Sustainability is all the rage these days, as asset allocators prioritize environmental stewardship and social and governance progress.

However, seasoned dividend investors know sustainability in another way: gauging a company’s ability to not only maintain its current payouts, but grow them over the long-term. Many investors may not realize that some exchange traded funds, including the Invesco Dividend Achievers ETF (NASDAQ: PFM), already blend both forms of sustainability.

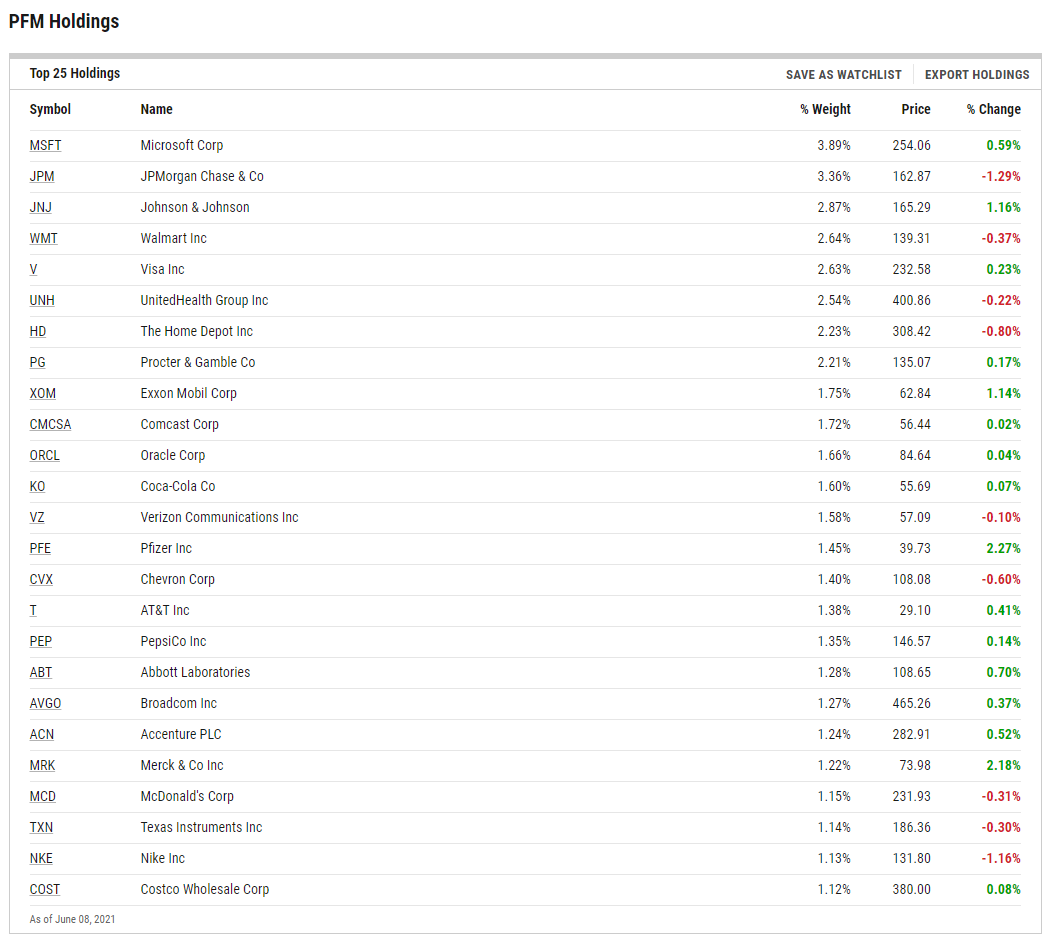

PFM, which turns 16 years old in September, follows the NASDAQ US Broad Dividend Achievers Index. That index mandates that member firms have dividend increase streaks spanning at least 10 years. That’s a tough standard to meet, but PFM has 353 components.

As the dividend landscape changes with more sectors contributing larger percentages to overall domestic payouts and with more companies walking the walk when it comes to environmental, social, and governance (ESG) talk, PFM could be an increasingly relevant idea for investors looking to check both boxes at once.

PFM More Sustainable Than Meets the Eye

Some PFM components are already players on the dividend growth and sustainability stages. Verizon (NYSE: VZ) is a good example. Not only does it have an enviable payout track record, but it operates in a space where companies must prioritize customer data protection.

“Data privacy and security issues stand out because the company’s turn to data monetization strategies places its users’ data under concern. However, Verizon has a strong rating when it comes to managing its exposure to these risks,” says Morningstar analyst Jokir Hossain.

Home Depot (NYSE: HD), the largest home improvement retailer and another PFM holding, has a stellar dividend growth track record. As Hossain points out, the company’s ESG report card isn’t perfect, but it’s working to address potential areas of weakness, such as climate change and “health, safety, and labor relationship controversies.”

Semiconductor company Texas Giants (NASDAQ: TXN) operates in an industry where environmental concerns are medium, but one where ethics and human capital issues can arise.

“Human capital and resource use as notable material ESG issues. Business ethics is another area of concern. However, the company is rated to have a strong management of these issues,” adds Hossain.

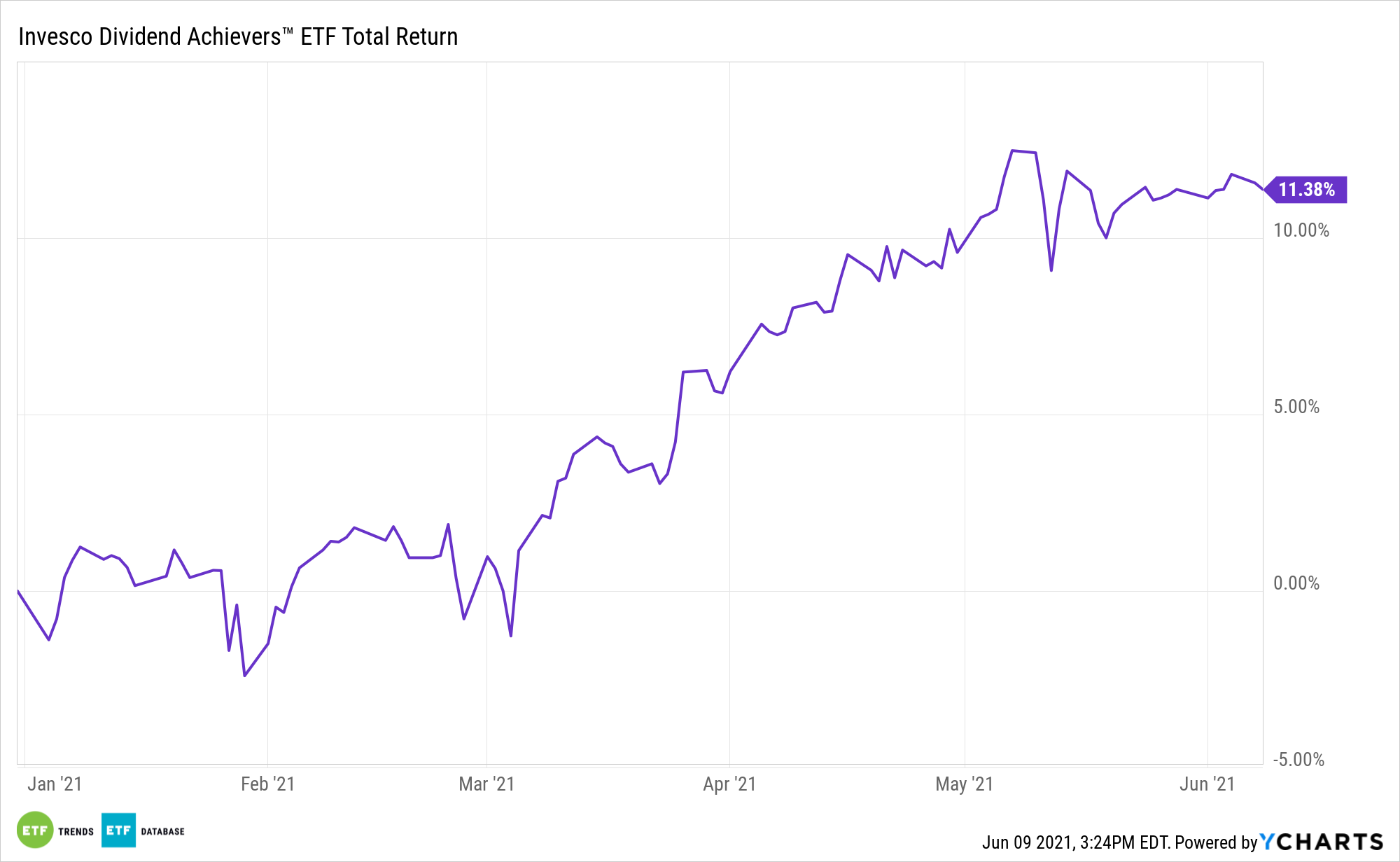

Home Depot, Verizon, and Texas Instruments combine for about 5% of PFM’s roster. The fund, which yields 1.67%, is higher by 11% year-to-date.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.