![]()

Growth Opportunities in International Equities

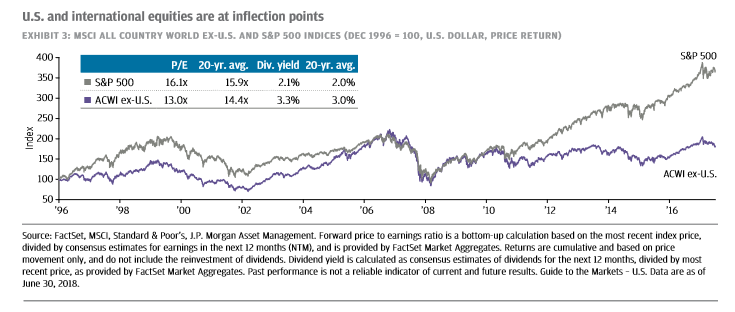

While U.S. equities continue to thrive, opportunities abroad cannot be ignored. Despite faltering on year-to-date basis in 2018, emerging market valuations could present opportunities for savvy investors on a going-forward basis.

While investors can still capitalize on the growth of U.S. equities in their portfolios, emerging markets is able to capture a diversification aspect necessary at the current, cheaper valuations. Should U.S. equities languish, investors with capital allocated into emerging markets are potentially exposed to international opportunities where the markets are beginning to gain strength following weakness.

“While opportunities still exist in U.S. equities, investors should ensure they have enough exposure to international equities,” the report noted. “With the U.S. economy in the later innings of its expansion, international exposure is increasingly important. Over the next decade, a meaningful allocation to international equities will be crucial to improve overall equity returns.”

Fixed-Income Opportunities in Rising Rates

Fixed-Income Opportunities in Rising Rates

While the current bull market has put U.S. equities in the forefront, other asset classes like fixed-income can’t be ignored. For the fixed-income investor, JPMorgan Ultra-Short Income ETF (BATS: JPST) can serve as a flexible tool during times when rates are decreasing or rising. Right now, the Federal Reserve is primed to incorporate two more rate hikes through the rest of 2018, but that shouldn’t deter fixed-income investors.

The floating rate component of bonds in JPST’s debt portfolio would effectively hedge against interest rate risk and capitalize on any short-term rate adjustments the Fed decides to make through the rest of 2018 and beyond.

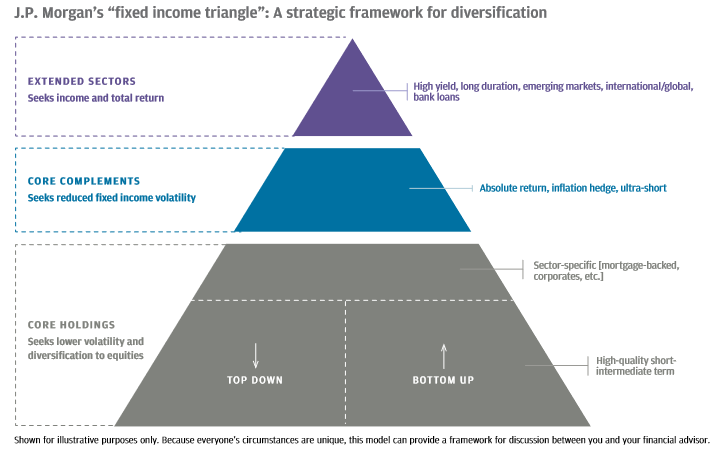

“With the difficult combination of navigating rising interest rates and a low-yield environment, fixed income investing will require creativity and flexibility going forward,” the report mentioned. “Identifying pockets of opportunity will be more important than ever.”

To help construct a fixed-income portfolio built for today’s market environs, JP Morgan suggests maintaining a broad allocation to core bonds to nullify volatility in stocks, augmenting with core complements to reduce fixed income volatility and adding extended sectors to increase income and return potential.

For more market strategies, visit ETF Trends.