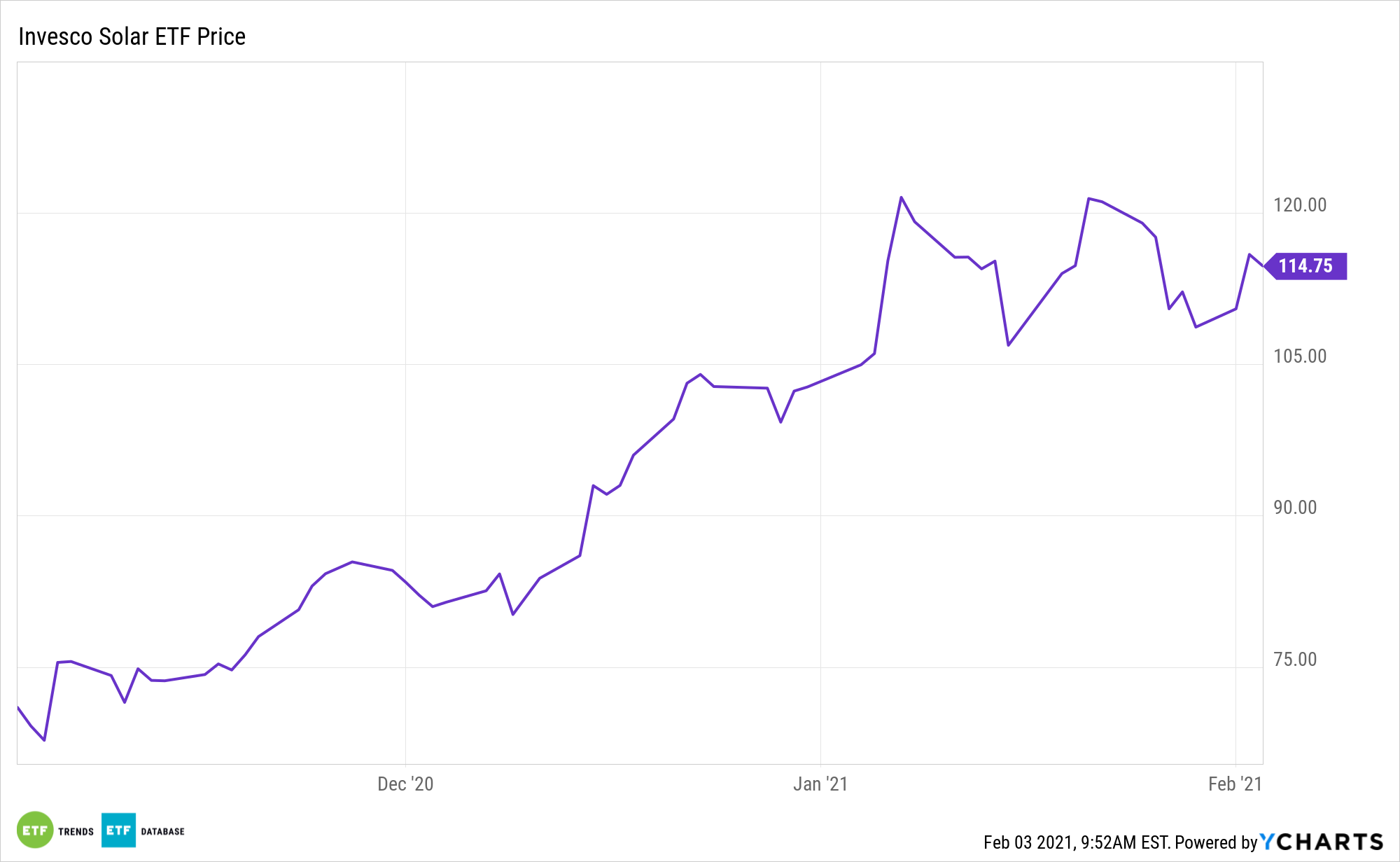

Amid expectations that political change will provide more fuel for the renewable energy boon, the Invesco Solar ETF (TAN) has stood out as one of the best-performing non-leveraged exchange traded funds over the past year.

TAN, which started back in 2008, seeks to track the investment results of the MAC Global Solar Energy Index, which is designed to provide exposure to companies listed on exchanges in developed markets that derive a significant amount of their revenues from the following business segments of the solar industry: solar power equipment producers including ancillary or enabling products.

Politics help, but TAN offers some other benefits, including being home to some fundamentally sound companies.

“Solar energy stocks have recorded significant growth in the last few months, boosted by factors like regulatory changes. These stocks’ growth is reflected in the Return on Investments for the selected leading solar energy companies,” notes Trading Platforms. “Data presented by Trading Platforms indicates that four leading solar energy stocks have recorded an average ROI of 135.2% over the last six months between July 27, 2020, and January 27, 2021. Jinko Solar Holding has the highest ROI at 264.12%.”

Deep Strength in the TAN ETF

As the world moves more towards renewable energy sources, solar energy could be one of the main beneficiaries. According to a United States Solar Energy Market – Growth, Trends, and Forecasts (2020 – 2025) report, more growth is ahead over the next five years.

“The United States solar energy market is expected to grow at a CAGR of 17.32% during 2020-2025,” the report noted. “Factors, such as solar PV projects under construction, in the pipeline and planning stages, and supportive policies of the government are expected to boost the cumulative installed capacity of solar energy during the forecast period.”

Boosting the long-term cases for TAN are data confirming solar and wind installation prices will continue declining in the coming decade. Renewables prices could increase due to the coronavirus, according to some market observers, but the consensus appears to be that the spike will be short-lived, if it arrives at all.

“The solar energy stocks have been boosted in the recent months following the election of Joe Biden as the 46th President of the United States, mainly to his administration’s support for clean energy. Since assuming office, Biden has issued executive orders for the U.S. to rejoin the Paris Agreement after his predecessor, Donald Trump, withdrew America from the agreement that calls on countries to scale up renewable energy,” adds Trading Platforms. “In general, Biden’s pledge to put the U.S. on a path toward an emissions-free future has boosted the sector’s expansion. This indicates that the industry could grow even faster in the coming years than the projections suggest. Investors are therefore considering putting their money in the sector with the hope of reaping later.”

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.