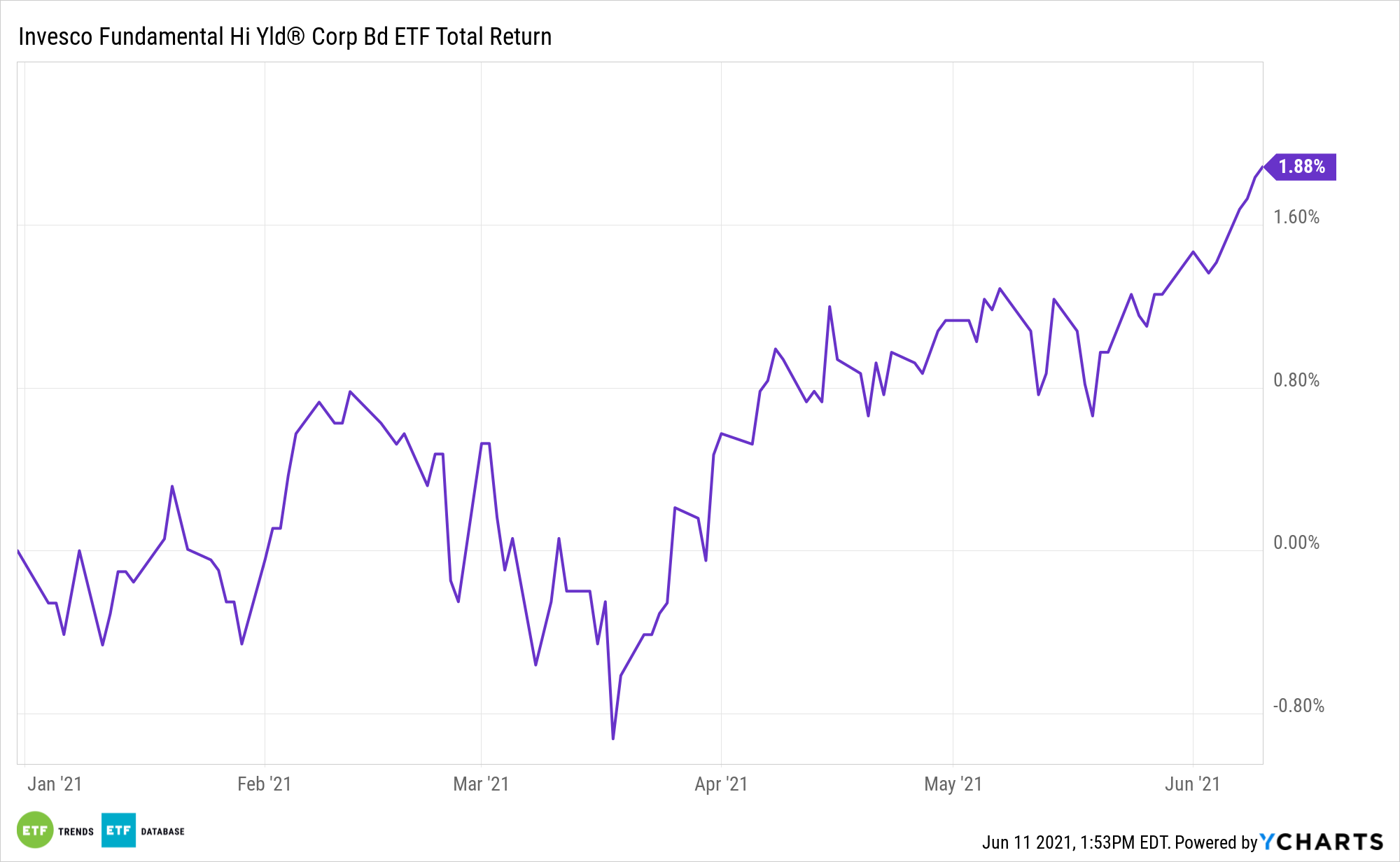

For many investors, credit risk is usually the primary concern when evaluating high-yield corporate bonds and their related exchange traded funds, including the Invesco Fundamental High Yield® Corporate Bond ETF (PHB).

After all, there are reasons why these bonds sport junk ratings and high yields and those reasons often revolve around issues such as balance sheet strength, slack business prospects, or bungled corporate actions, among others. Default risk is higher with high-yield bonds than it is with investment-grade fare and those higher yields are used to compensate investors for the elevated risk.

For investors searching for income and considering PHB, there is some good news in the form of 2021 defaults: there aren’t many. In a recent research report, Fitch Ratings trimmed its year-end default forecast for high-yield corporates to 1% to 2%.

That bullish revision reflects “increased capital market confidence as constricted sectors in the economy re-open, which has led to robust issuance and resulted in enhanced liquidity and pushed out maturities,” said the ratings agency.

PHB Particulars

The $821.1 million PHB holds 196 bonds and its credit profile is relatively sturdy as compared to some competing products. Seventy-eight percent of its holdings are rated BBB or BB on the Standard & Poor’s scale, according to issuer data. Conversely, just 1% of PHB’s components reside in the highly speculative CCC territory, where default risk is significantly higher.

Adding to the case for PHB is the downward trajectory of high-yield defaults. As Fitch notes, defaults have been trending lower for seven consecutive months, indicating easy access to capital is helping companies either pay off debt or refinance at lower interest rates.

“The expected 1% YE 2021 rate would be the lowest since 2013 and could challenge the 0.5% mark set in 2007 assuming the current strong environment continues. Year-to-date default volume totals $4.4 billion, down 88% compared with one year prior,” according to the research firm.

Nearly 35% of PHB component come by way of consumer discretionary and energy issuers. While those sectors have been default trouble spots in the past, the default outlook for both is favorable this year. Economic reopening, pent-up demand, and consumers flush with cash are scenarios constructive for consumer cyclical issuers. Meanwhile, oil prices are high and energy is the best-performing sector year-to-date, indicating default rates in the oil patch are likely to ease from last year’s levels.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.