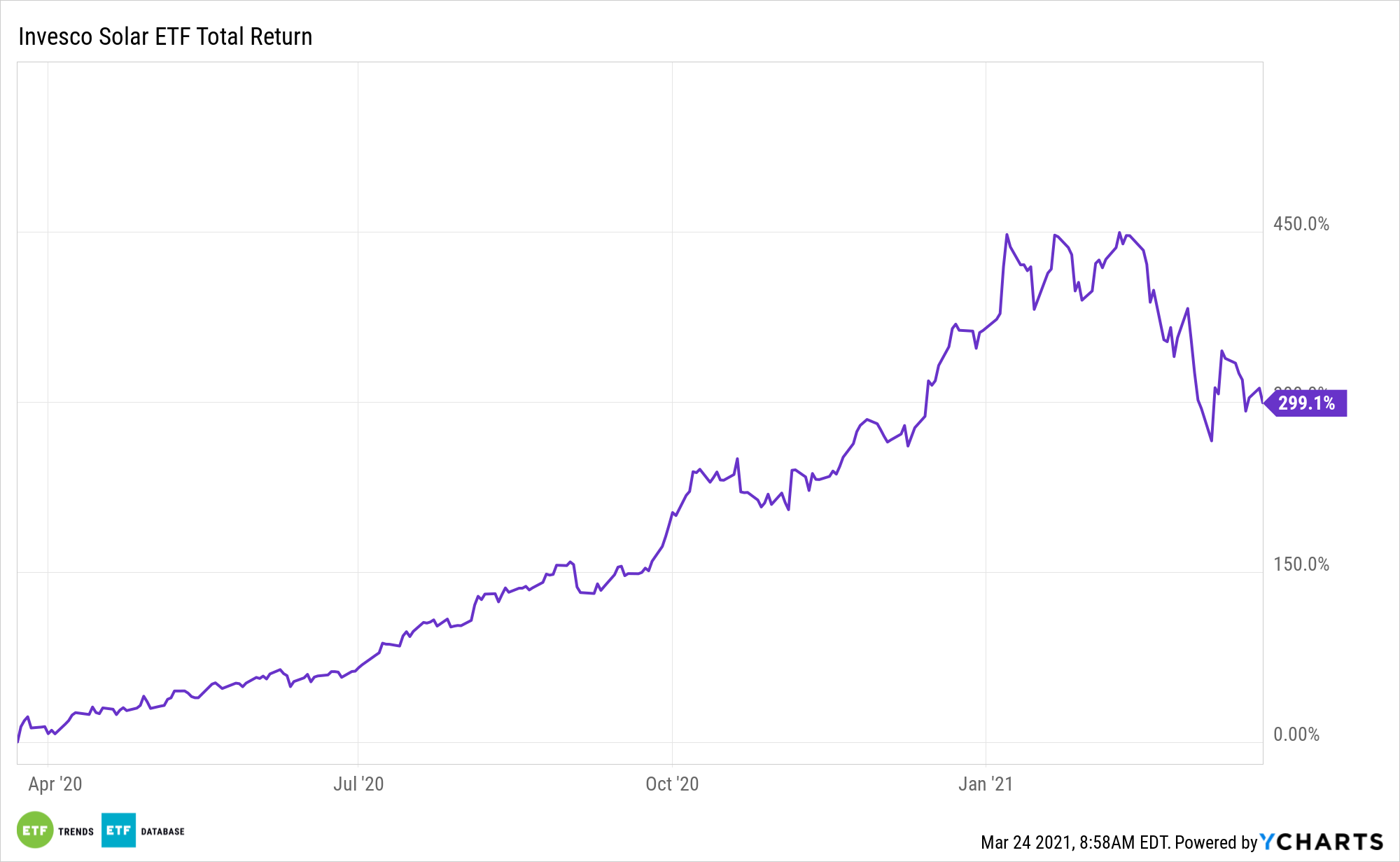

Like other renewable energy assets, the Invesco Solar ETF (TAN) has recently slid down the charts. However, if a Goldman Sachs forecast proves accurate, TAN’s recent slump could avail itself as a buying opportunity.

TAN seeks to track the investment results of the MAC Global Solar Energy Index, which is designed to provide exposure to companies listed on exchanges in developed markets that derive a significant amount of their revenues from solar power equipment producers, including ancillary or enabling products.

“The recent pullback in solar stocks is overdone, and with strong growth prospects on the horizon the sell-off represents a buying opportunity for some of the stocks in the space, Goldman Sachs said in a note to clients,” reports Pippa Stevens for CNBC. “The firm pointed to a number of reasons to remain positive on the industry, including solid fundamentals, a healthy financing backdrop, as well as policy catalysts.”

Politics at Play for TAN?

President Biden previously laid out a $2 trillion sustainable infrastructure plan to pave the way for the U.S. power sector to be carbon free by 2035, and for the country to be carbon neutral by 2050.

“Goldman noted that investors should remain selective. With that in mind, the firm upgraded shares of Sunrun to buy, while cutting SunPower to neutral. The firm also reiterated its buy rating on shares of Sunnova, which is on Goldman’s conviction list,” according to CNBC.

Not only is clean energy consumption increasing, but costs are also decreasing, which in turn bolsters adoption. Additionally, coal production is slumping, adding to the virtuous cycle for alternative energy ETFs. Declining solar costs are expected to lure more corporate and residential customers.

Emerging markets are also taking a cleaner approach as they try to cut down on pollution. For example, China, the world’s second-largest economy, suffers from heavy pollution after it quickly industrialized its economy, but it has also heavily adapted to solar as a means to combat the rising pollution and shift away from dirty coal.

See also: Easy Being Green With These 2 Clean Energy ETFs

Interestingly, TAN is being punished by rising 10-year Treasury yields. Goldman Sachs says this is not truly indicative of the fund’s viability.

“Goldman added that in the last five years, there’s been little observable relationship between TAN and the U.S. 10-year Treasury, meaning the group is potentially being unfairly impacted by a broader market sell-off,” concludes CNBC.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.