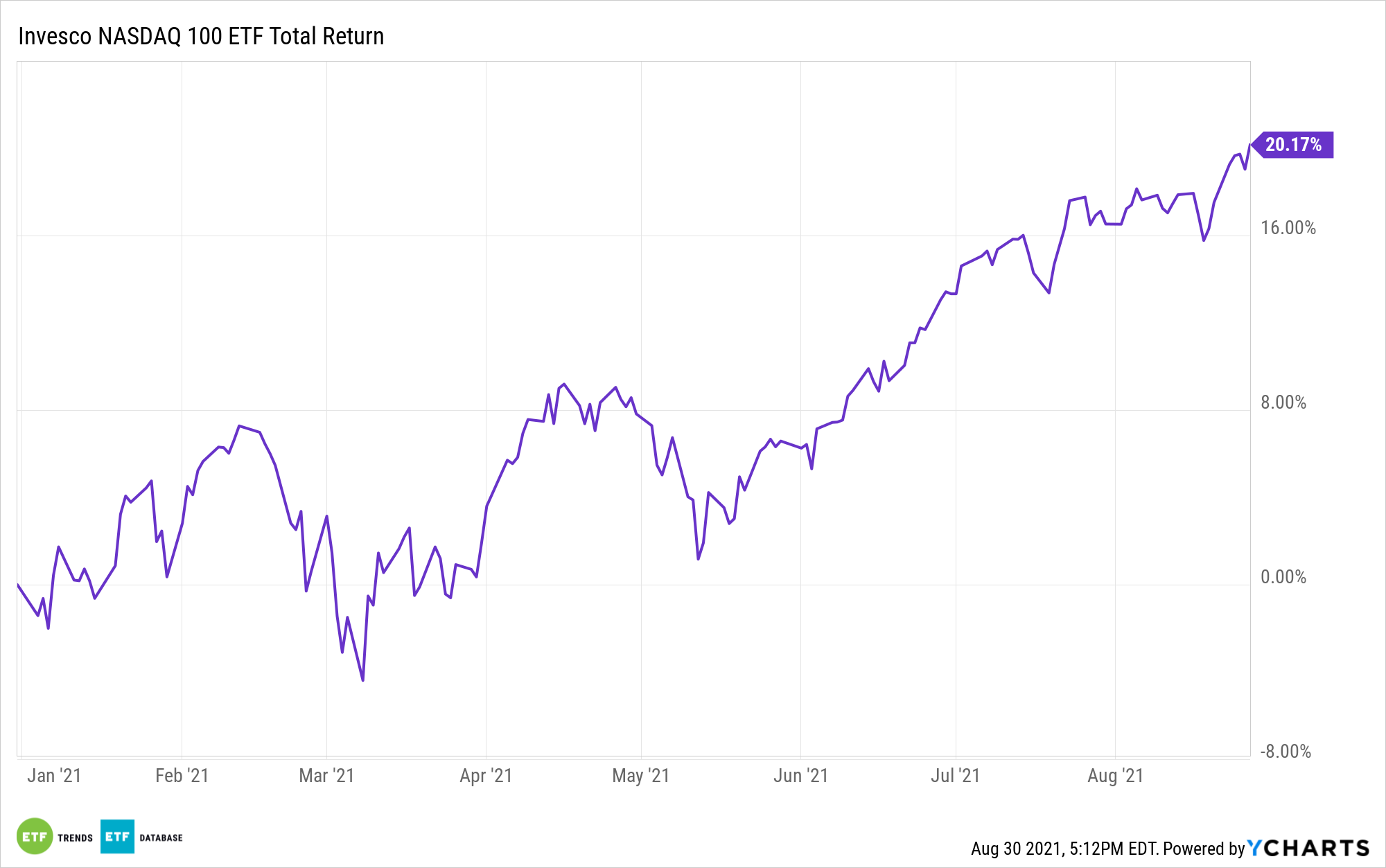

With the Nasdaq Composite seemingly printing new highs on an almost daily basis, the Invesco QQQ Trust (QQQ) is getting plenty of attention.

Investors shouldn’t sleep on QQQ’s newer, cost-effective counterpart: the Invesco NASDAQ 100 ETF (QQQM). Both Invesco exchange traded funds track the vaunted Nasdaq 100 Index (NDX), with the primary difference between the two products being their expense ratios.

QQQ, which is one of the largest ETFs of any stripe, charges 0.20% per year. QQQM, which debuted last year, has an annual fee of 0.15%, or $15 on a $10,000 investment. Following the Federal Reserve’s recent Jackson Hole, Wyo. Conference — held virtually this year — some analysts are bullish on tech stocks into the end of 2021. That’s good news for both QQQ and QQQM, because the Nasdaq 100 Index allocates over 49% of its weight to tech.

“We believe Fedspeak and messaging coming out of Jackson Hole is very bullish for tech stocks with an ‘all clear for risk-on assets’ in the near-term led by tech stocks,” said Wedbush analyst Daniel Ives.

Important to the tech thesis is that growth stocks are coming back into style after trailing in value for much of the first half of the year. In fact, the Nasdaq 100 is now outpacing the S&P 500 Value Index by 40 basis points on a year-to-date basis, as of Aug. 27.

Wedbush’s Ives sees tech’s disruptive, innovative nature overcoming concerns about rising interest rates, which are prominent this year.

“The fear of a more hawkish Fed/Powell and rates rising sooner has been a lingering worry for the Street that threatened to put the pause on the ongoing tech and market rally in our opinion,” said the analyst. “Our bullish view of tech stocks over the years is predicated on our multi-year thesis that the digital transformation story across the consumer and enterprise ecosystem is still in the early innings of playing out in what we characterize as a $2 trillion market opportunity for the next decade.”

Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) — two stocks that combine for 21.28% of QQQM’s weight — are among Wedbush’s preferred tech ideas for the remainder of the year. Several other names on the research firm’s list are also QQQM’s member firms.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.