Historically speaking, rising rates are a boon for bank stocks and the related exchange traded funds. Up nearly 5% over the past week, the Invesco KBW Bank ETF (NASDAQ: KBWB) is proving the point.

KBWB tracks the widely followed KBW Nasdaq Bank Index.

“The Index is a modified-market capitalization-weighted index of companies primarily engaged in US banking activities. The Index is compiled, maintained and calculated by Keefe, Bruyette & Woods, Inc. and Nasdaq, Inc. and is composed of large national US money centers, regional banks and thrift institutions that are publicly traded in the US,” according to Invesco.

With rates still low by historical standards, some market observers believe Treasury yields can continue climbing, potentially benefiting KBWB in the process.

“Bets on the global economic recovery have given lift to the industrials, while financials are seen as a beneficiary of rising rates,” reports Keris Lahiff for CNBC. “Delano Saporu, founder of New Street Advisors, pinpoints JPMorgan and Goldman Sachs as two financials stocks that could benefit from both higher yields, which boost banking profitability, and increased trading revenue.”

Making the KBWB Call?

For some time, financial services stocks have been viewed as a value destination, but low interest rates weighed on the thesis for the sector. With cyclical stocks rebounding and the economy showing some signs of life, KBWB is looking more attractive.

“JPMorgan and Goldman Sachs both hit all-time highs Thursday. They have risen 20% or more so far this year,” according to CNBC. “Steve Chiavarone, portfolio manager at Federated Hermes, is bullish on both financials and industrials as a play on the cyclical value trade.”

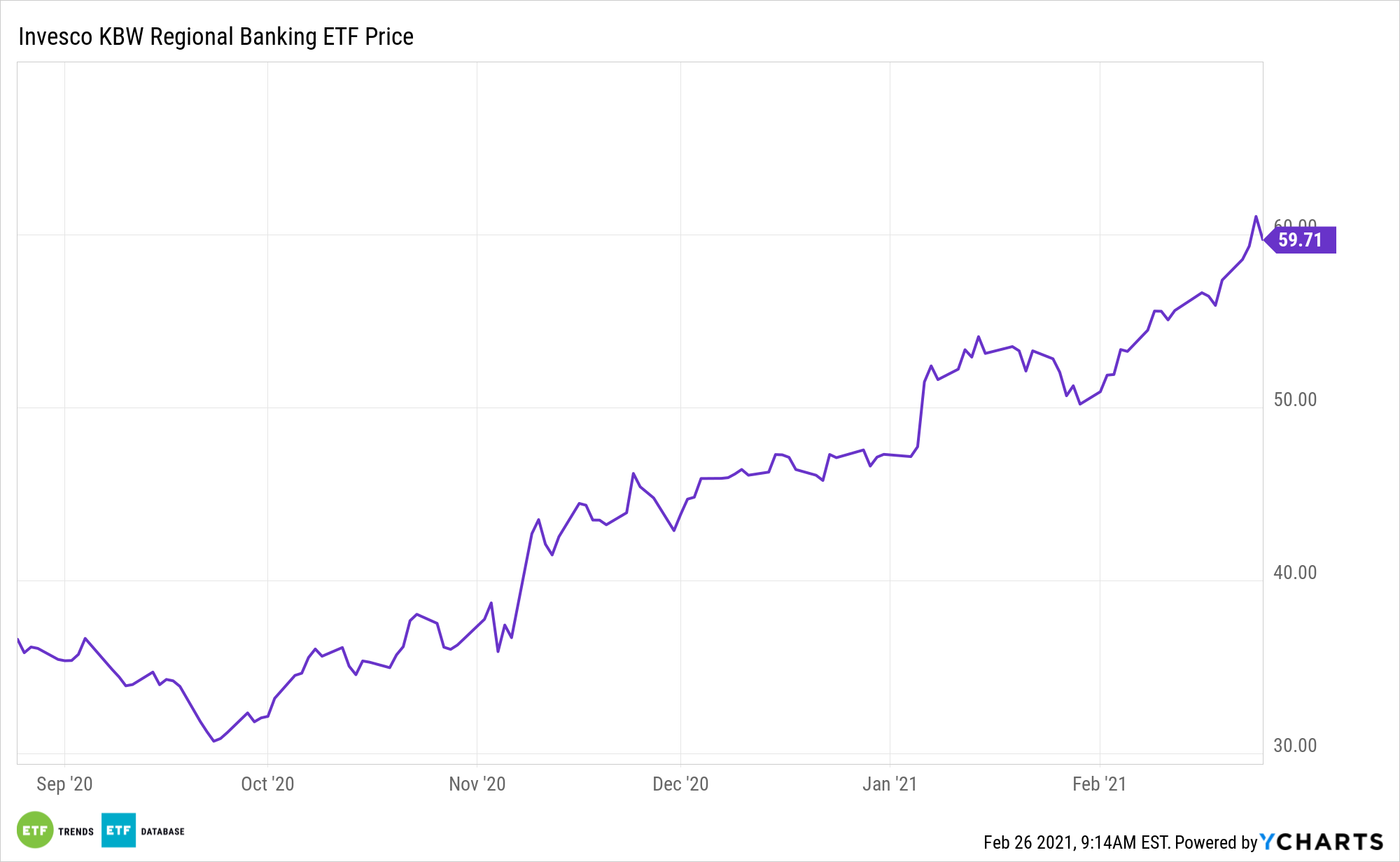

Another idea to consider is the Invesco KBW Regional Banking ETF (KBWR), which gives investors a tactical tilt to the hot sector. KBWR is riding a strong wave of momentum as yields begin to rise.

KBWR seeks to track the investment results of the KBW Nasdaq Regional Banking Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is a modified-market capitalization-weighted index comprised of companies primarily engaged in U.S. regional banking activities, as determined by the index provider. The underlying index is designed to track the performance of U.S. regional banking and thrift companies that are publicly-traded in the United States.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.