In its first issue of “In The Know,” J.P. Morgan Asset Management highlighted a bevy of trends apparent in the current ETF landscape, such as the flow of capital, as well as opportunities abound in U.S. equities, international equities and fixed income. As the capital markets move forward and strategies adjust in this extended bull market, financial advisors and investors alike must be stay abreast of these changes to identify profitable opportunities.

With the S&P 500 recording the longest ever bull market and the Nasdaq Composite breaking past the 8,000-point level, many market pundits are already predicting that the capital markets are ready to shed its late market cycle skin. If that’s certainly the case, then investors can begin their profitability-seeking research by simply following the money.

ETF Shopping Spree

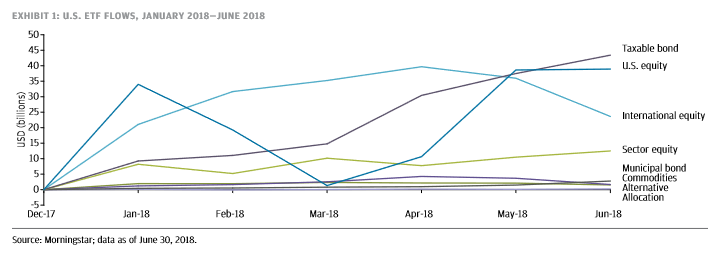

The first quarter of 2018 saw outflows in ETFs–a first in the previous two years, but that proved to be temporary as investors returned with cash-in-hand during the second quarter, resulting in an ETF shopping spree. ETF investors weren’t short of choices as there were roughly 2,000 funds to choose from–a total of $3.5 trillion in assets.

This exponential growth in ETFs the past decade is showing no signs of scaling down.

“With net flows of $123 billion year-to-date, growth is expected to continue as additional ETFs enter the marketplace,” the report said. “The number of ETFs has increased 3.2% in 2018 with 170 new funds launched and 102 delisted since the start of the year. A majority of the AUM sits in market-cap weighted strategies, $2.7 trillion in fact, compared to strategic beta and active strategies, which represent $746B and $58B in AUM, respectively.”

![]()

Related: In the Know – Stay up to date on ETF This Quarter

Late Cycle Opportunities in U.S. Equities

A lot of investors are wondering whether they are late to the party now that the market has turned the corner and is maintaining speed on “Late Cycle Street,” but where exactly is it headed? According to the JP Morgan report, rather than relying on traditional market-weighted capitalization strategies, investors are beginning to flock to strategic beta or factor-based strategies.

With a rise in volatility and an economic landscape of rising rates, investors are keen to use these strategies to help diversify their portfolios.

“Traditional market cap-weighted indexes may be less diversified than they appear,” the report stated. “A market-cap index, by the nature of its weighting mechanism, is prone to concentrations of risk across regions, sectors and stocks. While this may result in strong short-term performance, it increases volatility and reduces long-term performance, which significantly impacts investor behavior.”

For the most part, JP Morgan sees three ways that investors are using smart beta/multi-factor ETFs with respect to their portfolios: core allocation, core blend and active core blend.