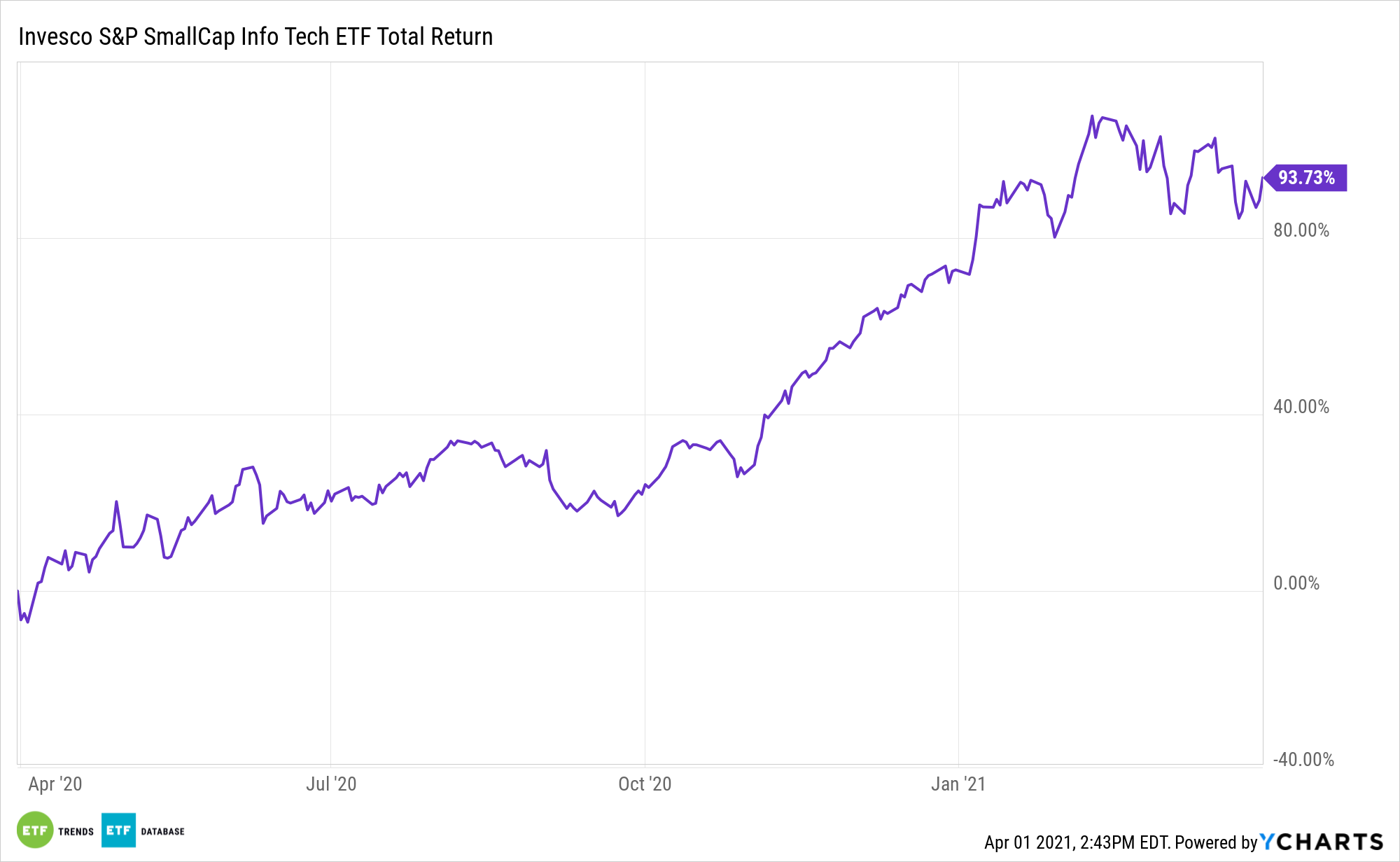

Rising bond yields weighed on technology stocks during the first quarter, but the group still has allure, and that includes small cap tech. Investors can get into that game with the Invesco S&P SmallCap Information Technology (NASDAQ: PSCT).

PSCT tracks the S&P SmallCap 600 Capped Information Technology Index. The ETF’s 77 holdings are “are principally engaged in the business of providing information technology-related products and services, including computer hardware and software, Internet, electronics and semiconductors and communication technologies,” according to Invesco.

Buoyant demand for chips is one reason to consider PSCT. A catalyst for PSCT in 2021 has been the strength of semiconductor stocks. The ETF allocates over half of its components to chip makers.

Cutting-edge chipmakers are the best-performing industry across sectors and regions as more consumers acquire internet-connected devices. Semiconductors now make up some of the most essential products and technologies we use every day, including advanced mobile networks, iPhones, and the new generation of artificial intelligence.

PSCT in Broad Strokes

Some market observers believe rising bond yields are creating opportunity in tech stocks.

“The recent bond yield spike has been blamed for pressuring tech stocks as they are seen as vulnerable to rising rates,” according to BlackRock. “We believe this view is too simplistic: tech is a diverse sector and the driver of higher yields matters more than the rise itself. Our new nominal theme implies central banks will be slower to raise rates to curb inflation than in the past, supporting our pro-risk stance and preference for tech.”

The technology sector continues to grow through innovation as more companies shift to cloud, progress into artificial intelligence, and adopt internet of all things devices.

While the various sector-specific ETFs provide broad exposure to their targeted segments, investors should keep in mind that there are crucial differences in the different ETF offerings.

“Yet it is important to recognize what a diverse sector tech is: The rate sensitivity for equity valuations is greatest for the highest-growth, least-profitable companies,” adds BlackRock. “A rotation into cyclicality amid an accelerated restart may pose a near-term challenge for some tech companies that have benefited from ‘work from home’ and other pandemic-related trends, and benefit more cyclical tech industries, such as semiconductors. Strong pricing power due to global semiconductor supply chain disruptions and demand for consumer electronics could give it a further boost.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.