 25% of the Irish labor force and create 57% of Ireland’s non-farm GDP. Ireland was also the first European country to realize that if you have the most liberal employment laws, you will attract the most jobs. Essentially, Ireland is a Euro member with a UK/U.S. pro-business mindset – a rare combination within the Eurozone.

- Irish Investors can provide singular perspective: Irish investors, both institutional and retail are some of the most global in the world as the domestic economy is so small. They have a Euro bias, but little home country bias. To an Irish investor, the U.S. looks expensive, especially if they feel the dollar might fall. Domestically-run Irish businesses are also global, having funneled cash flow into global acquisitions for over 40 years. They are passionate proponents of both the European Union and the Euro, both of which helped create the ‘Celtic Tiger’ economic boom of the last 20 years.

The Brexit Dilemma: To say that the negotiation of the exit of the UK from the European Union is in disarray, two years after the Brexit vote, might be an understatement. While Brexit has caused a boom in investment and jobs in Ireland as firms relocate from London to the only other English speaking country in the Eurozone, it has created huge uncertainty about the need to reinstate the Northern/Southern Irish border that was put in place during a period of internal civil war in Northern Ireland from 1972 to 1998. Northern Ireland voted overwhelmingly to remain in the EU during the Brexit vote and the North/South border is now one of the biggest stumbling blocks in the Brexit negotiation. There is considerable debate regarding whether the border should be “hard” (think U.S. and Mexico) or ‘open’, where people can move freely between North and South. Unfortunately, its not just the Irish border that is giving Prime Minister May and the ‘leave’ voters a headache. Time is running out and her party remains split over key ideological issues. For example, Boris Johnson, one of the most well known ‘faces’ of Brexit recently left the cabinet after Teresa May re-took the initiative on Brexit, encouraging her nemesis to get in line with her “soft” Brexit views. Complicating matters, while we think Prime Minister May could negotiate a successful deal with the EU, ‘soft Brexit’ may get rejected by Parliment. Brexit is causing declining investment growth and huge business uncertainty in the UK and to a lesser extent in the EU after 40 years of political, civil and legal integration.

Dry Powder – why we are holding some cash: Our balanced portfolios have reduced exposure to Europe this year, but have held the proceeds in cash and bonds pending potential reinvestment. It is likely that reinvestment will be more targeted toward the beneficiaries of the Brexit mess and away from those most negatively affected. The timeline for reinvestment is unclear given our view that Prime Minister May will have difficulty negotiating a trade deal with the EU that parliament will support. Without a trade agreement, the most likely near-term outcome will be another extension of deadlines and further uncertainty, with the possibility of another election, a new leader of the conservative party and even another Brexit vote.

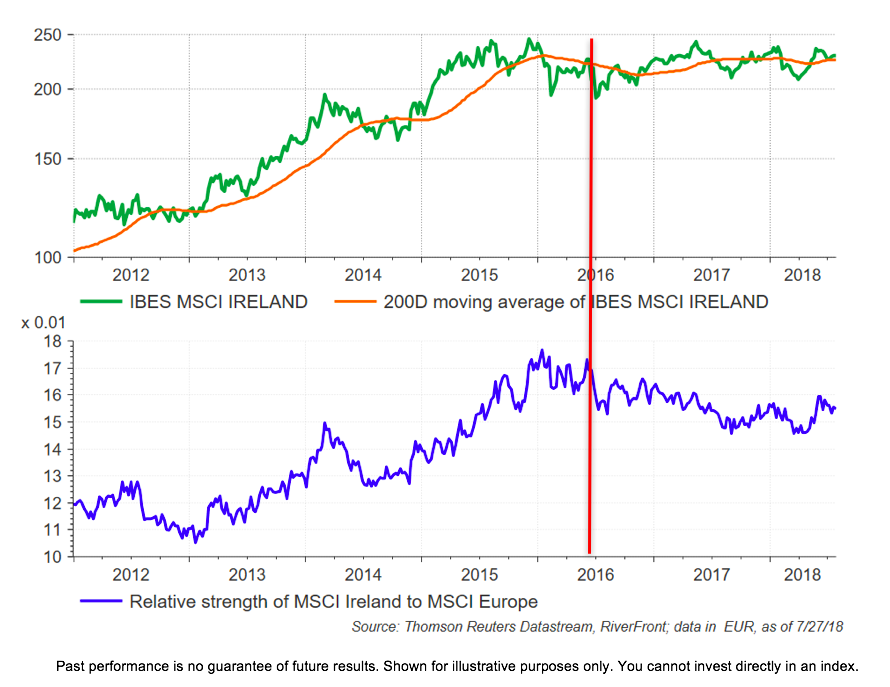

THE WEEKLY CHART: Irish Stocks – A Steady Outperformer within Europe until Brexit in mid-2016 (Brexit represented by red vertical line, below)

![]()

Europe is Healthier Than You Think and a EU/U.S. Trade Deal May Uncover Europe’s Unpolished Gems: Although not widely publicized, we believe important and necessary structural changes are starting to occur in the European Union. As Plato said, ‘necessity is the mother of invention’ and nobody needed to change more than the former PIIGS, the acronym applied to Europe’s weakest countries after the Financial Crisis. Portugal, Spain and even France have made significant strides towards labor reform, which is now showing up in earnings. In Italy Sergio Marchionne, the recently deceased CEO of Fiat Chrysler, showed that it is possible to transform an “old tech” industry like automobiles from a notoriously non-business friendly country. Ireland, which was devastated by a massive housing bubble that took down their banking sector has returned its finances to good shape as evidenced by its 10-year bond yields, which have declined meaningfully. Finally, Greece is now running a budget surplus and has a key port at the apex of China’s ambitions to open old trade routes.

To our frustration, political events such as Brexit, Syria, Ukraine and the absence of an economic model that works for both Germany and its western and southern neighbors continue to keep a lid on valuations. We hope that a rejuvenation of a trading partnership with the U.S., tantalizingly agreed to in principle by European Commissioner President Junker and President Trump, might be helpful in unlocking some of the value we see.

Doug Sandler, CFA, is Global Strategist; Chris Konstantinos, CFA, is Chief Investment Strategist; and Rod Smyth is Director of Investments at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.