The S&P 500 Value Index jumped 17.9% in the first half of the year, outperforming the broader S&P 500 by 110 basis points, and while there are recent inklings that growth stocks may be turning a corner, market observers are still bullish on value.

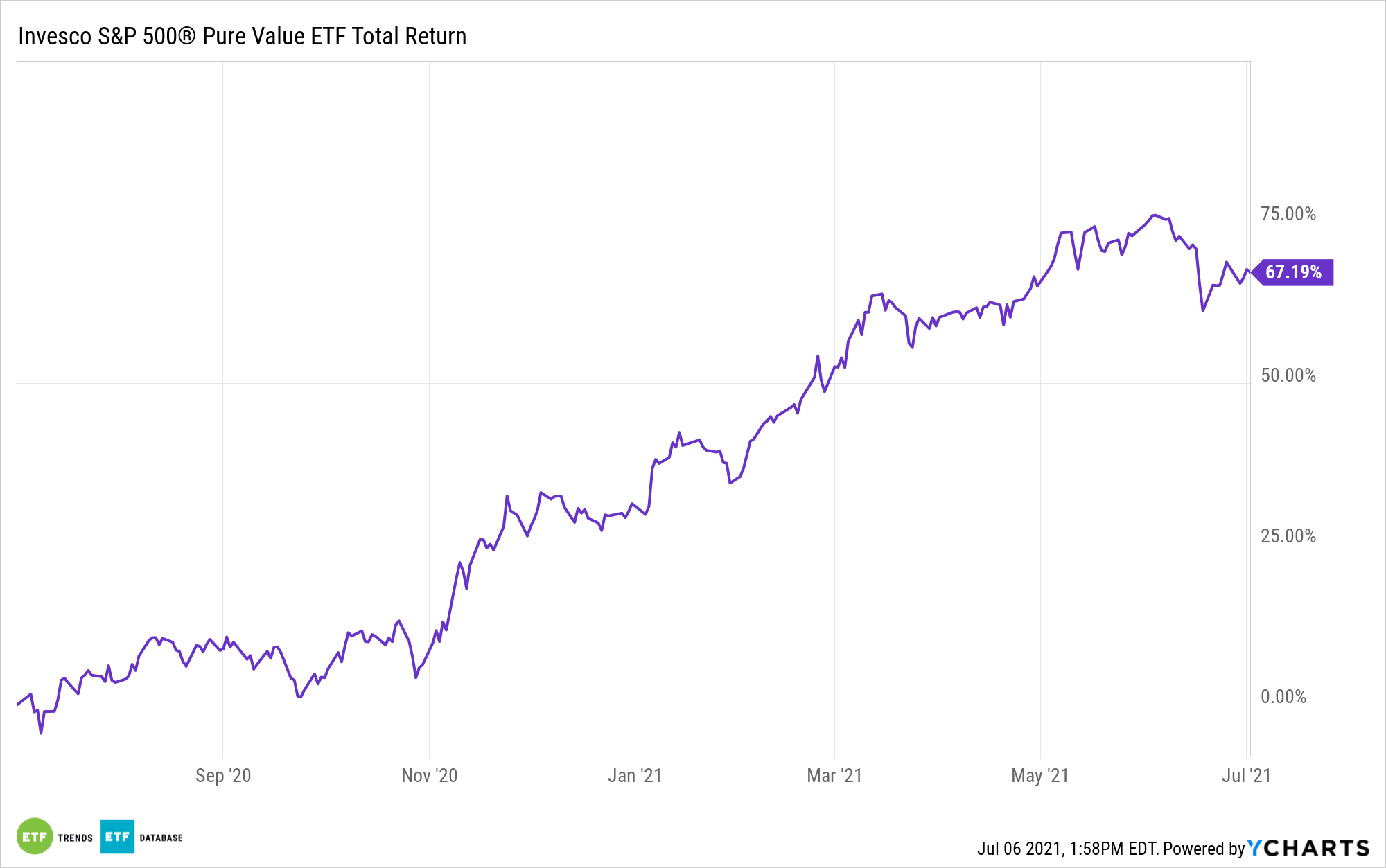

That’s good news for the Invesco S&P 500® Pure Value ETF (RPV), an exchange traded fund that surged a stellar 28.3% in the first six months of 2021.

In its recent quarterly report, CNBC surveyed about 100 chief investment officers, equity strategists, portfolio managers, and CNBC contributors who are also money managers with 70% saying they believe value stocks will extend their momentum into the third quarter.

To be precise, two-thirds see value coming out on top in the July through September period while just a third believe growth will win.

A Pause before More Upside?

“After an impressive rebound from pandemic lows, the rally in value shares took a pause as the Federal Reserve’s hawkish policy pivot and inflationary pressures made investors reassess the outlook for economic growth. The Russell 1000 Value Index fell 1.3% in June, trailing its growth counterpart by more than 7 percentage points as tech stocks outperform with bond yields stabilizing,” according to CNBC.

Indeed, RPV languished in June, but the case for the Invesco exchange traded fund and value at large isn’t dead. If economic growth continues powering higher, cyclical stocks, which primarily reside in the value space, are likely to benefit.

The $3 billion RPV, which tracks the S&P 500® Pure Value Index, has another ace up its sleeve: big exposure to bank stocks, a group market observers remain bullish on for the second half.

“On the sector level, the majority of investors (67%) believe financials will be a winning trade for the rest of 2021. The S&P 500 financials sector is the second best performer this year, up 24.5% year to date,” according to CNBC.

See also: ETF Investors Wait for Fed to Unleash Bank Payout Growth

RPV allocates about 43.5% of its weight to the financial services sector. That’s more than double the S&P 500 Value Index’s weight to the same group.

The Invesco ETF also offers some inflation protection. Among the favored choices for inflation buffering of those polled by CNBC are energy and consumer staples equities. Those are RPV’s fourth- and fifth-largest sector exposures, respectively, combining for 16% of the fund’s roster.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.