The Consumer Price Index (CPI) rose again in August, though the increase was more modest than in the preceding several months. Still, the persistent vs. transitory inflation debate remains, well, persistent.

With the inflation debate lingering for much of this year, investors are being treated to a laundry list of inflation-fighting investment ideas, including gold, real estate investment trusts (REITs), other hard assets, and Treasury inflation protection securities (TIPS), among others.

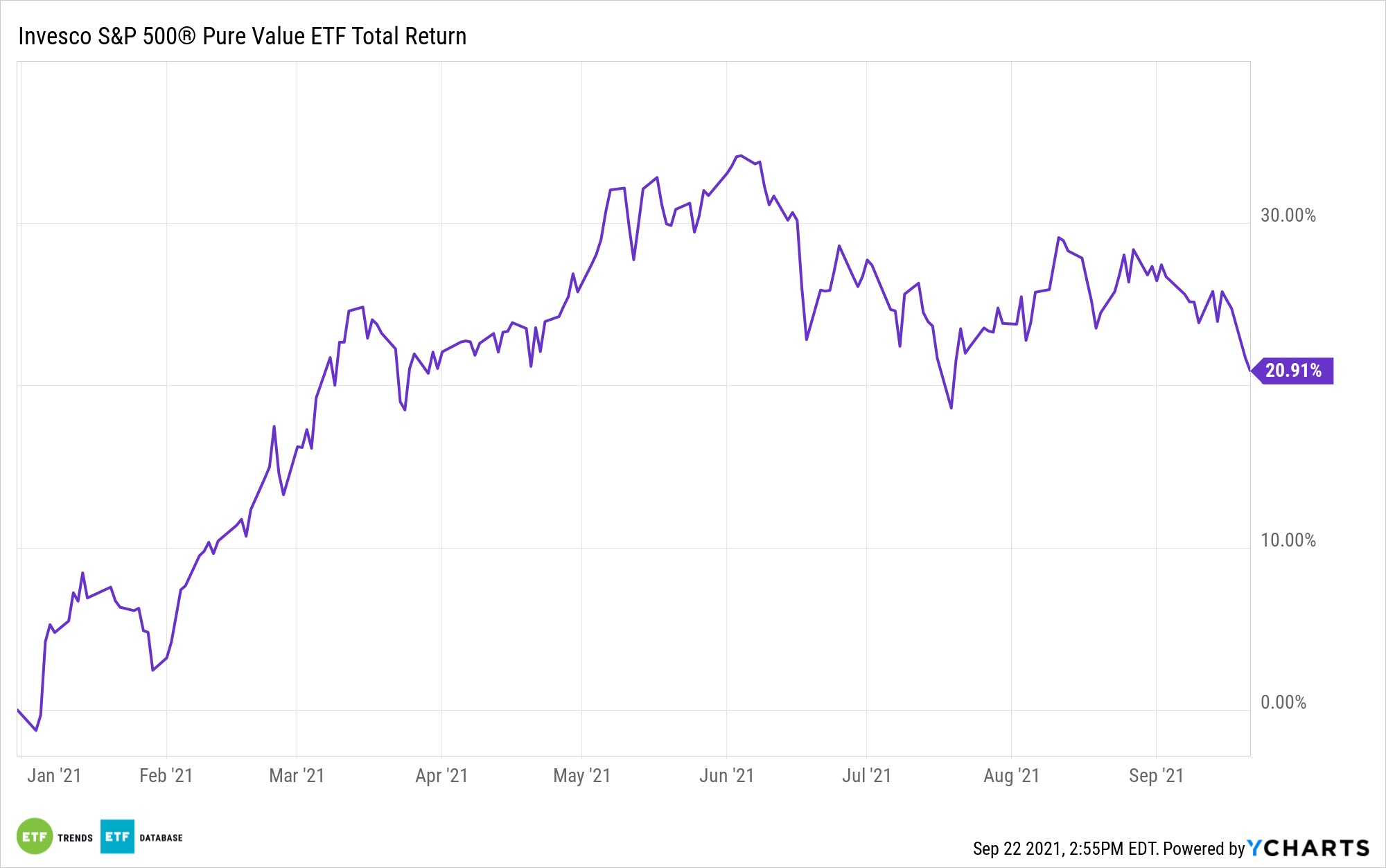

So it may be a surprise to some that pure value stocks, such as those residing in the Invesco S&P 500 Pure Value ETF (RPV), are admirable inflation fighters in their own right. RPV follows the S&P 500 Pure Value Index.

As Invesco research notes, the S&P 500 Pure Value Index beats the S&P 500 and the S&P 500 Value Index during periods of rising inflation. RPV’s underlying index also tops those benchmarks during times when producer prices increase, as is happening today.

“Investments and spending by companies is surging , and consumer spending is set to accelerate when government lockdown restrictions ease,” according to Invesco. “As a result of this activity, certain companies stand to benefit from potential growth in their earnings (e.g. more investment and consumer spending results in higher earnings). In particular, companies whose stock are deemed ‘value stocks’ may perform well, which investors may want to consider allocating to in their portfolio.”

The $2.47 billion RPV is home to just 118 stocks. That’s a fraction of the roster size of exchange traded funds tracking the S&P 500 Value Index, confirming that the “pure value” designation is indeed exclusive territory. Moreover, RPV is a relevant consideration today as the U.S. economy is in the midst of a growth spurt.

“Value stocks tend to perform well when economic growth is high. Why? Because as value companies’ earnings grow given the increase in investment and consumer spending, their earnings increase and, as a result, become more valuable to investors. If the company is considered a bargain based on its current price (aka ‘value stock’), its price may potentially increase as earnings increase which investors stand to benefit from,” adds Invesco.

RPV is also important for another reason: Its 43.62% weight to financial services stocks confirms that the ETF is likely to be positively correlated to rising 10-year Treasury yields — a scenario that’s a very real possibility seeing as those yields have been sliding for several months now.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.