Our concern is more about the pace of growth in private sector debt, rather than the overall level. According to Capital Economics, a London-based economics firm with offices around the globe, since 1990 no emerging market country has seen the ratio of private sector debt to GDP increase by more than 30% over a decade without experiencing a banking crisis. We think that China is flirting with danger here. While China’s strong fiscal position may help prevent a full -blown banking crisis, the probabilities of increased headline risk, volatility, and a potential economic slowdown, have us concerned. Any economic slowdown from China could hurt countries that export to China, especially those who run a trade surplus with China. In our view, South Korea and Taiwan are especially vulnerable.

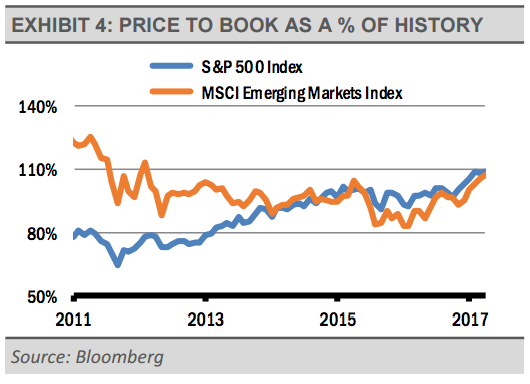

Still, China’s relatively closed economic system (not a lot of imports and little direct foreign investment) should keep the damage contained to its closest trading partners, especially those with lofty stock market valuations. We view the potential damage to stock and bond prices across broad emerging markets as significant. That is especially true given these stock markets’ relatively high valuations. Based on price-to-book value relative to history, investors are willing to pay as much for the uncertainty around emerging markets as they are for large U.S. companies as represented by the S&P 500 Index.

Still, China’s relatively closed economic system (not a lot of imports and little direct foreign investment) should keep the damage contained to its closest trading partners, especially those with lofty stock market valuations. We view the potential damage to stock and bond prices across broad emerging markets as significant. That is especially true given these stock markets’ relatively high valuations. Based on price-to-book value relative to history, investors are willing to pay as much for the uncertainty around emerging markets as they are for large U.S. companies as represented by the S&P 500 Index.

These lofty valuations may translate to reduced upside. Factoring in the increasing risks that we see in emerging markets, the risk-reward tradeoff makes little sense to us. Therefore, we are underweighting emerging markets and emphasizing other areas of the global market that we think have more attractive risk-reward potential.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

Disclosure Information

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted. The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. Data is provided by various sources and prepared by Stringer Asset Management LLC and has not been verified or audited by an independent accountant.