4. Corporate earnings have grown at an above-trend rate, and 80% of S&P 500 companies outperformed expectations in the second quarter. Valuations are high historically, but P/E ratios have adjusted lower given strong corporate earnings.

![]()

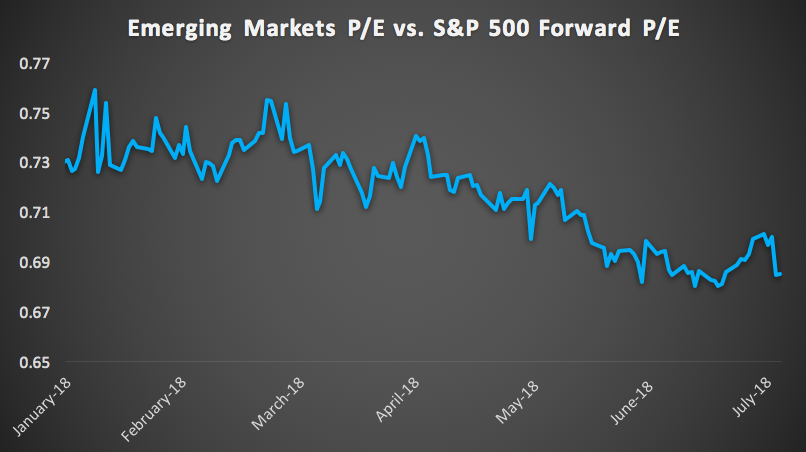

5. Given trade tensions between the U.S. and China, emerging markets equities have repriced lower. We believe emerging markets equities have room to outperform, given their attractive valuations and China’s stimulus measures.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.