ETF Trends CEO Tom Lydon discussed the U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) on this week’s “ETF of the Week” podcast with Chuck Jaffe on the MoneyLife Show.

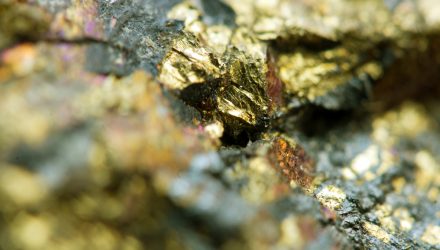

GOAU truly shines thanks to its actively managed nature. The fund only holds 28 companies, and the three royalty companies holding 30% have great financial discipline, compared to a lot of the rest of the industry. The focus for GOAU is on the carefully selected 25 other companies out of the additional 100 or so gold producers. Putting that into perspective, when gold goes up, gold mining companies tend to do even better than gold itself.

It provides a better approach to the gold mining sector, focusing on quality gold producers. After three months of net outflows, gold-backed ETFs saw inflows, adding $3.4 billion in May fueled by tailwinds from strong price performance, ongoing inflation concerns, a weakening US dollar, and lower real yields.

Gold ETFs recorded their first monthly inflows since January and the highest since September. Globally, gold-backed ETF AUM now stands at $222 billion, just below 9%, closely nearing the unsurpassed August 2020 high. Since February, net long positions in gold futures hit their highest level, nearly 50% above March lows. May broke the three-month stronghold of ETF outflows, reaching an AUM modest of 2020 highs.

Still, gold remains a safe haven asset for investors as market behavior is affected by inflationary pressures, US dollar weakness, and lower real yields. Looking forward, inflation and tightening concerns will be important drivers of gold in the near term, with the upcoming Fed and ECB meetings.

Gold may even be taking the wind out of bitcoin. According to an analysis of the CME futures contract, large institutional investors could be shifting away from Bitcoin in favor of gold. Over the past month, Bitcoin futures markets experienced their steepest and more sustained liquidation since the Bitcoin ascent started last October. These liquidations have corresponded with inflows into gold ETFs.

A Sustainable Focus

GOAU is different because it focuses not just on mining stocks with large market caps but high-quality, well-managed producers that have a proven track record of sustainable profitability even when precious metal prices are down. The fund places special emphasis on North American royalty and streaming companies, considered the “smart money” of the metals and mining space.

Royalty companies serve as specialized financiers that provide upfront capital to help fund producers’ exploration and production projects. In return, they receive royalties on whatever is produced or rights to a “stream.” A stream is an agreed-upon amount of gold, silver, or other precious metal at a fixed, lower-than-market price.

Many producers prefer obtaining credit from royalty companies because terms are typically less onerous than those offered by traditional lenders. As a bonus, most royalty companies provide producers with expert consultancy from their world-class team of mining engineers, geologists, and metallurgists.

Royalty companies can help investors manage many common risks associated with traditional producers. Because they’re not directly responsible for building and maintaining mines and other costly infrastructure, huge operating expenses can be avoided.

They also hold highly diversified portfolios of mines and other assets, which helps mitigate concentration risk if one of the properties stops producing. Compared to many other companies in the mining space, royalty companies have tended to be better allocators of capital, taking on very little debt and deploying cash reserves only at the most opportune times.

Listen to the full podcast episode on the GOAU:

For more podcast episodes featuring Tom Lydon, visit our podcasts category.