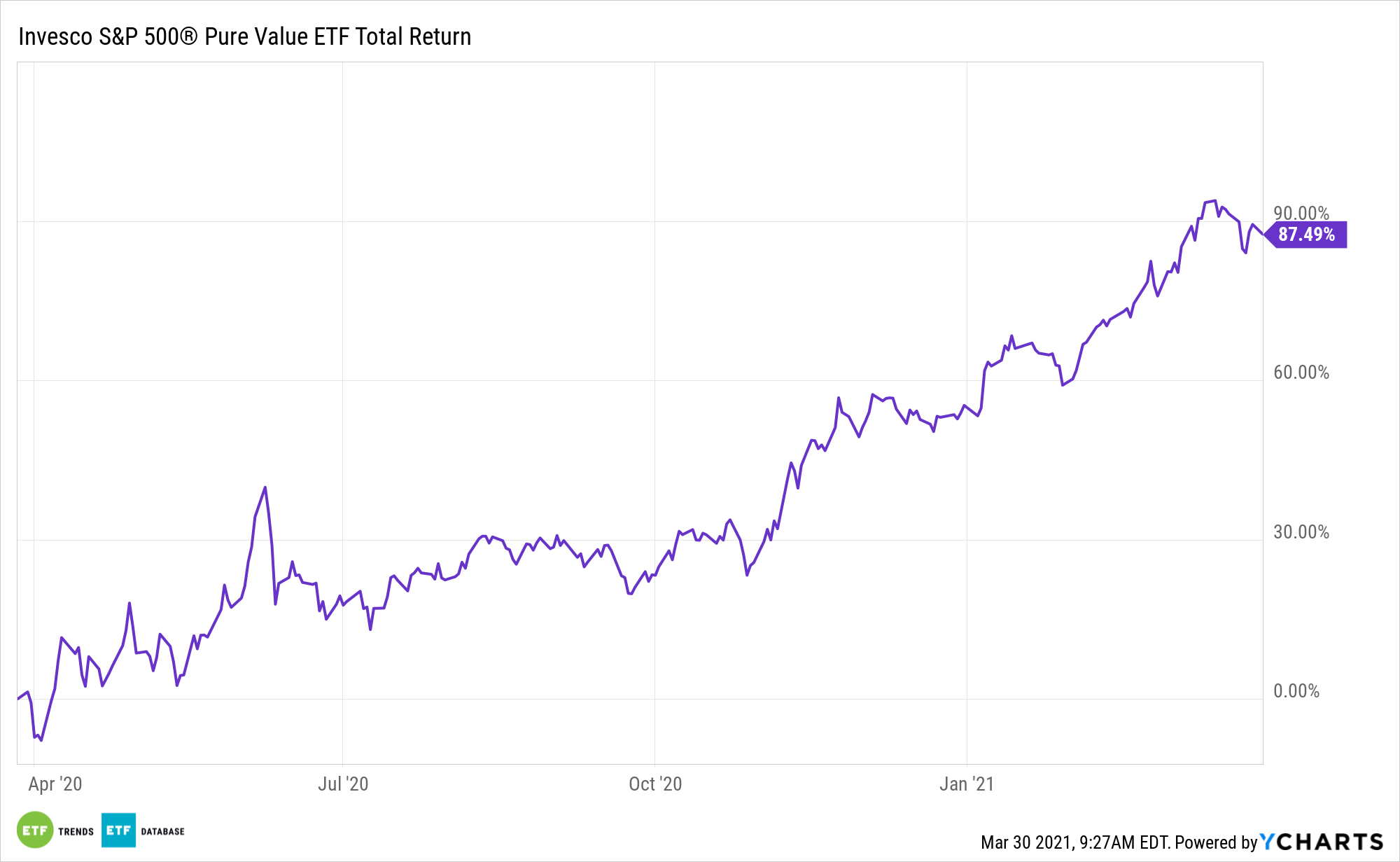

Value stocks are on the mend, and that’s good news for dedicated exchange traded funds like the Invesco S&P 500® Pure Value ETF (RPV).

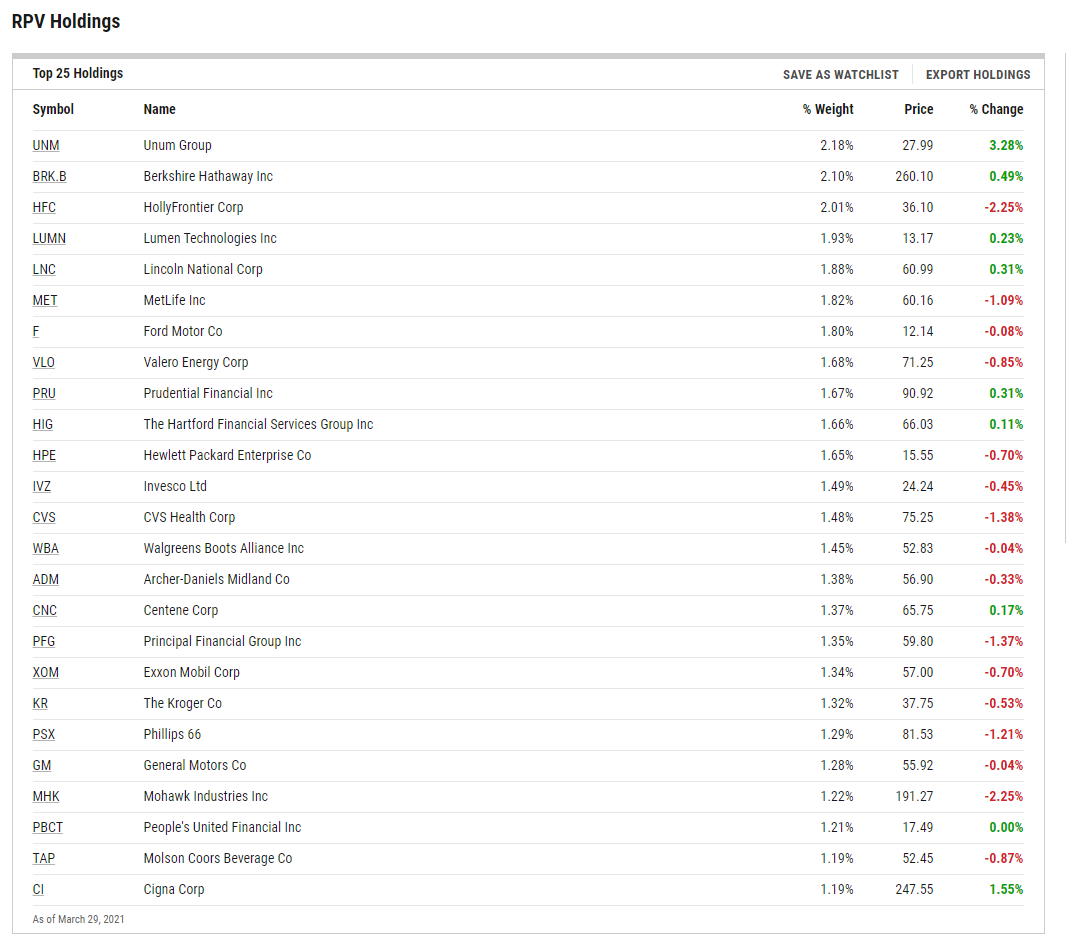

Adding to the allure of RPV right now is its value purity, and expectations that the recent rotation into value stocks could be long-lasting. RPV’s big exposure to resurgent financial services names bolsters the case for the fund.

“At 20 times forward earnings, the S&P 500 is in the 90th percentile of its valuation over the past 30 years, per data from Goldman Sachs’ chief U.S. equity strategist, David Kostin,” reports Nicholas Jasinski for Barron’s. “But even investors feeling valuation vertigo can still find pockets of value in this market. Financials go for a 30% discount to the S&P 500, at just the ninth percentile of their historical relative range. Energy stocks, at a 13% discount to the index, are only at their 21st percentile relative valuation. Technology stocks, which trade at a 16% premium to the index, are at their 45th percentile over the past 30 years.”

As banks look to free up cash, analysts have lowered their loan-loss projections since the start of the year and lifted the combined 2021 profit forecast for banks like JPMorgan Chase, Bank of America Corp., Citigroup, and Wells Fargo & Co., by 10%, or $7 billion, according to FactSet data. Analysts even project the four banks to earn $77 billion in 2021, compared to $61 billion last year.

Ramping Up with ‘RPV’

RPV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

“Evercore ISI strategist Dennis DeBusschere is focused on sectors’ cash-return yields, which represent the total dividend and stock-buyback payouts to shareholders. Relative to history, industrials, materials, energy, and financials all look attractive on that basis,” according to Barron’s.

Those groups combine for a significant portion of RPV’s portfolio.

Value hasn’t been in favor for several years, which has led to this start of rotation. A major inflection point begin with last November’s election and then got stronger with the vaccine news. The reflationary impulses of past cycles may finally be here to stay.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.