The best long-term scenario is that someone other than AMLO wins the election. Many of our conversations with political strategists focus on the undecided voters, which still represent a fairly large number, so perhaps a legitimate win for Anaya is still possible. As we have heard many times, these voters and others who may have expressed an opinion in a poll, will all line up for whichever candidate is in 2nd place going into July 1; an ‘anyone buy AMLO’ voting bloc. Simplistic math can support that thesis, but it would take everything falling into place. And we are late in the campaign; debates have come and gone with no real changes in the polls. Gaffes that may have doomed AMLO in previous elections do not seem likely at this point. So, again, best case scenario – he somehow loses which would undoubtedly bring chaos.

Accuvest is in the portfolio management business, so having an implementable view on every market in the ACWI is required. Our far-from-rosy outlook needs a bottom line recommendation for this article be meaningful. As mentioned in December, we were not going to be long Mexican assets any time prior to the elections.

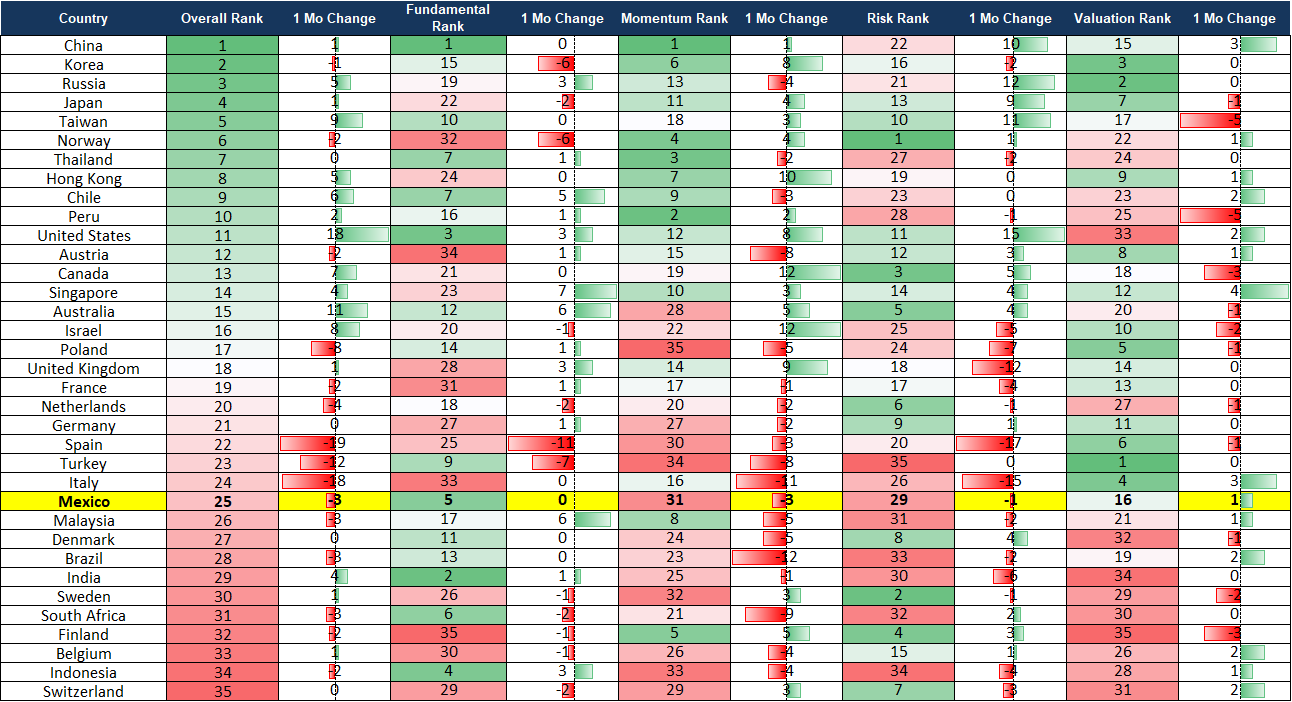

Accuvest Country Rankings – June 2018

![]()

For a brief time the peso did strengthen to levels that seemed extreme and for certain portfolios we actually initiated a short position on the currency. The weakening of the peso in the past month has been fairly dramatic in time and magnitude. We are likely to cover half the position prior to the election as negative sentiment is certainly not a secret and is in the price that has rewarded us nicely. A lot of the NAFTA rhetoric has also been negative and is baked in to the current price.

Another point made in the December piece was that in the past Mexico has had fairly significant declines in asset values in times of crisis. In all cases, those were buying opportunities. Our attitude is to assume that such a crisis could unfold after the elections; hopefully not, and maybe it’s a low probability. We will look to take advantage of this opportunity. If nothing so severe comes to pass, the opportunity cost is low given Mexico’s small weight in the ACWI. Accordingly, this is a time to be attentive and patient.

This article was written by the team at Accuvest, a participant in the ETF Strategist Channel.