![]() By David M. Haviland, Beaumont Capital Management

By David M. Haviland, Beaumont Capital Management

We have said it before, and we will say it again. 2017 was an anomaly. Now as we have seen bearish conditions in both 1Q and now 2Q, 1Q 18 was a significant contrast to what we were seeing before in 4Q 17. In our last quarterly letter, we wrote the following:

In what was by many measures a chaotic year the market remained as calm as ever. The market didn’t react as North Korea rose to the ranks of a nuclear power, developing an intercontinental ballistic missile (ICBM) that could potentially reach the continental United States. The market didn’t react as hurricanes and floods ravaged the gulf coast and wildfires scorched the west coast. The market didn’t react to political discourse that was unusually vehement even for Washington. The market didn’t react as the U.S. Federal Reserve announced and implemented three interest rate hikes along with plans to unwind almost a decade of quantitative easing (QE). The list goes on and on.

Now that the first quarter of 2018 has come to an end we know what the market finally did react to: inflation and tariffs. As a result, the S&P 500® Index realized its first negative quarterly return since 2015 and ended the quarter 8.08% off of its January 2018 all-time-high. With the benefit of hindsight this seems reasonable. While the events listed in the caption above are worrisome, one can make the case that they don’t significantly impair the aggregate long-term value of the underlying companies in the S&P 500¹. It’s difficult to make the same case for increased inflation and tariffs. We’ll explore this further in this letter and also talk about some of the unique characteristics of this most recent drawdown.

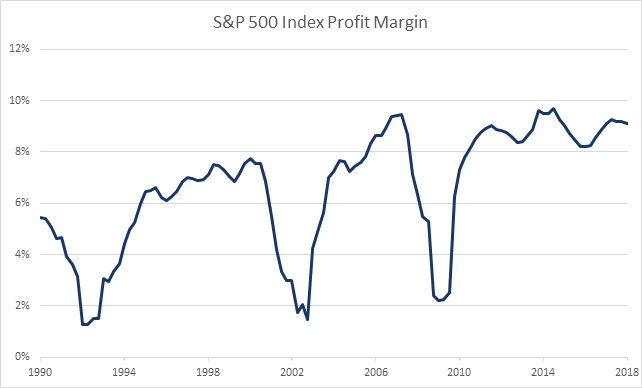

It’s difficult to think of a more frightening word within the financial lexicon than “inflation”. At a high level there are two different types of inflation: cost-push and demand-pull. Neither is ideal for owners of financial assets but the former is far worse than the latter. In a cost-push inflationary scenario, businesses are forced to raise prices as their costs of production, such as commodity prices or wages, increase. With demand for the final product unchanged, it is often difficult to pass through increased costs to consumers immediately which results in falling margins. The profit margins of the companies included in the S&P 500 have hovered around all-time-highs for the past seven years, a major justification for the index’s lofty valuation, so it’s no surprise that investors reacted negatively to data suggesting an uptick in inflation, specifically when it relates to input costs.

![]()

Source: Bloomberg

This is what we believe kicked off that market’s drawdown in late-January to early-February, although other factors have come into play since. The January jobs report, released the morning of Friday February 2nd, showed the largest year-over-year gain in wages of private sector employees since June of 2009. The S&P 500 fell 8.54% over the next 5 trading days.

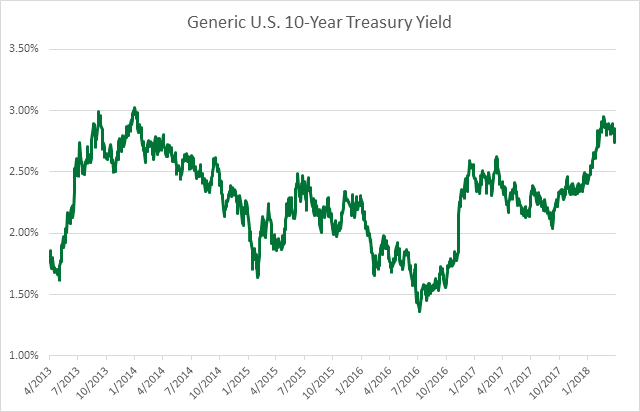

Another side effect of inflation is rising interest rates. In theory, interest rates should compensate for inflation, so when inflation increases, interest rates should rise as well. Equally important is the real interest rate, which is the rate earned by an investor in excess of inflation. The cumulative effects of the Federal Reserve raising the Federal Funds rate, the unwinding of quantitative easing (QE), and the larger than expected U.S. Government budget deficits may compound the effects of increased inflation by causing the real interest rate to rise as well. So far this appears to be more fear than reality. As outlined in the chart below, while the 10-year treasury yield did rise rapidly at the beginning of the quarter, by the end it was only 33 bps higher.

Source: Bloomberg

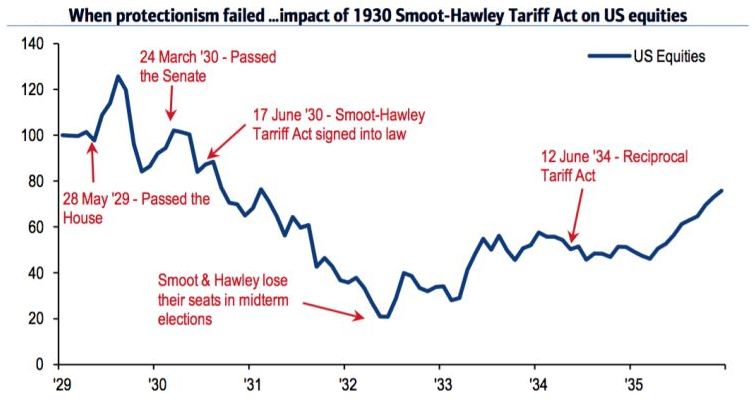

Another contributing factor to the market’s froth has been the prospect of a global trade war brought on by the Trump administration’s desire to lower the United States trade deficit with China. While noble in intent, the use of such a blunt instrument rarely, if ever, works. In fact, they often bring on many unintended consequences including increased prices for both U.S. producers and consumers alike. As you can see from the chart below, these policies are particularly damaging to the multinational corporations making up a large part of the S&P 500. Historically, just over 40% of the S&P 500’s revenue is derived from outside of the U.S. In addition, China will undoubtedly counter any U.S. tariffs with tariffs of their own. If our two countries, the first and second largest economies in the world, engage in a tit-for-tat exchange of tariffs, the ultimate result could devastate the global economy. With any luck, this will just be a tactic to engage in meaningful negotiations with the Chinese. Recently it was reported that these types of negotiations are taking place. We shall see.

Source: Bank of America Merrill Lynch