The growth factor will likely remain popular this year, highlighting the advantages of exchange traded funds with pure approaches to growth equities.

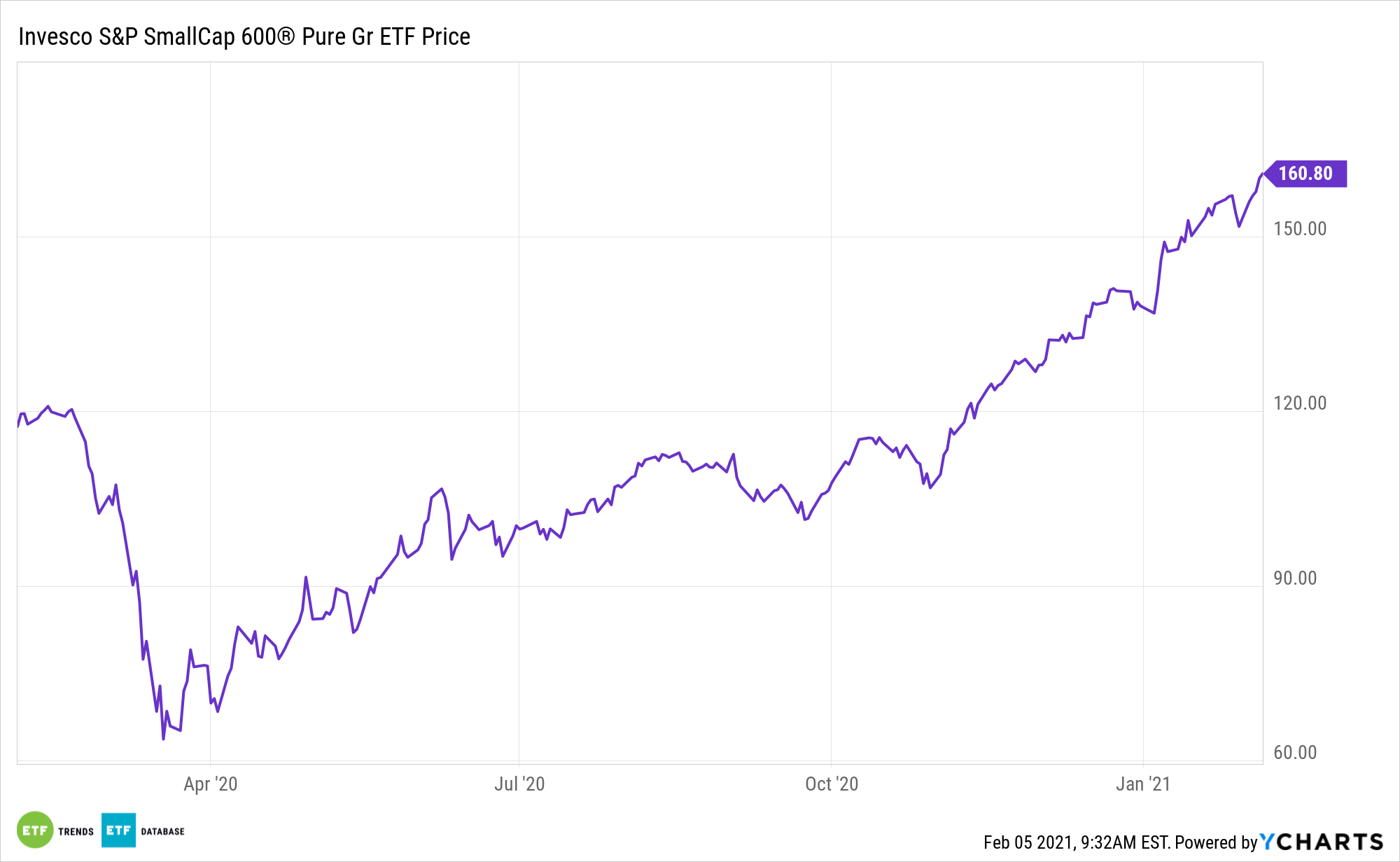

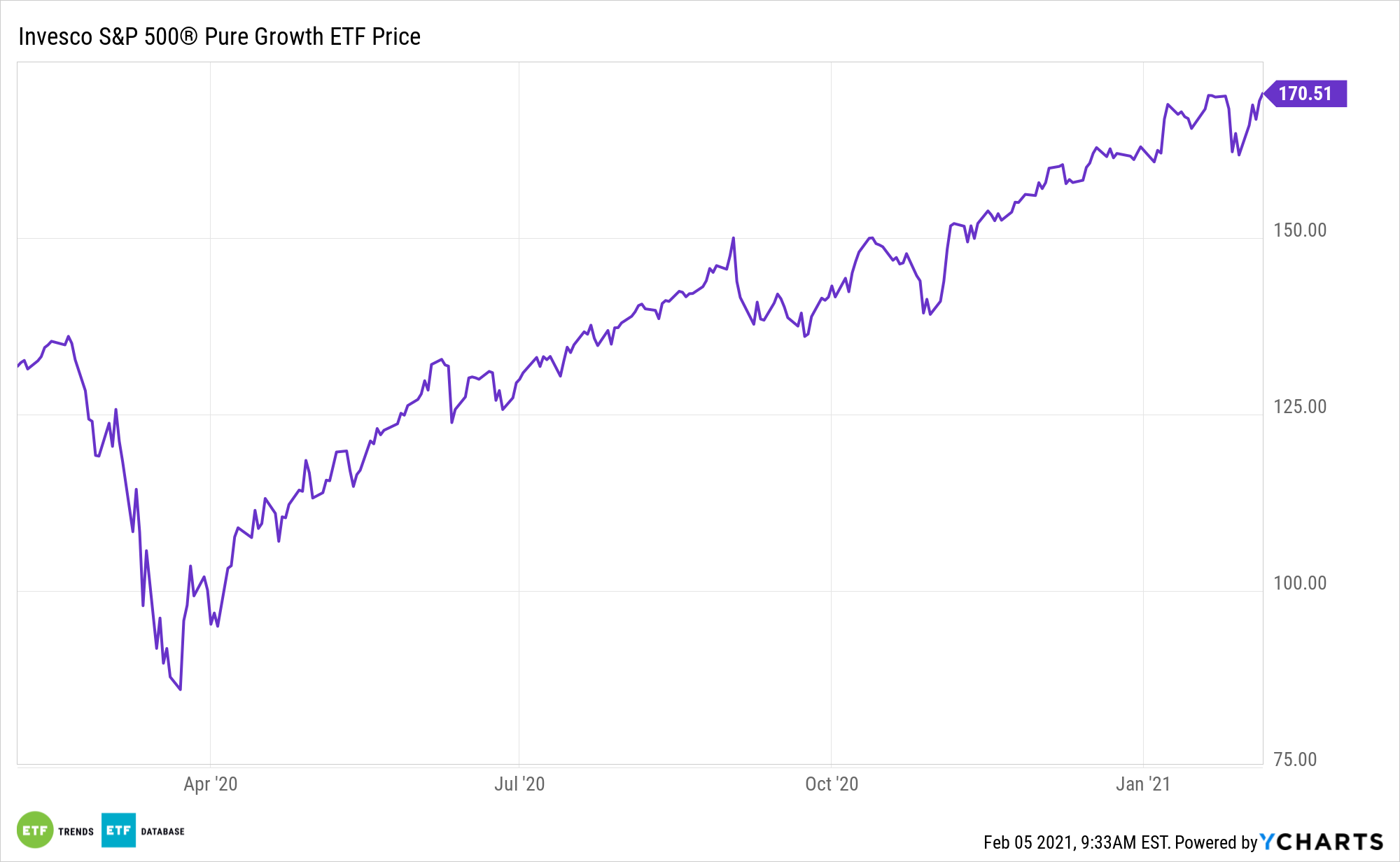

For example, investors have relied on the growth style to capture high-growth names in various market segments through ETF strategies like the Invesco S&P 500 Pure Growth ETF (NYSEARCA: RPG), Invesco S&P Midcap 400 Pure Growth ETF (NYSEArca: RFG), and Invesco S&P Smallcap 600Pure Growth ETF (NYSEArca: RZG).

Growth stock strategies entered 2021 with considerable momentum.

“Investors weren’t necessarily seeking low valuations in 2020. Growth stocks supercharged by low interest rates, digitization, work from home and other pandemic-related trends were continuously bid up and led the market higher,” according to BlackRock research.

The Benefits of Growth ETFs, RPG

RPG tracks the S&P 500 Pure Growth Index, which only features deep growth stocks.

The growth score “is measured using three other factors: three-year sales per share growth, the three-year ratio of earnings per share change to price per share, and momentum (the 12-month percentage change in price),” according to Invesco.

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

There remain compelling reasons to consider RPG in this market environment.

“We see good reason to stick with stocks with dominant and emerging business models that can continue to deliver for shareholders. Sectors like technology and healthcare contain many high-quality businesses with the ability to compound growth across time,” according to BlackRock.

RPG allocates more than 60% of its weight to technology and healthcare stocks.

For more news, information, and strategy, visit the ETF Education Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.