Recently the RiverFront Investment Team conducted our quarter-end review call and presented a ‘Bull/Bear’ debate on several topics. Building a ‘Bear’ case is not difficult these days, given the many unsettling headlines that predominate our news cycles, including the resurgence of COVID-19 and the economic downturn.

To be clear, our portfolio strategies are reflective of our ‘process over prediction’ mantra, rather than what we read in the headlines. Our tactical process remains generally positive (see our latest Tactical Rules update from our 7/27/20 Weekly View) and thus we are tilted towards equities and our outlook is positive. However, our process also calls for thorough qualitative input from our team, including ‘devil’s advocacy’ to challenge our decision makers and help illuminate blind spots. We think this is a perfect time for us to dig into the logical bear cases to try to understand them and flesh out our team’s opinion. This week, as a follow up to our debate, we address a few of the current headlines and our fundamental views on them.

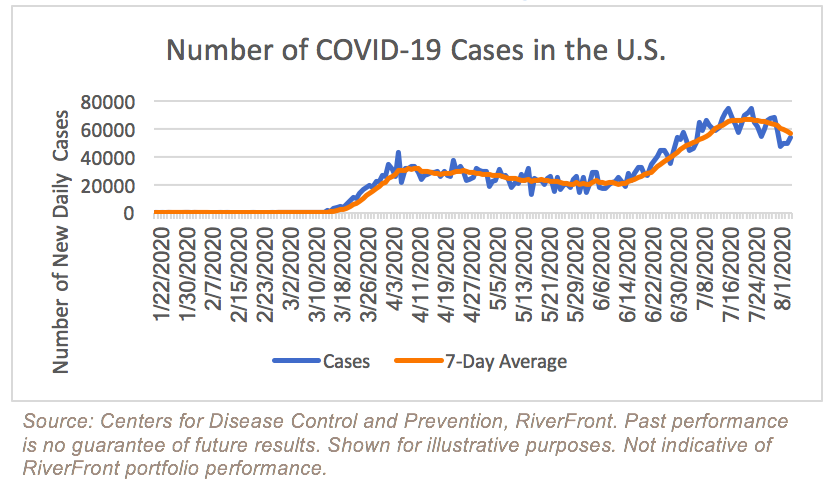

Worry #1: A resurgence of COVID-19 will dampen the reacceleration of the economy. From mid-June to mid-July, the number of new cases in the US reversed higher and remains above its April peak. While increased cases can be expected given the significantly higher levels of testing; economic restrictions and public sentiment appear to be impacted by ‘case count’. Thus, as case numbers increased, economic data began to decelerate. Consumer confidence as reported by both the University of Michigan as well as The Conference Board reversed lower.

While unemployment is trending lower, it is concerning that layoffs in July rose 54% month to month. A silver lining can be found, however, in the fact that over the past week, the number of new cases seems to have reversed trend as evidenced by data from the CDC. This reversal is an important component to keep the economy up and running. Additionally, we are encouraged by headlines almost every week about trials for new drugs to treat, or vaccines to prevent the disease with some suggesting the FDA could approve a vaccine as early as this year.

Worry #2: The stock market has bounced back too quickly: With the S&P 500 retracing nearly 100% of its pre-COVID-19 high and the economy still in recession, many think that the stock market has gotten ahead of the economy.

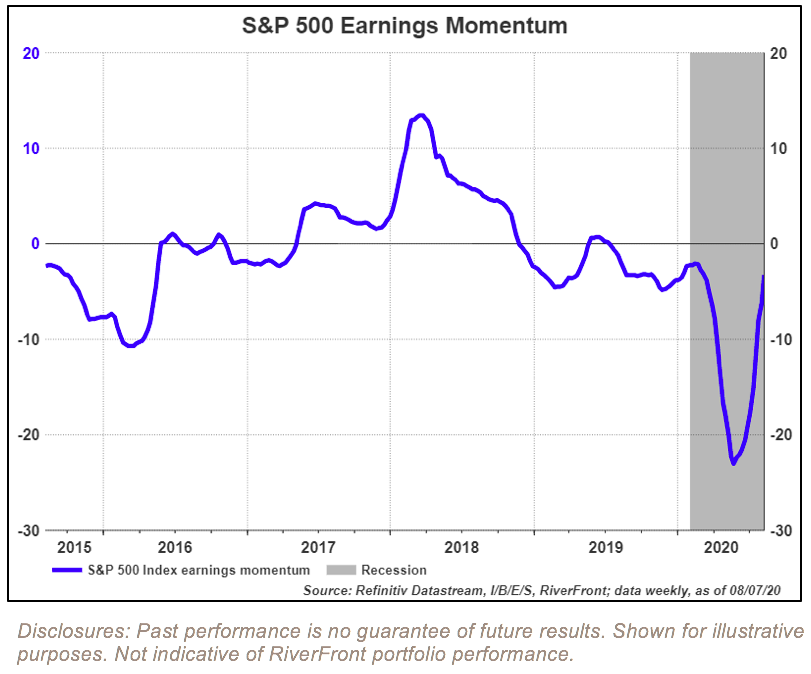

The reason for that discrepancy is that the stock market and economic data reflect two different perspectives: stocks look forward, while economic data looks backward, in our view. We believe that during periods of transition and volatility, the two will often be out of sync for a period of time. We have often found the market prescient and that a rising stock market signals better times ahead. To illustrate this, stocks bottomed late-March, while it took earnings momentum* three more months before bottoming (Right Chart). We believe there are two primary reasons the equity markets have risen sharply over the past four months. The first is that the monetary and fiscal backstops put in place by US policymakers will not only keep the economy afloat but also provide enough fuel to reignite growth in the coming months. Second, there is the growing belief that we could have a vaccine for COVID-19 within the next year. We believe earnings forecasts are also critical to forward expectations. We have just navigated through reporting season for the second quarter and it was not as negative as expected. While the level of the revisions is modest, we believe the directional reversal is important for expectations.

Worry #3: Politicians will fail to agree on further stimulus: The last time the economy faced a ‘fiscal cliff’ was in 2012 when the Bush-era tax cuts were set to expire leading to increased taxes for individuals and businesses and across-the-board spending cuts. Ultimately, the powers that be in Washington D.C. found common ground and a crisis was averted at the last minute. The circumstances this time are different as our economy was plunged into a recession by the pandemic induced shutdown and has become dependent on continued stimulus. Federal programs and Federal Reserve stimulus have allowed the economy to limp through the past several months. On July 31st, many of the benefits from the stimulus packages ended – most notably, the additional $600 per week in unemployment benefits. The impacts from the expiration of benefits will be felt by individuals and small businesses alike, and the headlines about those impacts are dire. According to data released by Apartment List, roughly one-third of Americans had unpaid housing bills at the beginning of August. Small businesses are also feeling pressure. A July survey conducted by The National Federation of Independent Business, revealed that over 20% of respondents expected to be out of business within six months if economic conditions don’t change – underscoring the need for additional funding for small businesses.

While the circumstances are different, we believe that with the elections less than three months away, it is likely that the politicians who want to keep their seats will work hard to reach a compromise very soon. In the meantime, President Donald Trump has issued executive orders on items including enhanced unemployment benefits, eviction protections, payroll tax cuts, and student loan deferments to provide a stop-gap in the absence of an agreement or to force the parties back to the negotiating table.

In conclusion: We believe markets can move higher despite these worries: In February, few of us envisioned 2020 would be defined by the tragedy of a global pandemic. We have all learned to adapt to new realities in terms of our everyday lives – virtual school openings, working from home, increased reliance on technology, and more. We don’t know what the path to recovery looks like nor how long it will take, but we feel certain that a recovery will ultimately occur. In the meantime, we believe that the bulls can still run toward a recovery and chase the bears along the way.

*Earnings momentum is defined as the ratio of positive earnings revisions by analysts minus the negative revisions, divided by total revisions.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions: You cannot invest directly in an index.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1298227