By Dave Haviland, Beaumont Capital

We have enjoyed the current bull market which recently surpassed the 1990-2000 technology-led bull as the longest bull ever. Hopefully you have been invested and enjoyed the benefits of this bull market, a most welcome market after the devastation of 2007-2009, nearly a decade later.

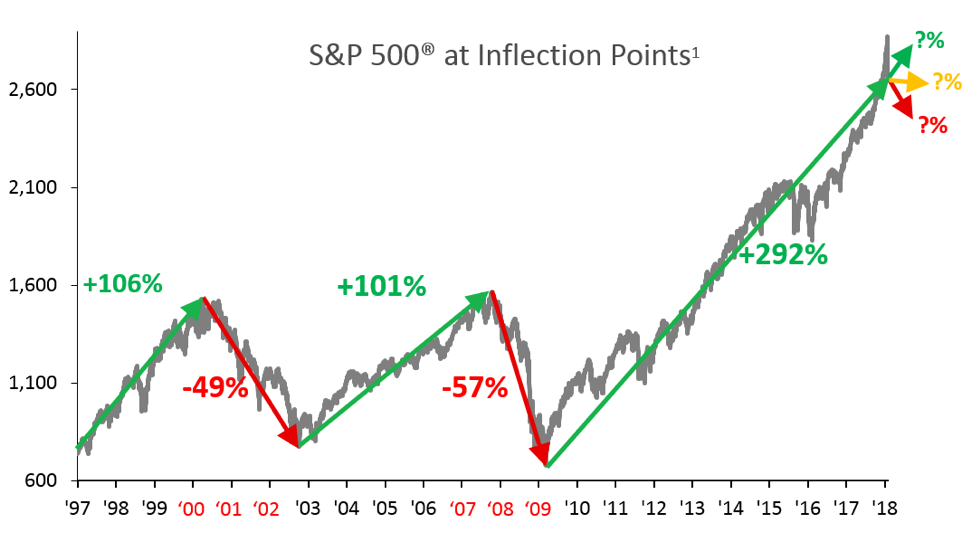

The chart below shows just how spectacular the U.S. equity markets have performed since the 2007-09 bear market that ended in March 2009. It also shows that while the markets have spent the majority of the time growing, when the bear roars, the results often wipe out years of gains.

![]()

We conveniently marked the page on where we are as of late. No one, including us, knows how long this bull will last. However, there are prudent actions to take today to prevent that bear from disproportionately ruining years of investment progress and letting your gains go down the drain.

Rebalance your portfolio to your financial plan’s original target

How far out of whack has your allocation become compared to the outline in your financial plan? If you don’t have a plan, consider seeing a financial planner pronto! For this conversation, simple benchmark would be to have your percent allocated to equities equal to 100 minus your age. For example, if an investor is 54, then 46% might go into equity. There are several ways your portfolio could have become unbalanced while enjoying the benefits of this most recent bull market:

1. Consider reducing your debt if retirement is imminent

Debt is costly to maintain in retirement. Higher rates such as credit cards should be paid first, but also focus on any non-deductible debt such as auto loans and student loans. Put simply, you’ll need risk asset returns to pay your debt in retirement and this ads risk to the entire equation. To explain:

A U.S. 10-year currently yields 2.82% and last yielded 3% on 8/1/18 and the U.S. 30-year currently yields 2.98% and has yielded over 3% for most of the past year. After tax, assuming a 30% combined Federal and State tax rate, you’ll keep 2.1%. If your interest rate is higher than 2.1%, then the difference, after tax, must be made up with equity or risk asset returns. Otherwise, you’ll be spending your principal on your debt.

2. Underweight International

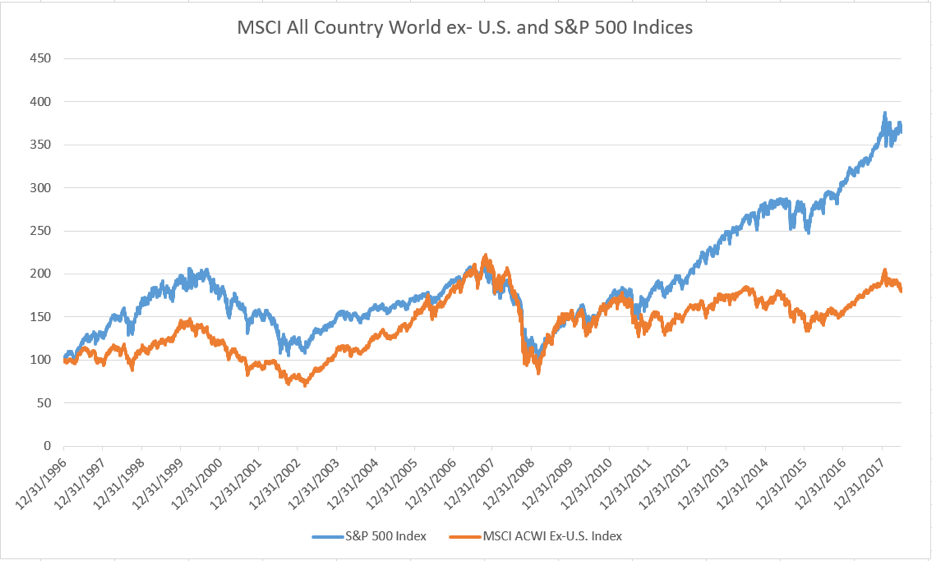

If U.S. equities have been on a tear, then other asset classes such as international equities may be significantly underweight. See the chart below. What do you think has the better prospect of growth going forward?

Data: FactSet, MSCI, J.P. Morgan Asset Management

3. Underweight Bonds or Diversifiers

Worse yet, other asset classes such as bonds or diversifiers will likely be even more underweight. It is a fine time to rebalance now and capture some of your gains. Yes, if in a taxable account you will likely have some tax due. But would you rather keep ~80% net of long term Federal and State capital gains tax or let the next bear market remove a much larger slice like the last two? (See first chart)

Consider Tactical Management

Most investors think their active manager will protect them in a market meltdown. Actually, for most, nothing could be further from the truth. While every active manager will take your cash and make the buying decision for you, they have no reason to sell when markets fail. Why? They are paid to stay close to their benchmark. Institutional money (read: the big money like universities versus the average investor) will fire them if they deviate too far from their benchmark. Therefore, practically, they are unable to sell without risking their own jobs. Please click here to read more on this topic. If your manager isn’t going to sell, and anything you have in an index fund/ETF/strategy is going to go up and down with the index, who is looking after your nest egg?

Tactical management adds the diversification of management style. Tactical management is designed to avoid the majority of a bear market by selling the risk assets for you and using cash or other asset classes to try and avoid the major loss. As part of a portfolio, this addition can significantly mitigate the losses found in a bear market. Click here to see how to build a simple UMA (unified managed account) portfolio that includes both strategic and tactical management that can help smooth the ride.