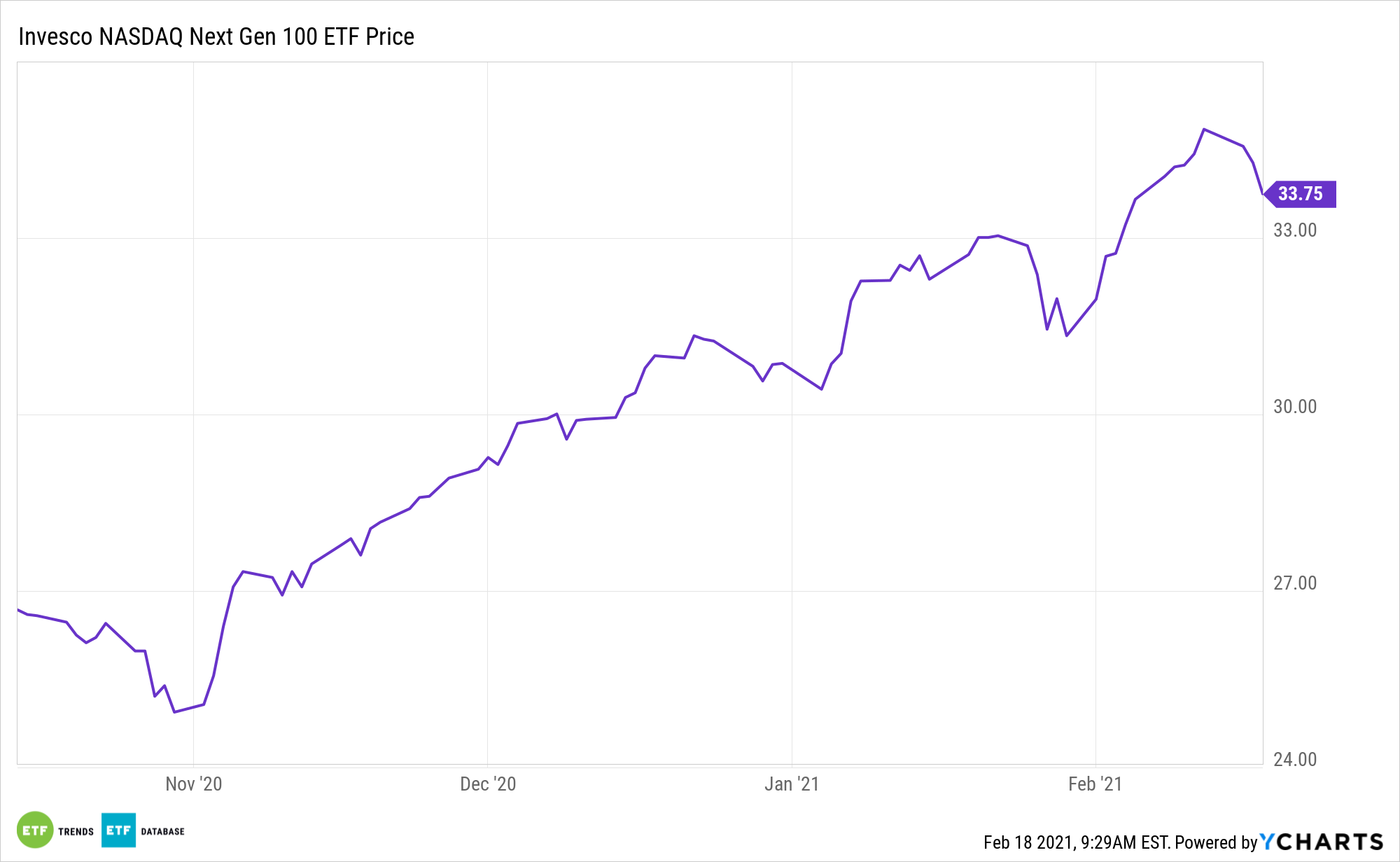

Investors are constantly searching for the next big thing, and that’s particularly true among growth and technology stocks. The Invesco NASDAQ Next Gen 100 ETF (QQQJ) is rising to the challenge.

There’s been plenty of demand for QQQJ, an ETF that’s just a few months old. In fact, QQQJ recently topped $1 billion in assets under management, making it one of the most successful ETFs to come to market in 2020.

“The Invesco NASDAQ Next Gen 100 ETF (ticker QQQJ) crossed the $1 billion-in-assets milestone last week, just four months after launching, according to data compiled by Bloomberg. It’s absorbed roughly $343 million in inflows so far this year,” reports Katherine Greifeld for Bloomberg.

QQQJ, which launched last year, features exposure to the ‘next 100’ non-financial companies listed on the Nasdaq, outside of the NASDAQ-100 Index, offering a mid cap alternative to the NASDAQ-100.

A Fast Start Coupled with Impressive Fundamentals

QQQJ gives ETF investors tech exposure, but with a mid cap twist. While large cap companies in tech like Apple or Microsoft are solid plays, there are also opportunities to be had in mid cap companies that investors may not yet know of.

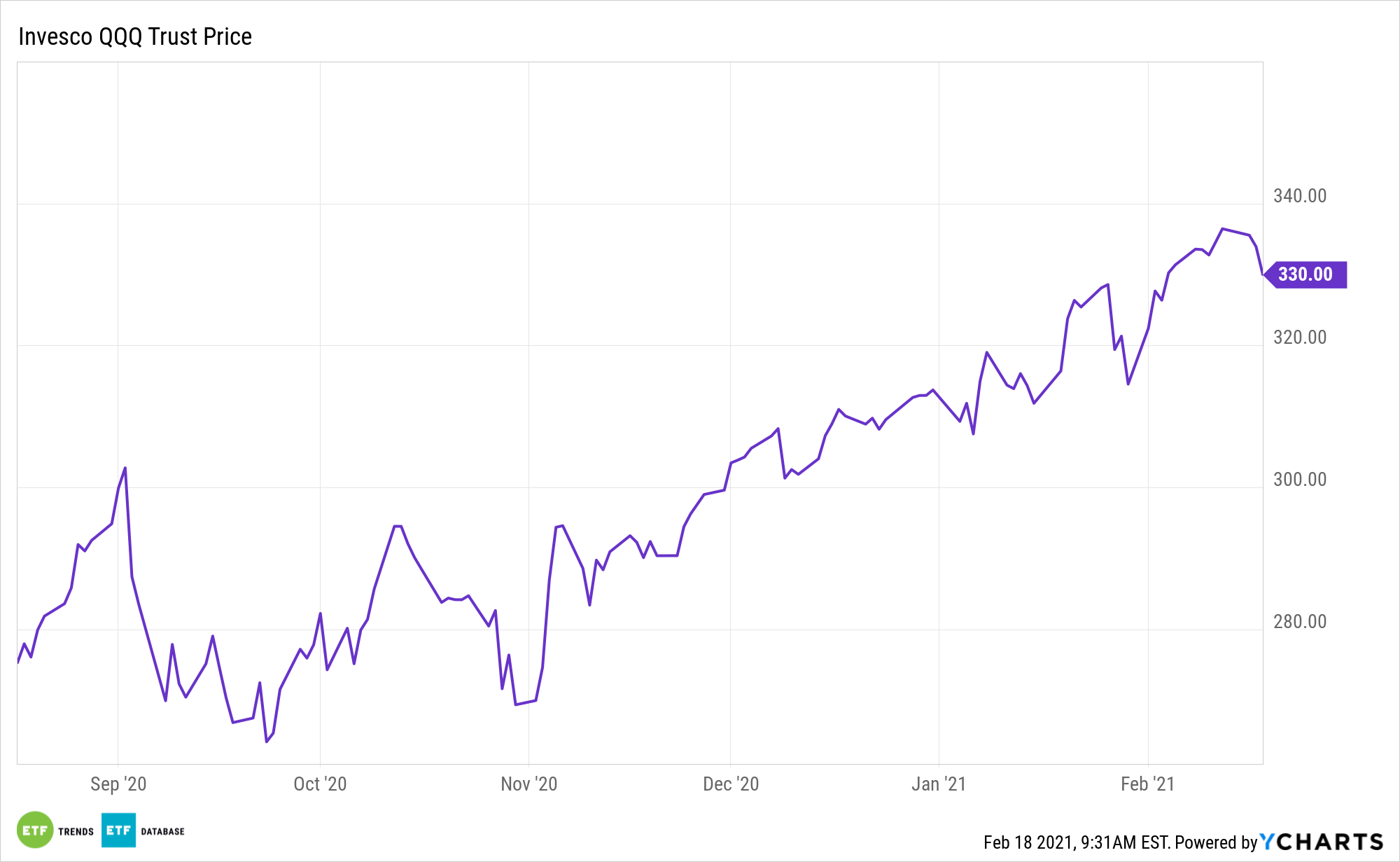

One way of looking at QQQJ is that it’s the proving ground for stocks to one day gain entry into the Nasdaq-100 Index (NDX) and the Invesco QQQ Trust (QQQ).

“QQQJ’s biggest holdings include Roku Inc. and CrowdStrike Holdings Inc., which have climbed 46% and 16% year-to-date, respectively. Meanwhile, Apple and Microsoft Corp., which are up 1.5% and 10% so far this year, are QQQ’s largest weights,” according to Bloomberg.

Unlike big brother QQQ, investors won’t see the likes of Microsoft, Amazon, and Apple in QQQJ’s top holdings. Instead, investors will see growth names like Etsy, Roku, CrowdStrike Holdings, The Trade Desk Inc, and ViacomCBS.

“The bifurcation in QQQ and QQQJ reflects a broader cooling of demand for large-cap stocks, according to Chris Zaccarelli of Independent Advisor Alliance. That tilt can also be seen in the small-cap iShares Russell 2000 ETF (ticker IWM), which has absorbed $122 million year-to-date, while the $339 billion SPDR S&P 500 ETF Trust (ticker SPY) has shed about $8.9 billion in 2021,” concludes Bloomberg.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.