By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

Defending Diversification with Data

Sometimes I feel like I have the worst luck. I was reminded of this fact the other day when I found myself in the slowest lane at the toll-booth. Being impatient and in a hurry, I took matters into my own hand and switched lanes…and to my dismay watched the cars in my previous lane begin moving while the progress of the cars in my new lane ground to halt. Additional lane changes only made my situation worse and I quickly concluded that it would have been better if I simply stayed where I started.

My traffic story has relevance to investing, particularly after living through the lopsided investment environment of the last few years. Like me, investors get impatient when they are not currently moving at the same pace as others, and, like me they want to move to where the pace has been the fastest. Unfortunately, we believe that investors who chase performance will encounter similar frustrations and lack of results like I did at the toll booth.

US OUTPERFORMANCE IS ENTICING SOME TO UN-DIVERSIFY

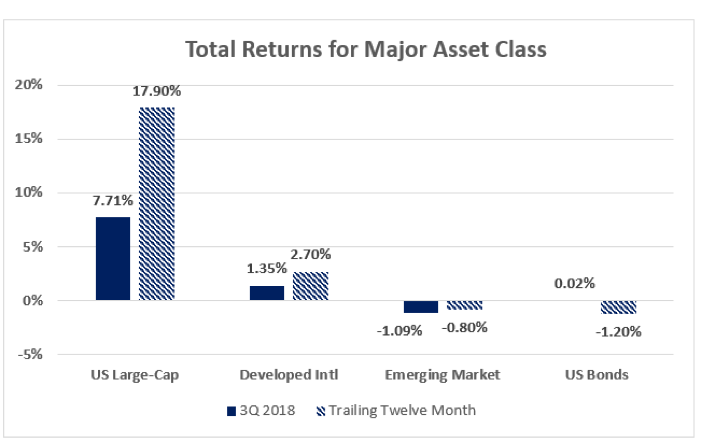

s quarterly statements arrive in coming weeks, investors in globally diversified portfolios may be disappointed to find that their accounts only returned a fraction of the S&P 500’s return. This is because in the third quarter and over the past twelve months the S&P 500 significantly outperformed most other asset classes (chart above), continuing a theme that has persisted since the Financial Crisis. We anticipate that the disappointing performance from diversified portfolios will once again raise questions about whether diversification still makes sense and recognize that the allure to un-diversify can be overwhelming when it is not working, and an investor’s home base is performing well.

![]()

Source: Morningstar Direct, RiverFront. Past performance is no guarantee of future results. Shown for illustrative purposes only, not indicative of RiverFront performance.

CHASING WINNERS’ is A QUESTIONABLE STRATEGY

“Chasing Winners”, which is the strategy of only buying the best-performing asset class of the prior period, can become a popular replacement for diversification after a long period of underperformance.

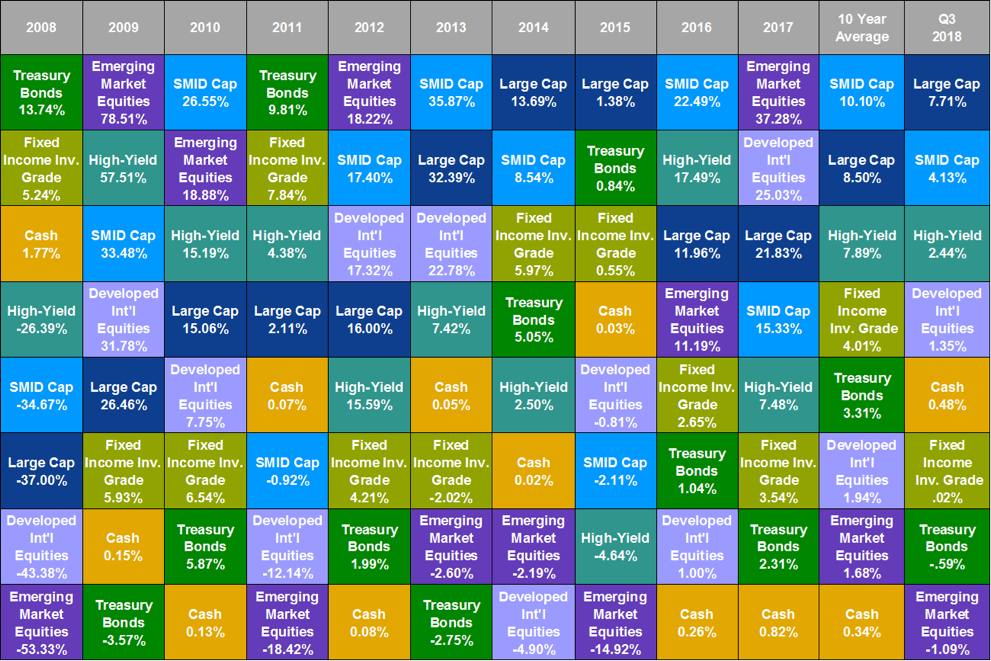

However, buying yesterday’s winners is far from a sure-fire recipe for success because winners regularly shift around, which can be seen in the table below. Yesterday’s winner can often become tomorrow’s loser as was the case with treasury bonds, which were the top-performers in 2008 and the worst performers in 2009. Emerging market equities appear to be setting up for a similar “first to worst” performance in 2017 and 2018.

In our view, diversification is a form of humility

The future is uncertain, which is why we diversify. But one should recognize that the moment a second position is added to a portfolio is the moment they will always own an underperformer. Diversification is certainly not an assurance of higher returns or a protection from losses, and it is not a panacea. In our view, it is a belief that spreading your investments across different countries and asset classes is a helpful approach to reducing risk and smoothing returns.

CASE FOR DIVERSIFICATION REMAINS STRONG

Since 1973 the overall yearly win percentage of international stocks versus those in the US is nearly identical in US dollar terms. We recognize that it often does not feel that way since there were two long-term mega streaks for each side over that time period, including the now decade-long hot streak the US is currently riding. RiverFront’s asset allocation framework, based on the potential of long-term mean reversion, suggests to us that international equities are priced to return significantly more over the next 5-10 years than US equities. We remain committed to diversification and to increasing weightings to those asset classes that have been underperformers, so long as we think they are attractively priced.

IN CONCLUSION

Timing is hard, and momentum can persist longer than investor emotions can tolerate. That said, in our experience, abandoning a previously determined diversified investment plan after it has underperformed a single asset class could be a decision that is later regretted.

Doug Sandler, CFA, is Global Strategist; Chris Konstantinos, CFA, is Chief Investment Strategist; and Rod Smyth is Director of Investments at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

Diversification does not ensure a profit or protect against a loss.

Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

Small, mid, and micro cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

In a rising interest rate environment, the value of fixed-income securities generally declines.