By Ryan O’Malley, Fixed Income Portfolio Strategist, Sage Advisory

In recent weeks, Sage has become more cautious on lower-quality corporate bonds. Our caution is based on the following signals.

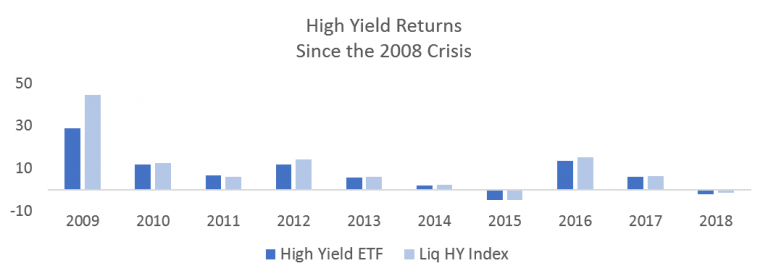

1. Abnormal Performance – High-yield bonds have performed well on an absolute-return basis this year, returning nearly 12% in 2019. Years of double-digit returns for high yield are rare and are typically followed by much weaker returns the following calendar year.

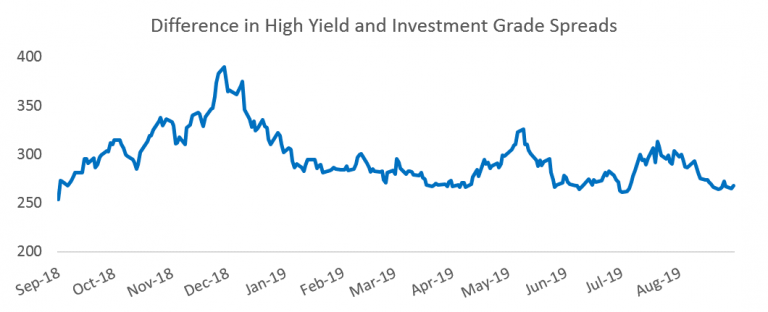

2. Relative Value – High-yield bonds have dramatically outperformed investment grade corporate debt this year, and particularly in the past few months. The spread premium paid by high-yield bonds compared to investment grade bonds has narrowed to its lowest level in 2019 and is near historic lows.

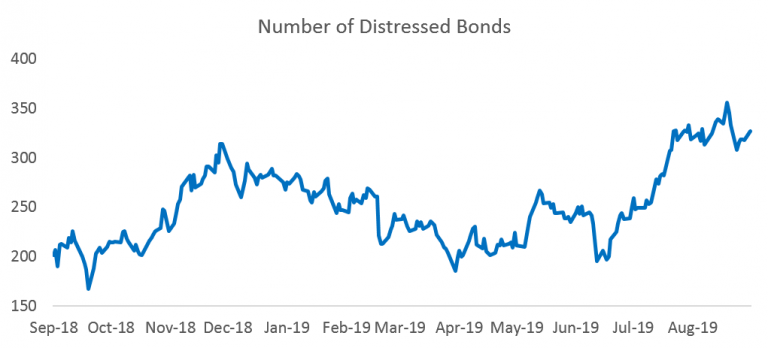

3. Signs of stress in the weakest parts of the market – Despite strong overall performance in the high-yield bond market, there are signs of stress. One such signal is the increase in the number of bonds trading at “distressed” levels. “Distressed” bonds are defined as those issuers who’s spread to the relevant U.S. Treasury exceeds 1,000 basis points, or 10%. The number of bonds trading at “distressed” levels has increased by 63% in the past 12 months.

Sage Positioning

As a result of this changing view, Sage has elected to trim high-yield exposure where we had individual bond positions – taking profits on some longstanding trades, including debt issued by Hilton Worldwide, T-Mobile, Ardagh Group, Cheniere Energy Partners, and Western Digital. Sage has also tactically shifted away from “crossover” credits, or credits that hold investment grade ratings from one agency and high yield from the other.

Investment grade spreads often follow trends in the high-yield markets, so Sage has also shifted its investment grade exposure away from riskier credits and towards higher-quality ones.

This article was written by the team at Sage Advisory, a participant in the ETF Strategist Channel.

*Source on all charts is Bloomberg.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.