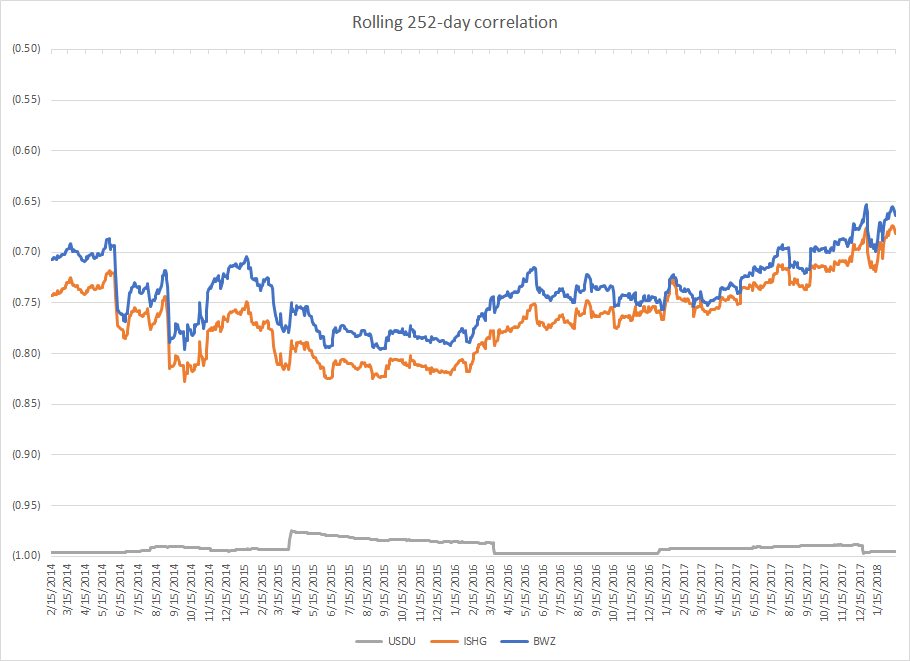

Going back to the correlation question, here is a chart of the rolling 252-day correlation of the underlying indices of BWZ and ISHG vs the dollar, with the UDN index as a point of reference:![]()

While both the underlying bond exposure and the different currency weights dampen the correlation a bit versus UDN, there remains a strong negative and rather steady negative correlation to the US dollar (for the entire period, the ISHG index had a -0.76 correlation while BWZ had a -0.73 correlation).

For those who may have fears about having exposure at the front end of the curve (whether it be negative interest rates abroad or potential rate climbs/curve flattening like the market has seen here in the US), an investor could also step out into broad government exposure rather than staying on the short end of the curve. Two options here would be:

- IGOV (iShares International Treasury Bond)

- BWX (SPDR Bloomberg Barclays International Treasury Bond)

In terms of currency exposure, both names have very similar exposure to their short-duration counterparts. They also have a similar underlying yield dispersion (0.72% versus 1.19%). But going back to the original question at hand, these names will have a slightly less favorable negative correlation to the dollar given the other forces at play (higher yield, more volatile underlying rates out the curve, etc.), although they are still decently low at -0.68 and -0.63 respectively. Here is the same rolling correlation chart with the additional names added:

In conclusion, for investors looking for ways to take advantage of a weaker dollar, there are a handful of names in ETF land they could use.

Clayton Fresk is a Portfolio Manager at Stadion Money Management, a participant in the ETF Strategist Channel.

Disclosure Information

Past performance is no guarantee of future results. Investments are subject to risk and any investment strategy may lose money. The investment strategies presented are not appropriate for every investor and financial advisors should review the terms and conditions and risks involved. Some information contained herein was prepared by or obtained from sources that Stadion believes to be reliable. There is no assurance that any of the target prices or other forward-looking statements mentioned will be attained. Any market prices are only indications of market values and are subject to change. Any references to specific securities or market indexes are for informational purposes only. They are not intended as specific investment advice and should not be relied on for making investment decisions. One cannot invest directly in indexes, which are unmanaged and do not incur fees or charges. At the time of writing, Stadion did not own any of the securities referenced. Founded in 1993, Stadion Money Management is a privately owned money management firm based near Athens, Georgia. Via its unique approach and suite of nontraditional strategies with a defensive bias, Stadion seeks to help investors—through advisors or retirement plans—protect and grow their “serious money.” Contact Stadion at 800-222-7636 or www.stadionmoney.com. SMM-022018-176