By Riverfront Investment Group

Today’s Weekly View represents a summary companion to our recently released 2020 Outlook. Investors may be dizzy when staring at a stock chart these days, with US stocks at all-time highs. Call it ‘altitude sickness’ – that disorienting combination of risk aversion and loss aversion that can result in investors missing out on markets that are going up. We think succumbing to this altitude sickness is a mistake for investors in 2020. RiverFront believes the most likely scenario for 2020 is for markets to continue to climb a ‘wall of worry’ to new heights, albeit in an uneven fashion.

Our base case predicts that an easing of trade tensions and expansion of central bank liquidity will lead to a mildly positive global corporate earnings cycle in 2020. We would view the signing of USMCA, a ‘phase-one’ China trade deal, and France’s agreement to extend negotiations on the proposed ‘digital tax’ as promising signs of easing trade tension. We believe that both history and momentum are on investors’ side this year; presidential election years tend to be positive, and global stock breadth is improving. Despite this attractive backdrop, fund flows into equities have been dwarfed by flows into bonds, suggesting a lack of the type of euphoria usually present at structural market peaks.

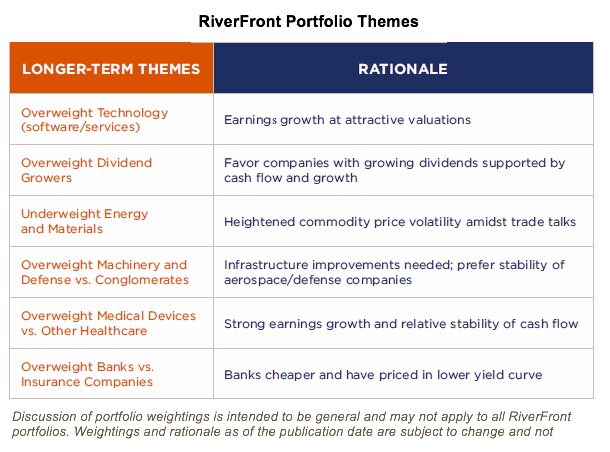

In keeping with these views, we favor equities over bonds in our balanced portfolios. Our preferred investment themes include Technology, Healthcare, consumer-oriented logistics, defense contractors, and companies who consistently grow cash flow and pay dividends. We also start the year constructive on Japanese equities and other selected European and Asian markets. While international stocks in general remain a ‘show-me’ story given their compromised economic backdrops, they may have the most potential upside in a bullish global economic scenario in 2020.

RIVERFRONT’S BASE, BEAR, AND BULL CASE SCENARIOS FOR 2020

A yearly tradition for us is to publish a base, bull, and bear case in our Outlook, along with RiverFront’s opinions of the relatively probabilities of each. This year, we assigned a combined 85% probability of positive total returns in global markets in 2020, with the magnitude of these gains highly dependent on a continued trade truce, the restart of a stagnant corporate earnings cycle, and the outcome of the 2020 elections.

While stock valuations rose meaningfully in 2019, we must contend with the possibility that ultra-low bond yields are with us for the foreseeable future, driving up the scarcity value of the yields provided by stocks. A comparison of stock dividend yields to “risk-free” rates across the globe suggests stocks are still highly attractive relative to bonds and cash. In our base case scenario, corporate earnings show single-digit growth this year, a function of bottoming global economies and a ‘low-bar’ from last year’s flat to down earnings performance. We acknowledge that a higher starting point creates greater risks for future returns and sets up 2020 to be a potentially volatile year. Potential volatility may be compounded by the reality that the US will face an even more contentious than usual presidential election in November.

We view a true bear case scenario as relatively unlikely because we believe it would require a series of events, each of which is somewhat possible in isolation but much less likely to occur in tandem. These include a trade war reacceleration leading to a 2nd half recession in the US, a Democratic sweep of both the presidency and Congress in November, combined with little action from the Federal Reserve should the first two events occur. On the flip side, the bull case would require the type of environment that we witnessed in 2017, with global economic growth and earnings both surprising meaningfully to the upside on the back of calmer geopolitics in Asia and Europe. While this not our most likely scenario, we view it as incrementally more probable than the bear case.

The table above depicts RiverFront’s predictions for 2020 using three scenarios (Pessimistic (Bear), Base, and Optimistic (Bull)). Our assessment of each scenario’s probability is also shown. The assessment is based on RiverFront’s Investment Team’s views and opinions as of the date of publication shown on inside back cover. Each case is hypothetical and is not based on actual investor experience. These views are subject to change and are not intended as investment recommendations. There is no representation that an investor will or is likely to achieve positive returns, avoid losses or experience returns as discussed for various market classes.

2020 OUTLOOK POSITIONING HIGHLIGHTS:

·RiverFront favors stocks relative to bonds in our balanced asset allocation portfolios. We place a relatively high probability of positive returns for equities in 2020, though we acknowledge that the strong end to 2019 may lead to higher volatility in the year to come.

· Our base case scenario predicts that an easing of trade tensions and expansion of central bank liquidity will lead to a mildly positive global corporate earnings cycle in 2020.

· We think both history and momentum are on investors’ side in 2020; Presidential election years tend to be positive, and global stock breadth is improving.

· We remain constructive on US stocks, believing stock valuations can stay elevated with the lack of attractive yield in the bond market. We see opportunity in certain industries within Technology, Healthcare, consumer-oriented logistics, defense contractors, and companies who consistently grow cash flow and pay dividends.

· International stocks are still a ‘show-me’ story given their compromised economic backdrops; however, areas like Japan and certain parts of Europe and emerging markets may have the most potential upside in a bullish global economic scenario in 2020.

· Regarding bonds: it’s hard to get too excited given the starting point for both yields and spread.

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

It is not possible to invest directly in an index.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2020 RiverFront Investment Group. All Rights Reserved. 1064160