By K. Sean Clark, Clark Capital

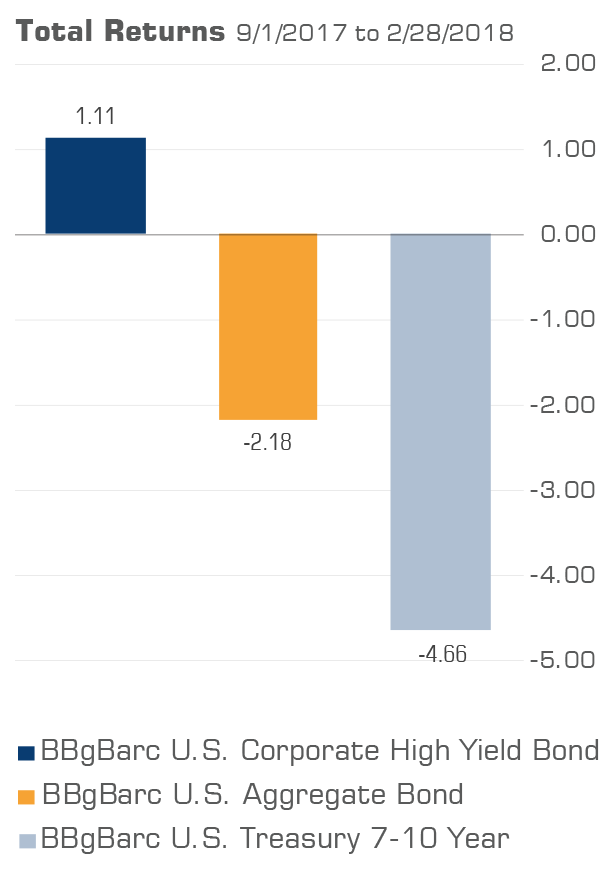

From September 1, 2017 to February 28, 2018, the bond market experienced adjustments as economic data continued to surprise to the upside. During this period the Bloomberg Barclays U.S. Treasury 7-10 Year yield rose 0.81% or a noteworthy 40% in percentage terms. This significant rise in rates has investors searching for ways to navigate the fixed income markets.

![]()

High Yields Increased with Interest Rates

In rising interest rate environments, high yield bonds may offer investors the ability to generate positive total return. They are generally more affected by shifts in credit valuations than shifts in interest rates, and during this time period credit was strong, even as interest rates increased.

The chart below illustrates the total return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index compared to the Bloomberg Barclays U.S. Treasury 7-10 Year Index and the Bloomberg Barclays U.S. Aggregate Bond Index. During this time period, Clark Capital’s tactical fixed income strategies were allocated to the high yield sector.

High yield has historically been negatively correlated to Treasuries but also positively correlated to equities. It is for that reason Clark Capital takes a tactical approach, providing the ability to rotate to Treasuries or to the safety of cash based upon our quantitative research.

Takeaways

- High yield bonds may offer a better risk/return profile than Treasuries in a rising rate environment

- The ability to rotate one’s investment allocation between high yields, Treasuries, and safer short-term asset classes like cash may help investors navigate challenges in the fixed income markets

- Consider Clark Capital’s separate account fixed income solution and mutual fund fixed income solutions as part of your clients’ fixed income allocation

K. Sean Clark is the Chief Investment Officer at Clark Capital Management, which is a participant in the ETF Strategist Channel