By RiverFront Investment Group

In our 2019 Outlook, our base case scenario pointed to a positive outcome for stock markets in 2019… but that outlook was highly dependent on the path of three key market drivers that we call the ‘3 Rs’ – Recession Risk, Rates and Resolution of Trade Disputes.

After a strong initial start to the year (see Weekly View, 2/4/19: Checking in on Our ‘3 Rs’: So Far, So Good), this quarter’s update paints a darker fundamental picture, particularly with regard to international economies. Surprisingly, global markets are higher despite these deteriorating fundamentals prompting RiverFront’s portfolio managers to make portfolio adjustments in late May. In our short-horizon portfolios, we shifted some money out of international stocks and into cash, bringing overall risk levels to ‘neutral’ versus our benchmarks. In our longer-horizon portfolios, we chose to reallocate the proceeds from international sales back into US equities, where economic fundamentals appear stronger.

Recession Risk: Still Remote in the U.S., but Rising Internationally

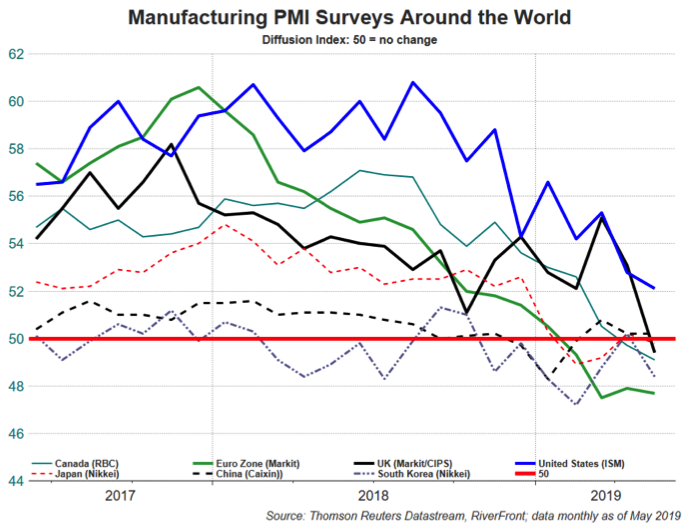

In the US, forward-looking business sentiment indicators such as the ISM Purchasing Manager’s Index (PMI) survey have deteriorated but are still high enough to suggest the economic recovery remains on steady footing. Ed Hyman, Chairman of Evercore ISI, suggests that the May’s ISM reading of 52.1 correlates to US GDP growth of around 2.5%. If Evercore ISI is right, it is premature to assume a US recession is just around the corner.

However, outside of the US trade concerns have contributed to less positive manufacturing sentiment readings. For example, the PMIs in Japan, UK, Canada, South Korea, and the Eurozone are now all under 50 (see chart above), with Germany clearly in recessionary levels at 44.3. Export data in trade-oriented countries like Germany, Korea, and Japan is continuing to deteriorate as well.

Rates: The Fed Still On Investors’ Side

As markets were reminded last week, our tactical rule of “Don’t Fight the Fed’ is still very much in effect, as dovish comments from the Federal Reserve on June 4 helped spark a rally that ended a six-week slide in markets. One thing that keeps us from being more cautious on the US market is the ‘Powell Put’ – the idea that the Federal Reserve remains proactive in protecting the US economic recovery from increasing global economic and political risks. Fed Chair Jerome Powell’s comments on Wednesday suggested the Fed is poised to cut interest rates, and a surprisingly weak May payrolls number on June 7th boosted the already high probability of preemptive Fed action in the summer. Outside the US, markets are less sanguine. While the European Central Bank (ECB), Bank of Japan (BoJ) and People’s Bank of China (PBoC) all continue to employ accommodative policies, markets are concerned that they may be ‘falling behind the curve’ on stimulus.

Resolution of Trade Disputes: Far from Being Resolved at This Point

Progress on trade is perhaps the most disappointing of our 3 Rs since May, when a relatively abrupt turn in US/China relations heralded a complicated new phase of trade negotiations. Rhetoric on both sides has turned much more aggressive, suggesting a long, drawn-out negotiation versus a quick resolution by June, as many had hoped for. A topic we discussed in detail last week (Weekly View, 6/3/19: US/China ‘digging in’ on Trade).

In addition, the trade ‘war’ has suddenly become a multi-front affair. While news over the weekend suggests that the Trump administration has dropped tariff threats on Mexico ‘indefinitely’, investors remain unsettled that the US can threaten unexpected tariffs to achieve non-economic objectives, like border security, despite previously agreed upon trade agreements. In addition, the US’s exercise of leverage over the global tech supply chain with their war on Chinese telecommunication equipment maker Huawei has both Asian and US technology companies bracing for further retaliatory measures. These new approaches to trade make it more likely that tariffs will be threatened more regularly and that counterparties to US trade agreements, including some of our closest allies, may be more reticent to come to an agreement quickly. Ultimately, we believe that market valuations must discount these uncertainties for the foreseeable future. While we believe it is in both the US and China’s best interests to reach a cease-fire, we are concerned it may be delayed until the start of 2020, which would disappoint investors, in our view. If positive progress can’t be made by the end of the summer, both direct effects of the tariff increases as well as the indirect hits to business and consumer confidence could start to create a negative feedback loop into our 2nd ‘R’ – Recession Risk – forcing us to reevaluate our neutral stance on market positioning.

S&P 500 Technicals: S&P 500 Settling into a New Trading Range?

The technical picture has grown more mixed in the US. After a definitive break above its trading range in early April, the S&P 500 pulled back sharply on trade concerns. The pullback caused the primary trend, as defined by the 200-day moving average (red dotted line), to turn slightly negative.

Past performance is no guarantee of future results. Shown for illustrative purposes, not indicative of RiverFront portfolio performance. You cannot invest directly in an index.

Thus, we have lowered the bottom end of our trading range to 2775. Beyond that 2700 may serve as support and we continue to view meaningful resistance near the old highs at 2950.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

When referring to portfolio asset class weightings and shifts, we are referring to Advantage portfolios. For more information on our other portfolios, please visit our website.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared the composite benchmarks for each portfolio. Composite and benchmark definitions can be found on our website.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 870512