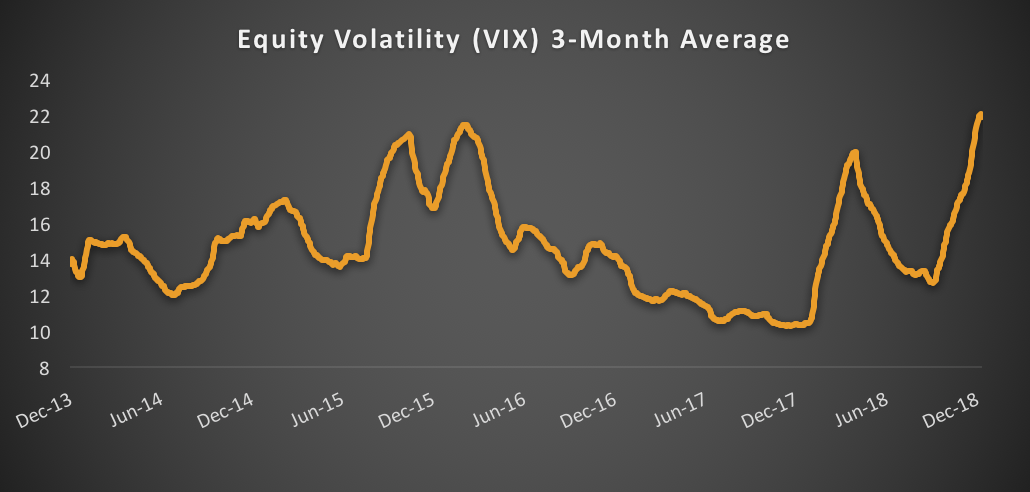

1. Higher Volatility. Even after factoring in some spread widening during the year, Sage believes 3% to 4% return is easily achievable for core fixed income. And with equity return expectations below average, in the 5%-to-6% range, and accompanied by greater downside risks and high volatility, fixed income is the more attractive asset class from a risk-reward perspective going into the new year.

Source: Bloomberg

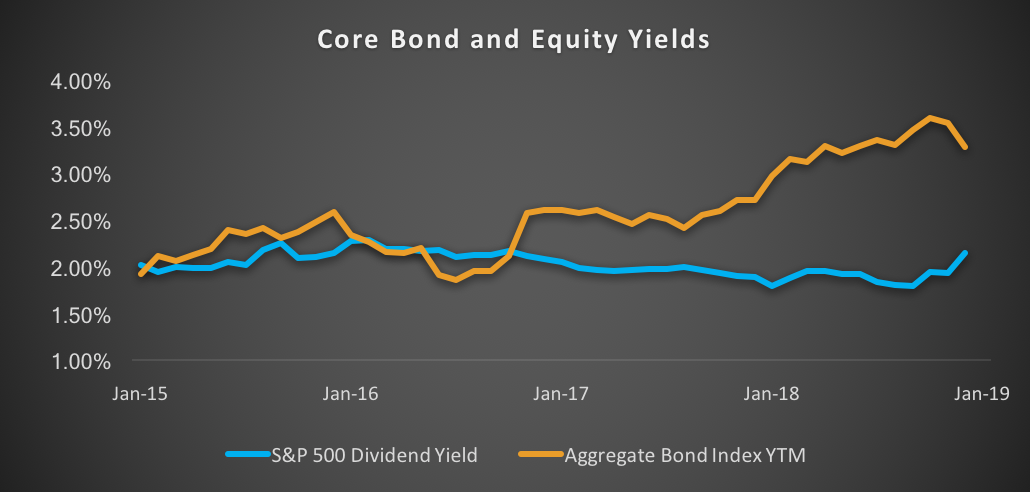

2. Higher Yields. For income seekers, yields on diversified core investment grade fixed income are now 3.25%, up 60% from just three years ago, and are now well above equity dividend yields. This should add some stability to returns. For more risk-averse investors, with the curve flattening, short-duration strategies now offer attractive yield with limited interest rate risk.

Source: Bloomberg

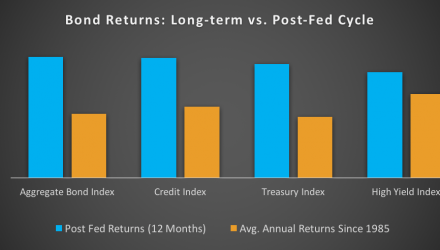

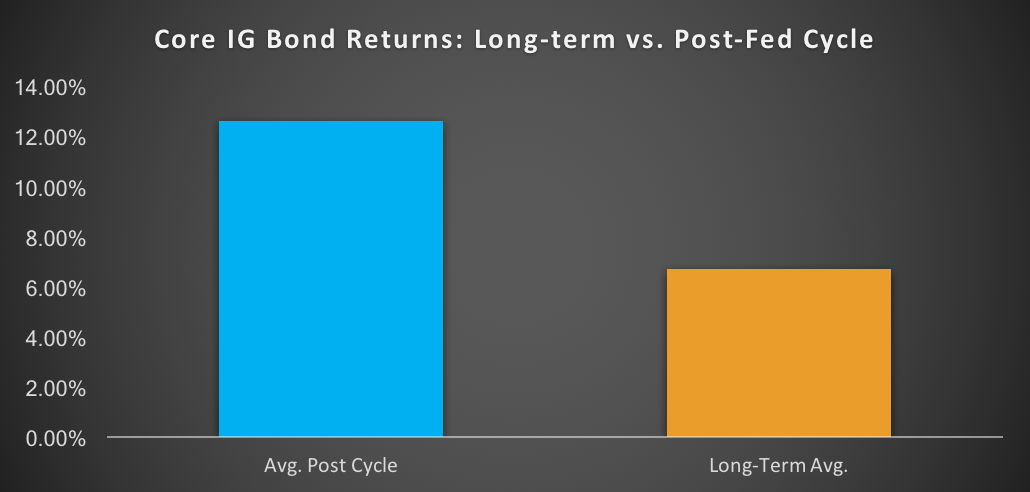

3. The End of the Fed cycle. Unlike equities, which experienced a deteriorating picture into year end, bond investors enjoyed improving returns throughout the year, with the Aggregate Index posting better returns each subsequent quarter. This is not an unusual pattern, as bond returns are typically higher into the end of a Fed cycle, as investors reap the benefits of higher yields and long rates stabilize in anticipation. The environment improves further for bond investors post-Fed cycle, with returns for the 12 months following the end of a Fed cycle almost double the longer-term average.

Source Bloomberg. Average post-cycle includes the last six Fed cycles, and long-term average is since 1985.