By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

We think that the recent equity market volatility is a typical correction and does not suggest a recession for three reasons. First, the U.S. Federal Reserve (Fed) normally causes a recession and several of our measures suggest that the Fed has not yet gone too far in its current cycle of monetary tightening. Secondly, market-based forecasts for Fed rate hikes have been declining, which implies that the market believes that the Fed will significantly slow the pace of its monetary policy tightening. Finally, many fundamental indicators point to continued economic growth, though at a slower pace of growth.

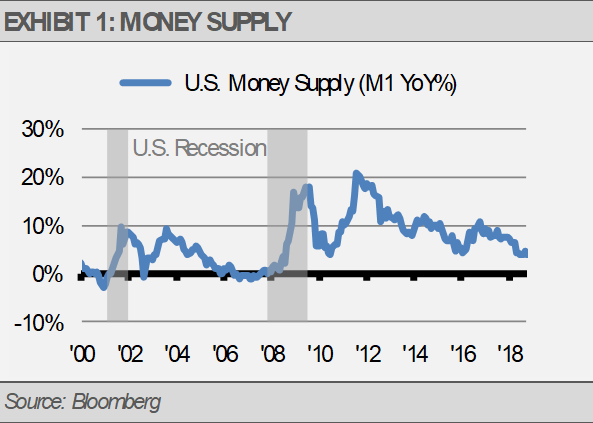

Historically, the Fed has pushed the U.S. economy into a recession and we typically see cautionary signals coming from monetary conditions and credit conditions beforehand. Importantly, current monetary conditions support growth. We tend to focus on inflation adjusted narrow money growth, or real M1 growth, which includes currency in circulation, checking accounts, and negotiable orders withdrawal accounts. While M1 has slowed, the monetary system and liquidity continues to grow.

Similarly, credit conditions suggest continued economic growth, but at a slower pace. The yield curve, which is the difference between long-term interest rates and short-term interest rates, such as the 10-year Treasury yield minus the 1-year Treasury yield, tends to go negative nine months to 24 months prior to a recession. Though the yield curve has flattened, it has not gone negative. Therefore, we view these changes as reflective of slower growth, not an economic decline. Additionally, high yield and investment grade credit spreads (the difference between corporate bond yields and similarly maturing Treasury bonds) suggest that investors are demanding higher interest payments to take on credit risk. However, current higher interest rates are not at levels that point to an imminent economic decline in our opinion.

Additionally, market-based forecasts for Fed rate hikes have been declining, which implies that the market believes that the Fed will significantly slow the pace of its monetary policy tightening. The CME Group FedWatch Tool, which measures market-based expectations for future Fed rate hikes, has recently shown a decline in the probabilities of more than two rate hikes from this point. Judging by this measure, it seems that the market is moving towards our expectation for the pace of rate hikes to slow.

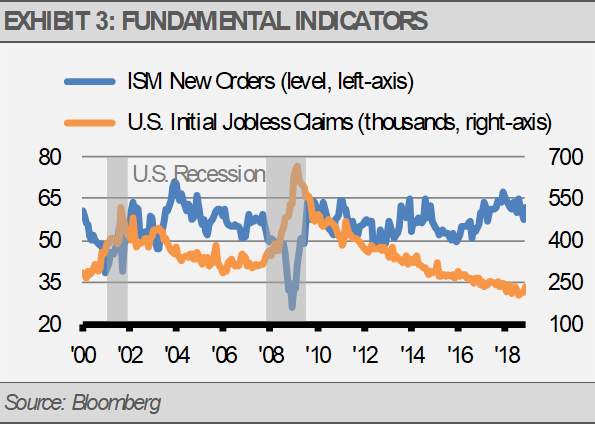

Finally, fundamental indicators, such as new orders and jobless claims continue to suggest growth, though at a slower pace. For example, the ISM New Orders Index has declined to a level that still suggests economic growth ahead, but not contraction.

Furthermore, layoffs, as measured by weekly initial jobless claims are near all-time lows. Though it will be difficult for the number of layoffs to decline from these low levels, the current level suggests a strong labor market ahead. Both of these indicators tend to deteriorate significantly in the months leading into a recession.

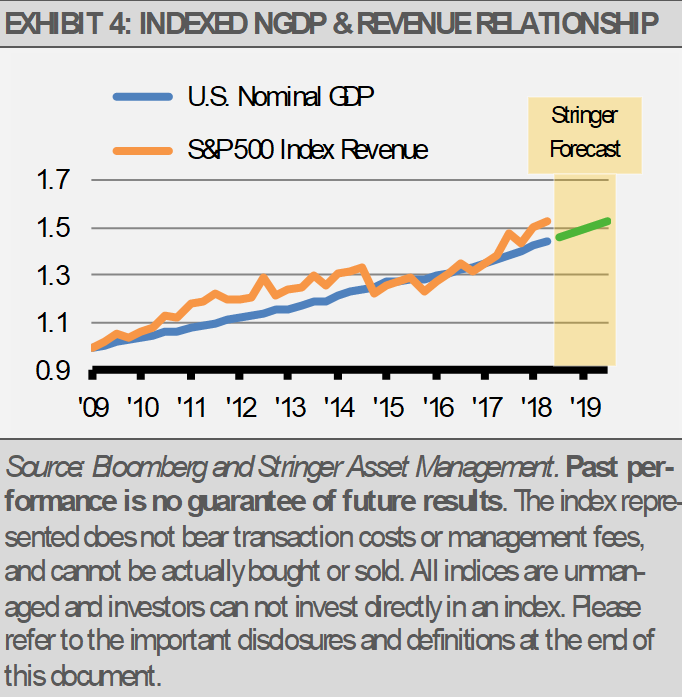

Each of these areas suggest continued growth of the U.S. economy. Economic growth, even slow economic growth, leads to higher corporate revenue and earnings, which can ultimately lead to higher stock prices over time.

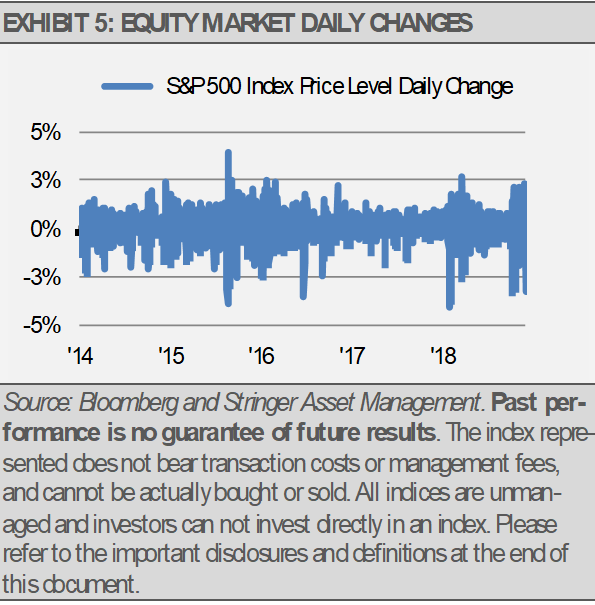

With this positive outlook as a backdrop, we think that market volatility should be viewed as both an opportunity and not unusual. For example, since the first trading day of 2014 through December 7, 2018, the S&P 500 Index has experienced a daily loss of 0.5% or more on 224 trading days, or 18% of the time. The Index has lost at least 1% on 102 occasions, or 8% of the time. So, using the S&P 500 Index to represent the market means that the equity market has experienced a one-day loss of at least 1% almost 10% of the days. As the chart below illustrates, the equity market tends to go through bouts of volatility, then calms down, only to finally repeat the volatility again.

As long as the fundamental economic backdrop remains constructive, we would look past the recent market volatility or use difficult days as buying opportunities.