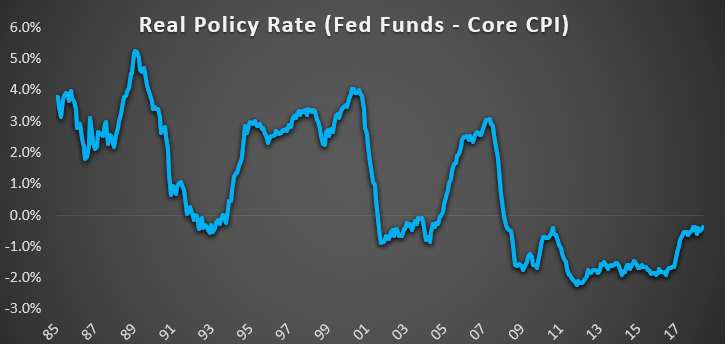

1. The real policy rate, aka the Federal Funds rate minus the core inflation rate, remains below zero. Compared to the level of economic growth in the U.S., conditions are still easy relative to past market cycles.

![]()

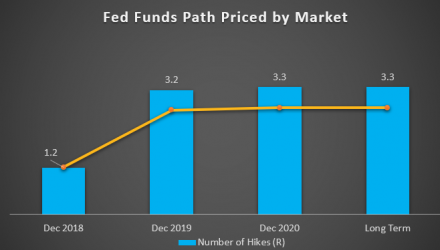

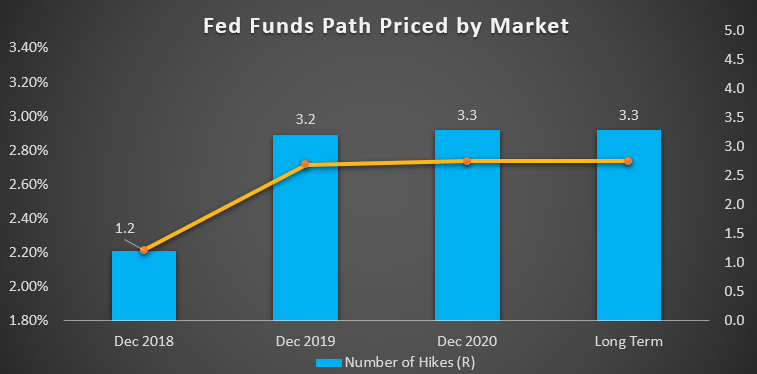

2. After seven rate hikes since 2015, we believe that we are seeing the later innings of the current Fed hiking cycle. The Fed Funds Futures Market is pricing in more than one hike through the rest of the year, and two additional hikes in 2019 before pausing.

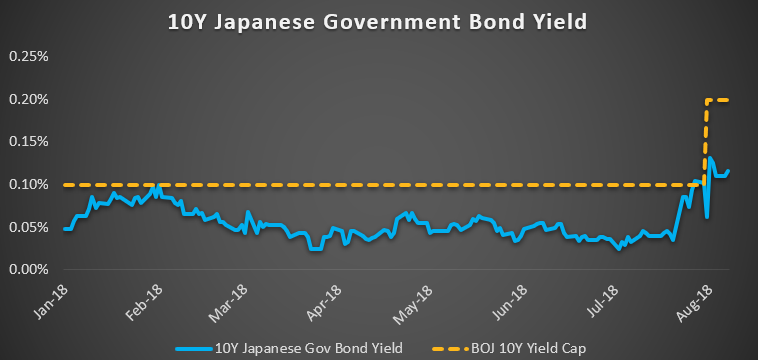

3. The Bank of Japan has recently introduced measures to tighten monetary policy by increasing the bounds around its longer-term yield target, from 10bps to 20bps. Yields have risen in kind as market participants expect a “stealth tapering” of QE purchases.